Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year.

Saturday, February 21, 2026

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Sunday, February 8, 2026

A Bit of Update on the Energy Market, and a Few Political Opinions.

The winter weather is the likely culprit for the drop in overall consumption. Only time will tell.

Wednesday, January 7, 2026

A FEW CHARTS WITH SOME POLITICS - January 07, 2026

The crude inventories are in good shape for this time of year...

Saturday, June 14, 2025

Millions of People

I kept hearing about millions of people protesting something today, but all the pictures seem to show significant less. Of course there are about 3 million people attending college football games on any given Saturday, in the fall.

3 Million is less than 1% of the U.S. population. Then there is the matter of how many millions protested and how many were actually virtue signaling.

Thursday, February 13, 2025

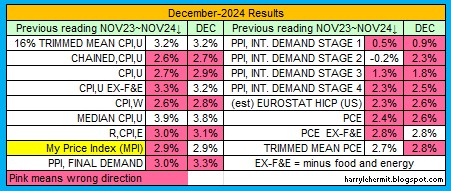

Producer Price Index and some other opinions

The Producer Price Index was released this morning and indicated an upturn.

Note that I did not revise the December, 2024 final demand, as did the BLS. Yes, December was revised upward to 3.5%. https://www.bls.gov/news.release/archives/ppi_01142025.htm

The nervous nellies will scream inflation is roaring back. Maybe so, but it will not repeat the horrors of 2021~2022. How can I say that? Once you understand the causes, the answer becomes easy.

- After the covid shutdown and collapse of international trade, the shipping industry was in disarray, with containers to move goods... in all the wrong places.

- Retailers had significantly reduced inventories to meet the slowing demand.

- There was a rather large stimulus paid to American citizens, on top of some previous payouts.

- The covid vaccine was becoming rapidly available.

- The American people were told that it was now safe to resume normal activities.

- An impending west coast port strike for mid 2022, which did not materialize.

Wednesday, February 12, 2025

A Few Reports and some opinions... of course!

The CPI came out today and now that Trump is in office, it has suddenly turned terrible. Nevermind, it is for January, so remarkable for just 11 days in office. /s

The media's memory is a bit wacky, with claims that it has suddenly shifted upward, even though the lowest annual rate since February 2021 was this past September.

Thursday, February 6, 2025

The Press has a dilemma.

Apparently, some of the left of center media people are noting that Trump tells what he thinks when answering their question.

The press is so used to the evasive non answers, that Trump speaking freely and off the cuff has them concerned.

Previously, the press were responsible for interpreting what the politician's doublespeak meant. Usually by citing some anonymous "source" while spouting endlessly on air. Which begs the question... are those sources real and/or are they honest.

Think about it, the news media has a much reduced role, or even need... in this environment.

Those flashy press jobs don't look as important as those flashy media types have projected.

Friday, January 31, 2025

1-31-2025 Week In Review

Energy

Crude inventory up a bit, with distillates down, and gasoline up. SPR up a bit. Price at the pump has barely budged and should continue in a narrow band.

Politics

It is the same old, same old. It was funny, but is now getting boring. Example: When there is a school shooting, we know what is said immediately by both sides. A plane crash provides us with the same dynamics, but in opposite polarization.

Unfortunately, there is a history regarding this issue, dating back to the Obama presidency, which is in the courts since 2014 and is still not resolved, as of 1-29-2025.

BRIGIDA v. UNITED STATES DEPARTMENT OF TRANSPORTATION

GDP

Annualized at 2.3%. Personal Consumption Expenditures were up dramatically.

Almost, as it has been 27 days and the temps are expected to be near 60 for a couple of days, and above freezing til the 9th.

End of the line

I am getting so bored with the current news cycle. I think it is time to simply blog, when there is something of interest.

Also, I have had adsense running and think it is time to remove adsense from this blog. I am the only person interested, so it makes more sense to cut adsense. My reasons for adsense were mostly to understand the audience, but since there isn't any... there you go. Besides, there never was any meaningful knowledge to gain, that was not already present under stats.

Also, I always checked from my home screen and never really looked at the end product on line. I recently checked and clearly, I do not know how to properly place ads. It is rather embarrassing.

Adios!

Friday, January 24, 2025

1-24-2025 Week In Review

Current Rage...

I probably should stop watching UK's Sky News. I was watching it during the swearing in and their announcer said something that just hit me the very, very wrong way. For the record, it was not something derogatory about Trump, which is typical of this outfit, while ignoring anything negative about you know who.

When did it start...

I am not a historical scholar and would not suggest that political rancor never existed. However, the "butthurt" of losing parties seems to have dialed up in my lifetime. Actually, I would suggest it started with the election of Clinton.

There was a lot of rumors, etc. during his tenure. With the 2000 election, the opposite party seemed to have some butthurt. The election of Obama gave us the "tea party" and then there was the first term of Trump. Biden followed and now with Trump again.

Both sides seem to have developed severe cases of "butthurt", imo. I don't see it ending any time soon, either.

Misinformation abounds in unlikely places.

"FBI" agent that took down Capone. That was in a crossword puzzle. Ness was a Prohibition Bureau agent, and the FBI was not in place until 1935, although it was preceded by the Bureau of Investigation. The Prohibition Bureau was originally in the Treasury and absorbed by the BOI (Justice) in early 1933. Late 1933, saw it returned to the Treasury and eventually became the ATF of today.

Make up your damn minds...

The media kept saying all he does is lie, lie, and lie. Now they are complaining because he actually told the truth. Make up your damn minds... or at least stop losing your minds.

ENERGY

A lot of racket, but no serious movement, imho. Pump prices are set to slightly rise, for both gasoline and diesel. There was a lot of talk about a "draw", which did bring down the total about 3.9M barrels, but the total is still 24.2M barrels ahead of last year on this date.

Birthright citizenship...

Remember this... "so long as they are permitted by the United States to reside here."

United States v. Wong Kim Ark, 169 U.S. 649 (1898) Chinese persons, born out of the United States, remaining subjects of the Emperor of China, and not having become citizens of the United States, are entitled to the protection of, and owe allegiance to, the United States so long as they are permitted by the United States to reside here, and are " subject to the jurisdiction thereof" in the same sense as all other aliens residing in the United States.

If you can't understand that part, then you may be shocked with the final outcome of this. The recent judge's ruling is merely the first salvo, imo.

Weather

Finally, the temps are set to moderate, which means above freezing. Maybe it will last long enough for all this snow to melt.

That's all for this round.

Friday, January 10, 2025

1-10-2025 Week In Review

Weather

Yep, been a fun few days, as we received about 6" of snow, then about 3/4" of ice, then another 3" of snow. I am no longer able to clear the driveway, so hoping nothing in the way of an emergency.

I have no real reason to leave the house, although the long range forecast shows no warming temperatures to thaw that mess. Another 2" predicted for this weekend, below freezing temps through the following weekend, with a possible big snow of 6"+.

Groceries might be needed.

Politics

You already know the U.S. news, but what about abroad?

U.K. news media is all a-flutter over Musk tweets. This forced the Labour government to respond. Apparently, there was a grooming gang problem back a decade ago, which resulted in several inquiries, which further resulted in recommendations.

A decade later, after the Musk tweets, it seems the Labour government has decided to begin implementing some of those recommendations.

Sir Keir Starmer was the head of the Crown Prosecution Services back in the day, and is now Prime Minister. He claims Musk is promoting a right wing attack. Strange that nothing was implemented until Musk got to tweeting.

So successive U.K. governments did nothing and it is Musk's fault for tweeting about it. Hard to imagine where the issue would be without the tweets.

A Sky News (UK) reporter, after news of META dropping "fact-checking" and going to community notes... asked the question of what is the future of liberal fact-checking. The irony of such a question.

I watch Sky News on a regular basis and the opinion I have is... The U.K. has much bigger problems than Musk tweeting.

Back to the U.S., and is the media hyperventilating like they did... 8 years ago? It does seem that way to me.

Energy

Not much to say, although pump prices likely to rise a nickel in the coming week. Same for diesel.

and the rest...

Fires. Plentiful dry vegetation, high winds, and homes built of largely dry timber. Just takes a spark.

Jobs report. Looks really good, but remember all the revisions the past year. I'll take a wait and see.

Zombie companies. These are companies that seemingly were profitable, but largely due to low interest bonds and rates. Those days are gone and we will likely see some corporate profits suffer as these bonds are rolled over.

Trump jail. He's a convicted felon without having to spend time in jail, or on parole, etc. Almost as good as a pardon. Speaking of which... wonder who else is about to get pardoned.

Greenland. This suddenly got interesting.

Friday, January 3, 2025

Changing direction on blogging

A new year is upon us, and just some thoughts.

Thus returning to my thoughts and opinions. Which could be about anything.

The presidential election is over, but politics is never over, so there is that.

The economy is something of interest, which includes several items and becomes political.

International events might arise, which are also political in nature.

Frankly, about everything that happens anymore... becomes political, whether immigration, crime, etc.

I could summarize what transpired in 2024, but you should already know. What none of us know... is what impact it will have on 2025.

We have the debt ceiling, a new congress, a new president, wars cropping up everywhere, and the list goes on and on.

After the past few years of revisions to various previous month's economic numbers, which resulted in more positive news on date of release... we will likely start to see the truth going forward. I am suggesting the results have not been as positive as the media has proclaimed.

Energy Prices

Futures indicate that gasoline pump prices ranging from -4.2¢~+4.4¢ over the near term.

Port Strike

It strongly appears that the ILA v USMX strike will be postponed for 3 1/2 months, as that would be the most beneficial for both sides.

Tariffs

Has anyone been watching the foreign exchange market? The Yen and Yuan have been weakening against the dollar. So have a host of other currencies.

Woohoo! The strong dollar fans are overlooking what caused offshoring and will inhibit reshoring. Our trading partners are not converting all those sales in dollars... back to their native currencies. No, they are purchasing Dollarized assets, such as bonds, financials, properties, etc.

Basically... propping up the dollar. We have not learned a darn thing over the past 40 years, as to why the early 80s inflation was brought down so low, until the great covid shipping snafu.

That's it for this week.

Friday, December 27, 2024

This Week in Petroleum Summary December 27th, 2024 per EIA.GOV

This week's full report.

Gasoline pump prices fell -1.6¢ for the week, but continues below year ago levels, by -8.8¢, or -2.88%. Days supply fell to 25.2. For perspective... last year was 25.7 days.

Inventories were mixed , with crude down -4.2M barrels; Distillates down -1.7M barrels; Gasoline stocks rose +1.6M barrels. Total Petroleum + products +SPR slipped -12.4M barrels, with the SPR rising +260K barrels.

For those interested, the exports of Crude, Petroleum Products, Including Gasoline has far outweighed the imports, by this much, since March, 2022.

The current crack spread fell from last week's $16.89, to $16.68. Gasoline rose to $7.74, from last week's $7.68. Distillates fell to $8.94, compared to last week's $9.22. Per barrel of diesel is $29.60; Per barrel of gasoline is $17.02. Generally speaking... above $25 indicates rises.

Wednesday, December 18, 2024

This Week in Petroleum Summary December 18th, 2024 per EIA.GOV

This week's full report.

Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days supply fell to 25.4. For perspective... last year was 26.5 days.

The total products is still +11.6M barrels ahead of year ago levels.

For those interested, the exports of Crude, Petroleum Products, Including Gasoline has far outweighed the imports, by this much, since March, 2022.

The current crack spread fell from last week's $17.11, to $16.89. Gasoline fell to $7.67, from last week's $8.38. Distillates rose to $9.22, compared to last week's $8.72. Per barrel of diesel is $30.53; Per barrel of gasoline is $16.86. Generally speaking... above $25 indicates rises.

Tuesday, December 17, 2024

2024 Presidential Election Review, part 4 of 4 and conclusion

It would appear the final counts for the election are now completed.

Wednesday, December 11, 2024

This Week in Petroleum Summary December 11th, 2024 per EIA.GOV

This week's full report.

Gasoline pump prices slid -1.3¢ for the week, but continues below year ago levels, by -13.3¢, or -4.2%. Days supply rose to 25.5. For perspective... last year was 26.3 days.

Wednesday, December 4, 2024

This Week in Petroleum Summary December 4th, 2024 per EIA.GOV

This week's full report.

Gasoline pump prices slid -0.4¢ for the week, but continues below year ago levels, by -20.9¢, or -6.4%. Days supply rose to 24.5. For perspective... last year was 26.2 days.

For those interested, the exports of Crude, Petroleum Products, Including Gasoline has far outweighed the imports, by this much, since March, 2022.

Wednesday, November 27, 2024

This Week in Petroleum Summary November 27th, 2024 per EIA.GOV

This week's full report.

Gasoline pump prices rose +0.7¢ for the week, but continues below year ago levels, by -17.7¢, or -5.4%. Days supply rose to 24.2. For perspective... last year was 24.8 days.

Inventories were mixed , with crude down -1.8M barrels; Distillates up +416K barrels; Gasoline stocks rose +3.3M barrels. Total Petroleum + products +SPR slipped -625K barrels, with the SPR rising +1.2M barrels.

The total products is still +9.8M barrels ahead of year ago levels.

For those interested, the exports of Crude, Petroleum Products, Including Gasoline has far outweighed the imports, by this much, since March, 2022.

The current crack spread fell from last week's $18.64, to $17.96. Gasoline fell to $8.76, from last week's $9.46. Distillates rose to $9.21, compared to last week's $9.18.

The data sets continue to diverge with price movement in the coming days, within a narrow band, imo. -1.9¢ ~ +3.1¢.

Still, just as the past few weeks... nothing dramatic in the way of prices surging, or at least for now and should continue until the Christmas holiday, imo.

Friday, November 22, 2024

2024 Presidential Election Review, part 3 of ?

We now have about 99.5% of the votes tabulated.

Wednesday, November 20, 2024

This Week in Petroleum Summary November 20th, 2024 per EIA.GOV

This week's full report.

Gasoline pump prices fell -1.8¢ for the week, and continues well below year ago levels, by -24.2¢, or -7.3%. Days supply rose to 23.4. For perspective... last year was 24.3 days.

Saturday, November 16, 2024

My electricity bills over time (November, 2024 Edition)

My electricity usage over time. I track many things to monitor my inflation versus the CPI.

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

Remember back when the 2022 1st and 2nd quarter GDP numbers came in... and those politically motivated types screamed "we are in a rece...