Finally some more reports coming out from the government services, with PPI and Retail Sales. Granted it is still a month behind, as October data should be out.

Tuesday, November 25, 2025

It's Been Awhile

Thursday, December 12, 2024

PPI - Dec. 2024 release with Nov. 2024 Data

The BLS has released the November 2024 Producer Price Index Report for the month of October. (historical releases)

The Producer Price Index for final demand rose 0.4 percent in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices increased 0.3 percent in October and 0.2 percent in September. (See table A.) On an unadjusted basis, the index for final demand advanced 3.0 percent for the 12 months ended in November, the largest rise since moving up 4.7 percent for the 12 months ended February 2023.

In November, nearly 60 percent of the broad-based rise in final demand prices can be attributed to a 0.7-percent increase in the index for final demand goods. Prices for final demand services moved up 0.2 percent.

Wednesday, December 11, 2024

BLS Data Dump. Real Earnings - December 11th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.25 for hourly- private non farm payrolls, seasonally adjusted...

BLS Data Dump. CPI - December 11th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in November, after rising 0.2 percent in each of the previous 4 months, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.

The index for shelter rose 0.3 percent in November, accounting for nearly forty percent of the monthly all items increase. The food index also increased over the month, rising 0.4 percent as the food at home index increased 0.5 percent and the food away from home index rose 0.3 percent. The energy index rose 0.2 percent over the month, after being unchanged in October.

The 2.749% is above last month's 2.598% is back above the 2.62% of March, 2021, and still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Thursday, November 14, 2024

PPI November 2024 release with October 2024 Data

The BLS has released the November 2024 Producer Price Index Report for the month of October. (historical releases)

The Producer Price Index for final demand increased 0.2 percent in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.1 percent in September and 0.2 percent in August. (See table A.) On an unadjusted basis, the index for final demand moved up 2.4 percent for the 12 months ended in October.

In October, most of the rise in final demand prices can be traced to a 0.3-percent advance in the index for final demand services. Prices for final demand goods inched up 0.1 percent.

The index for final demand less foods, energy, and trade services increased 0.3 percent in October after moving up 0.1 percent in September. For the 12 months ended in October, prices for final demand less foods, energy, and trade services rose 3.5 percent

Wednesday, November 13, 2024

BLS Data Dump. Real Earnings - November 13th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.24 for hourly- private non farm payrolls, seasonally adjusted (last month was revised downward)...

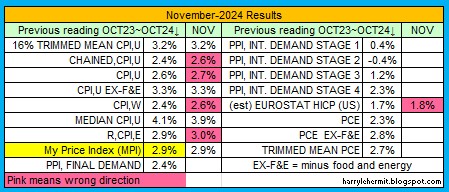

BLS Data Dump. CPI - November 13th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in October, the same increase as in each of the previous 3 months, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.6 percent before seasonal adjustment.

The index for shelter rose 0.4 percent in October, accounting for over half of the monthly all items increase. The food index also increased over the month, rising 0.2 percent as the food at home index increased 0.1 percent and the food away from home index rose 0.2 percent. The energy index was unchanged over the month, after declining 1.9 percent in September.

The 2.598% is still below the 2.62% of March, 2021, but still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Friday, October 11, 2024

PPI October 2024 release with September 2024 Data

The BLS has released the October 2024 Producer Price Index Report for the month of September. (historical releases)

The Producer Price Index for final demand was unchanged in September, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.2 percent in August and were unchanged in July. (See table A.) On an unadjusted basis, the index for final demand rose 1.8 percent for the 12 months ended in September.

Within final demand in September, a 0.2-percent increase in the index for final demand services offset a 0.2-percent decline in prices for final demand goods.

Thursday, October 10, 2024

BLS Data Dump. Real Earnings - October 10th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.24 for hourly- private non farm payrolls, seasonally adjusted...

BLS Data Dump. CPI - October 10th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, the same increase as in August and July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.4 percent before seasonal adjustment.

The index for shelter rose 0.2 percent in September, and the index for food increased 0.4 percent. Together, these two indexes contributed over 75 percent of the monthly all items increase. The food at home index increased 0.4 percent in September and the food away from home index rose 0.3 percent over the month. The energy index fell 1.9 percent over the month, after declining 0.8 percent the preceding month.

The 2.44% is below the 2.62% of March, 2021, but still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Thursday, September 12, 2024

PPI September 2024 release with August 2024 Data

The BLS has released the September 2024 Producer Price Index Report for the month of August. (historical releases)

The Producer Price Index for final demand increased 0.2 percent in August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices were unchanged in July and rose 0.2 percent in June. (See table A.) On an unadjusted basis, the index for final demand advanced 1.7 percent for the 12 months ended in August.

The August rise in the index for final demand can be traced to a 0.4-percent increase in prices for final demand services. The index for final demand goods was unchanged.

Wednesday, September 11, 2024

BLS Data Dump. Real Earnings - September 11th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.21 for hourly- private non farm payrolls, seasonally adjusted...

Whereas real weekly earnings for that same cohort has moved from $378.92 to $384.47, up from last month...

BLS Data Dump. CPI - September 11th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, the same increase as in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.5 percent before seasonal adjustment.

The index for shelter rose 0.5 percent in August and was the main factor in the all items increase. The food index increased 0.1 percent in August, after rising 0.2 percent in July. The index for food away from home rose 0.3 percent over the month, while the index for food at home was unchanged. The energy index fell 0.8 percent over the month, after being unchanged the preceding month.

The 2.53% is finally below the 2.62% of March, 2021, but still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Wednesday, August 14, 2024

BLS Data Dump. CPI - August 13th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, after declining 0.1 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment.

The index for shelter rose 0.4 percent in July, accounting for nearly 90 percent of the monthly increase in the all items index. The energy index was unchanged over the month, after declining in the two preceding months. The index for food increased 0.2 percent in July, as it did in June. The food away from home index rose 0.2 percent over the month, and the food at home index increased 0.1 percent.

It was a bit below the expectations of 3.0% on the annual, and the 0.2% was seasonally adjusted up from the actual 0.116%. So not so bad, and in fact... fairly decent.

For the record: February 2021, 1.7%; March 2021, 2.6%.

Here is the unadjusted CPI for the past 12 months...

My own personal CPI rose 3.0% Y/Y, but slid -0.2% on the month (I'm happy with that) ...

BLS Data Dump. Real Earnings - August 13th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.19 for hourly- private non farm payrolls, seasonally adjusted...

Tuesday, August 13, 2024

PPI August 2024 release with July 2024 Data

The BLS has released the August, 2024 Producer Price Index Report for the month of July. (historical releases)

The forecast was +2.3% year over year. Which can be done by rounding down +2.27%, and voila +2.2%... or softer than forecast. The month to month was forecast at +0.2%, which can be achieved by revising the months of March, through June... UPWARD.

Using the prior month's published data and comparing to this month... yields an advance of +0.18% which could be rounded down to +0.1%.

It is not uncommon for data to be revised, which is why I download all the reports. I do get suspicious, but can prove nothing.

So (with all revisions)...

Friday, July 12, 2024

PPI July 2024 release with June 2024 Data

The BLS has released the July, 2024 Producer Price Index Report for the month of June. (historical releases)

The Producer Price Index for final demand advanced 0.2 percent in June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices were unchanged in May and increased 0.5 percent in April. (See table A.) On an unadjusted basis, the index for final demand rose 2.6 percent for the 12 months ended in June, the largest advance since moving up 2.7 percent for the 12 months ended March 2023. [emphasis added]

Product detail: Over 60 percent of the June decrease in the index for final demand goods can be traced to a 5.8-percent decline in prices for gasoline. The indexes for processed poultry, residential electric power, diesel fuel, jet fuel, and fresh and dry vegetables also moved lower. Conversely, prices for chicken eggs increased 55.4 percent. The indexes for residential natural gas and for aluminum base scrap also advanced.

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

Remember back when the 2022 1st and 2nd quarter GDP numbers came in... and those politically motivated types screamed "we are in a rece...