I keep reading about the national debt, then consumer debt, etc.

Saturday, October 21, 2023

There Is More Than the National Debt to Worry About!

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Tuesday, October 17, 2023

10-17-23, Advance Retail Sales Report for September Data

Advance Monthly Sales for Retail and Food Services, September 2023.

Advance estimates of U.S. retail and food services sales for September 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $704.9 billion, up 0.7 percent (±0.5 percent) from the previous month, and up 3.8 percent (±0.7 percent) above September 2022. Total sales for the July 2023 through September 2023 period were up 3.1 percent (±0.4 percent) from the same period a year ago. The July 2023 to August 2023 percent change was revised from up 0.6 percent (±0.5 percent) to up 0.8 percent (±0.1 percent).

Retail trade sales were up 0.7 percent (±0.5 percent) from August 2023, and up 3.0 percent (±0.5 percent) above last year. Nonstore retailers were up 8.4 percent (±1.6 percent) from last year, while food services and drinking places were up 9.2 percent (±2.3 percent) from September 2022.

As always, a reminder... "not for price changes", means not adjusted for inflation.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, October 12, 2023

BLS Data Dump. CPI - October 12, 2023

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis, after increasing 0.6 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment.

The index for shelter was the largest contributor to the monthly all items increase, accounting for over half of the increase. An increase in the gasoline index was also a major contributor to the all items monthly rise. While the major energy component indexes were mixed in September, the energy index rose 1.5 percent over the month. The food index increased 0.2 percent in September, as it did in the previous two months. The index for food at home increased 0.1 percent over the month while the index for food away from home rose 0.4 percent.

The index for all items less food and energy rose 0.3 percent in September, the same increase as in August. Indexes which increased in September include rent, owners' equivalent rent, lodging away from home, motor vehicle insurance, recreation, personal care, and new vehicles. The indexes for used cars and trucks and for apparel were among those that decreased over the month.

I had readings of 3.6%~3.9%, so the 3.7% was within that range.

The past 12 months...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

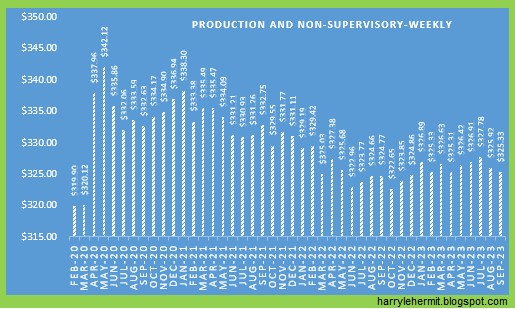

BLS Data Dump. Real Earnings - October 12, 2023

The BLS has released the latest Real Earnings Report.

Real average hourly earnings for all employees decreased 0.2 percent from August to September, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.2 percent in average hourly earnings combined with an increase of 0.4 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

Real average weekly earnings decreased 0.2 percent over the month due to the change in real average hourly earnings combined with no change in the average workweek.

Real average hourly earnings increased 0.5 percent, seasonally adjusted, from September 2022 to September 2023. The change in real average hourly earnings combined with a decrease of 0.6 percent in the average workweek resulted in a 0.1-percent decrease in real average weekly earnings over this period.

I added emphasis to the decrease.

Graph time...

I suppose the good news... the Real Hourly is still +2¢ above pre covid, and down -2¢ from last month.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, October 11, 2023

Producer Price Index October release with September 2023 Data

The BLS has released the September Producer Price Index Report. (historical releases)

The Producer Price Index for final demand increased 0.5 percent in September, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.7 percent in August and 0.6 percent in July. (See table A.) On an unadjusted basis, the index for final demand advanced 2.2 percent for the 12 months ended in September, the largest increase since moving up 2.3 percent for the 12 months ended in April.

Leading the increase in the final demand index in September, prices for final demand goods rose 0.9 percent. The index for final demand services advanced 0.3 percent.

Prices for final demand less foods, energy, and trade services increased 0.2 percent in September, the fourth consecutive advance. For the 12 months ended in September, the index for final demand less foods, energy, and trade services moved up 2.8 percent.

As is often the case... there were revisions to previous month's data, so don't be surprised if this month's data is revised next month. The size of July's data was a bit surprising however. When that data came out, it was considered above expectations at +0.3%. A couple of month's later, it was revised to +0.6%, without any discussion.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Review of March 2024 data, 1Q GDP, PCE and personal income

The monthly summary is not so wonderful, incomparison... Inside all that pink is some troubling food related issues. Even though energy is s...

-

As you know by now , it was ugly for consumer's future prospects of inflation. Yes, a lot of this will get passed on to us. It is a se...

-

via GIPHY I've belonged to various websites over the years and naturally gravitated towards those websites for older folks. These are th...

-

Gasoline prices were (per AAA) were up 2¢ this week, to $3.50. A year ago, the price was $3.38. There was a bit of good news, as prices seem...