This week's full report.

Wednesday, February 7, 2024

This Week in Petroleum Summary February 7th, 2024 per EIA.GOV

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, January 31, 2024

This Week in Petroleum Summary January 31st, 2024 per EIA.GOV

This week's full report.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, January 24, 2024

This Week in Petroleum Summary January 24th, 2024 per EIA.GOV

This week's full report.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, January 18, 2024

This Week in Petroleum Summary January 18th, 2024 per EIA.GOV

This week's full report.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, January 11, 2024

This Week in Petroleum Summary January 11th, 2024 per EIA.GOV

This week's full report.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, January 4, 2024

This Week in Petroleum Summary January 4th, 2024 per EIA.GOV

This week's full report.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, December 28, 2023

This Week in Petroleum Summary 12-28-2023, per EIA.GOV

A quick summary of this week's report.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, December 20, 2023

This Week in Petroleum Summary 12-20-2023, per EIA.GOV

Another week, and another set of charts summarizing things from the Energy Information Administration...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, December 13, 2023

This Week in Petroleum Summary 12-13-2023, per EIA.GOV

Just some charts to summarize today's report...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, December 6, 2023

This Week in Petroleum Summary 12-6-2023, per EIA.GOV

Just some charts to summarize today's report...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, November 29, 2023

This Week in Petroleum Summary 11-29-2023, per EIA.GOV

Just some charts to summarize today's report...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, September 27, 2023

This Week in Petroleum Summary 9-27-2023, per EIA.GOV

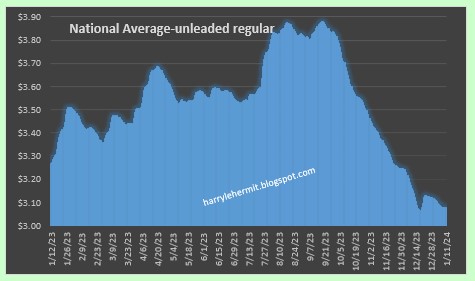

Gasoline prices (per AAA) fell from last report's $3.875, to $3.832. One year ago the price was $3.747, and was rising higher into Mid October's peak, then heading for the December low of $3.096.

Distillates inventory rose +340K barrels; and Gasoline inventories eose +1027K barrels. Distillates (-10.2%,-1.5%) and Gasoline (-0.9%, -0.2%) are both below 5 year and 3 year adjusted average inventories.

The SPR decreased -250K barrels this past week. Breaking a 7th consecutive week streak for increases, which were the first since January, 2021.

WTI is $93.72, compared to $90.27 (+3.8%), one week ago, and $81.24 one year ago (+15.4%).

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, September 20, 2023

This Week in Petroleum Summary 9-20-2023, per EIA.GOV

Gasoline prices (per AAA) rose from last report's $3.848, to $3.875. One year ago the price had fallen to $3.674, but was at a low, before heading higher into Mid October's peak, then heading for the December low of $3.096.

Distillates inventory fell -2.9M barrels; and Gasoline inventories fell 831K barrels. Distillates (-11.5%,-3.1%) and Gasoline (-1.4%, -0.9%) are both below 5 year and 3 year adjusted average inventories.

The SPR increased another 600K barrels this past week. This is the 7th consecutive week for increases, which were the first since January, 2021.

WTI is $90.27, compared to $88.77 (+1.7%), one week ago, and $82.43 one year ago (+9.5%).

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

This Week in Petroleum Summary May 8th, 2024 per EIA.GOV

This week's full report . Gasoline fell -2.3¢ for the week, but remains +10.3¢ from year ago level. Consumption did edge up this past r...

-

Time for an update, although not a lot has changed. Since the last election blog, the national poll indicates a slight dip in Biden's nu...

-

The Energy Information Administration released their weekly report yesterday. The Pacific Region continues to be below year ago and 5 year...

-

The Energy Information Administration released their weekly report Thursday. In great shape, except for the west coast... So prices are do...