That seems to be all the rage, now with gasoline prices topping the US $5 mark. It seems that everyone can agree, that it is the fault of one political party or the other. So it would seem that allowing the Keystone XL pipeline to be built... would have increased the volume of crude coming into the United States and thereby reduce the price of gasoline.

Except we are exporting crude and petroleum products at an enormous and historical rate. We have exported 920,255,000 barrels of oil and petroleum products since the beginning of March. Certainly we have imported a lot as well. 827,071,000 barrels of oil and petroleum products in that same period. Oh wait... that export number is nearly 100 million barrels higher than the import number.

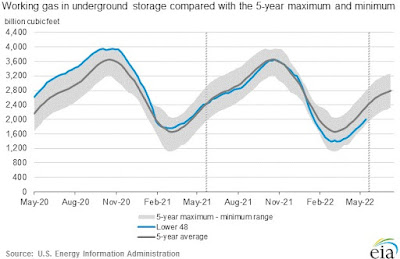

What would the crude inventory look like... Note the gray area is the 5 year range, both top and bottom, with the blue line being where we actually are and the red line being those 100 million barrels. Note the 5 year is distorted by the sudden drop in consumer demand, due to covid, which would normally be in the 420 million barrel range. Even the past 5 years is distorted in comparison to 7 years ago. (If you struggle with the small print, just click on the image.

It gets even better as we have exported 86,667,000 barrels of gasoline over that same period, while importing 74,508,000 barrels of gasoline. Oops!

This is why I am having a problem with the idea surrounding the failure to approve Keystone XL as having an impact on our current gasoline prices.

To be sure, IF we could go back in time and retroactively approve Keystone XL it should reduce the global impact of crude and thereby the price of gasoline, IF everything else remained the same.

To do that, we would need to ignore the shale boom (drill baby drill) and our own Congress in December, 2015, lifted the oil export ban that had been in place for over 40 years and let's not forget the releases of the Strategic Petroleum Reserve (SPR).

Briefly, the Keystone XL was proposed back in 2008, just as U.S. gasoline prices roared past the $4 per gallon mark. Keystone XL was a proposal by what was then called Trans Canada, based in Calgary. It was the 4th phase of the project, which came under fire. Politics in Canada prevents pipelines of this scale from going to their coasts, thus it is almost captive to the U.S. Market.

It should be noted that XL was struck down in November, 2015.

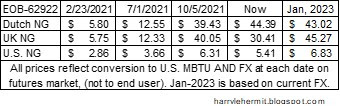

Here is the gasoline price chart, with some embedded notes from me. (Pardon the penmanship)

Here is the U.S. Production chart without my adding comments, so refer to above dates and times... (Note that dates may not line up and I probably should have marked each)

So while we can blame Obama (Democrat) for the Keystone cancellation, it should be pointed out the repeal of the crude oil export ban... was Republican led. So here is what transpired, regarding exports from the USA.

Then finally, the last part of the picture... crude oil historical inventory.

At that point in time, the drill baby drill people were under severe financial stress and really needed to unload crude via exports. Keystone XL would have added pressure as well, although the XL stood for export limited, which seems like the exports would be limited, but in American terms, Keystone XL (export limited) would have been branded Keystone XI (export inc.) Keystone was a Canadian venture. Granted it was being exported to the USA, but intent was points further.

And it was clear the aim was to link up to Cushing Oklahoma and the new pipelines being put in place to the gulf coast AND thereby be further exported to parts unknown. Pipelines that had moved crude from the gulf to the interior were being reversed, as part of this plan. Yes, the refiners in the Gulf had established Foreign Trade Zone status, thereby exempting the Canadian crude from export ban. It was a pass through arrangement being planned.

Keystone XL was slated to add 850,000 barrels per day into the mix. Yes, it would have theoretically lowered global petroleum prices, but so would the release of 1,000,000 barrels a day from the SPR. Coupled together, the likelihood was prices being about the same as current, as the need to phase out Russian Crude would be pulled forward.

Just because XL was struck down, does not mean their crude is not making its way to the gulf and the U.S. refineries along the gulf. Remember all the problems with rail tanker explosions and fires? The result was new tanker requirements and the biggest makers of these new tankers were subsidiaries of Burlington Northern, which was owned by Berkshire Hathaway. A lot of money to be made by building these new rail tankers and hauling this crude. It would have been cheaper by pipeline, but politics is politics.

Striking down XL doesn't appear to have staunched the flow of crude oil from Canada...

CALGARY, Alberta, March 24 (Reuters) - Canada has capacity to increase oil and gas exports by up to 300,000 barrels per day (bpd) by the end of 2022 to help improve global energy security following Russia's invasion of Ukraine, Natural Resources Minister Jonathan Wilkinson on Thursday.

It would seem that existing flows were not at capacity, so how would XL have increased the flows?

I can't really see a way around the current price of gasoline at the pump. We may have seen prices lower than 1 year ago and may see prices come down quicker in the fall... but right now, it would likely be the same.

As usual, there is plenty of blame to pass around and nothing will really be done to alleviate the rise in prices.

Would Keystone XL have helped? ONLY IF YOU BELIEVE NONE OF IT WOULD BE EXPORTED OR DISPLACE U.S. CRUDE TO BE EXPORTED. By the way, I have this beachfront property for sale in Death Valley... if you are interested.

If you feel the need to blame politicians, be sure to blame ALL, in my humble opinion. The finger prints of each party are all over the current situation.