First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.6 percent in August on a seasonally adjusted basis, after increasing 0.2 percent in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment.

The index for gasoline was the largest contributor to the monthly all items increase, accounting for over half of the increase. Also contributing to the August monthly increase was continued advancement in the shelter index, which rose for the 40th consecutive month. The energy index rose 5.6 percent in August as all the major energy component indexes increased. The food index increased 0.2 percent in August, as it did in July. The index for food at home increased 0.2 percent over the month while the index for food away from home rose 0.3 percent in August.

Depending on which consensus forecast you use, this was either slightly above or slighty below.

It was slightly below my chosen group. I had mentioned +0.8% increase, versus +0.6% actual. Both the month to month and annual were slightly below my chosen group's forecast. +3.8% versus +3.7%.

The actual readings.

Then there is my personal results, which is important to me. +0.4% M/M and +1.8% Annual.

Now for the C.O.L.A projections...

I can nearly predict the C.O.L.A will be +3.2%. This is based on the expecation the minimum September number would be 301.829 (+0.09%) and the maximum being 302.704 (+0.038%). Given current forecasts, the September numbers should be in this range.

Considering that the C.O.L.A is nearly set at 3.2%, it is time to look at impact on old folks, such as myself. While mine edged up this month, the R-CPI-E, is well above the 3.2% C.O.L.A. at 4.2%. R-CPI-E stands for Research CPI Experimental, not the retired cpi elderly, that some people think. However, it was experimental research targeting 62 year olds and over.

For years the Medicare B standard rates were announced in November. Last year the Biden Adminstration had it announced almost simultaneously with the C.O.L.A. While the Biden White House ballyhooed the 8.7% C.O.L.A. as an achievement, then quickly caught flak for taking credit for inflation, they were able to rejoice in the Medicare B standard rates falling.

With the likelihood of Medicare B standard rates being raised... Gee, I wonder when that announcement will come?

With the headline CPI being 3.2% in July, and currently 3.7% for August, the September forecast of 3.6% will come out... just as that likely 3.2% C.O.L.A. is announced.

This is called a political dilemma.

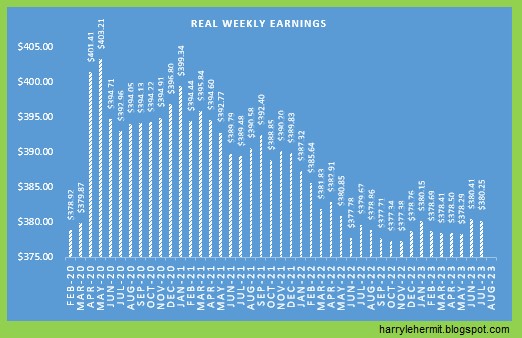

Of course, no one is mentioning the real earnings report, which I will delve into next.