Finally some more reports coming out from the government services, with PPI and Retail Sales. Granted it is still a month behind, as October data should be out.

Tuesday, November 25, 2025

It's Been Awhile

Saturday, August 16, 2025

Week Ending Report-August 16th, 2025

A few reports of interest (to me), from this past week.

The inflation report was rather benign and met expectations. The oddity was in the CPI-W, which directly relates to C.O.L.A. It was a mild 2.5% y/y. The previous projection was a 2.6%~2.7% cola, which now moves a bit down to 2.5%~2.7%.

Saturday, August 9, 2025

Week Ending Report-August 9th, 2025

A few reports of interest (to me), from this past week.

The international trade numbers are self explanatory in the linked report.

As for the petroleum report, usage of gasoline continues to drift downward, with pump prices in a narrow range.

OPINION time:

Barely any movement in inflation expectations, although a slight move upward from now into the 4th quarter is in the offing.

3rd Qtr. GDP projections remain positive, although barely, with 4th quarter in the same range and an uptick by first of year.

I guess if I were a president of a country at war and had suspended elections, knowing I wouldn't be re-elected... I would likely resist any form of peace, even if my citizens continued to die. Especially if the fighting was supported with foreign tax dollars... whether directly or through military munitions.

Saturday, August 2, 2025

Week Ending Report-8-02-2025

A few reports of interest (to me), from this past week.

The GDP exceeded forecasts, but not really by that much. It was just as much about the trade and services deficit, as was the first quarter negative.

Personal Income and outlays was mostly positive. Here is the July Report card, which includes several variables.

Saturday, July 26, 2025

Week Ending Report-7-26-2025

A few reports of interest (to me), from this past week.

https://www.census.gov/manufacturing/m3/adv/current/index.html

https://www.eia.gov/petroleum/weekly/crude.php

Much was made of the -9.3% drop in Durable Goods from May, but the spin doctors overlooked the +16.5% rise for the previous month. Year to date from 2024, is up 7.9%. Probably why the spin didn't last very long.

As for the petroleum sector, gasoline usage has fallen considerably on a 4 week moving average. Down -5.2% from year ago levels and -2.9% from last week. The inventory of gasoline slipped a bit, but the day's supply is increasing.

Probably why pump prices are staying stagnant, compared to my last forecast. Not sure why the drop, which could be indicative of a slowing economy, although much of that data is contradictory.

In any case, the sharp drop off is unexpected, at least to me.

Some meaningless thoughts...

The Late Show... I stopped watching the late show, early on in Colbert's tenure. His brand of humor did not match mine. Why the show is being canceled is beyond my realm of thought. Even if it were, I am not part of that important demographic.

Epstein files... I would have thought any Trump connections would have been exposed during his last term. Certainly during the Biden years. Perhaps the whole darn bunch have their names listed on... some yet to be released "file".

Clinton Saga... I am not a fan, but she is largely irrelevant, imho. It is good to know that most of the political back in forth is now focusing on days gone by. Maybe we will eventually move past all of this.

Or is the political news cycle a couple of decades behind?

Saturday, July 19, 2025

Week Ending Report-7-19-2025

Several reports from the week, including...

CPI- https://www.bls.gov/news.release/cpi.htm

PPI- https://www.bls.gov/news.release/ppi.htm

Real Earnings- https://www.bls.gov/news.release/realer.htm

Advance Retail- https://www.census.gov/retail/sales.html

Petroleum- https://www.eia.gov/petroleum/weekly/crude.php

A brief snapshot of CPI, CPI-W, CPI-E, PPI...

Tuesday, June 17, 2025

Advance Retail Sales

The numbers came out today... https://tinyurl.com/2tjb5w36

Automotive and Home Improvement stores were almost the entirety of the slippage.

It does indicate some slippage in inflation adjusted, but still within the range from March, 2021... to present. Very near the median and average for that period of time.

Of course, the impact of tariffs cannot be ascertained by this report. On the surface... what the impact is, the economy is adjusting, or so it seems.

Saturday, June 14, 2025

So Far No Recession

It's been awhile since last post, as I have been very busy.

First up, the CPI report. My personal CPI was 2.4%, which matched the CPI-U. The CPI-W edged up to 2.2%, and the forecast of COLA jumped up quite a bit.

Thursday, February 13, 2025

Producer Price Index and some other opinions

The Producer Price Index was released this morning and indicated an upturn.

Note that I did not revise the December, 2024 final demand, as did the BLS. Yes, December was revised upward to 3.5%. https://www.bls.gov/news.release/archives/ppi_01142025.htm

The nervous nellies will scream inflation is roaring back. Maybe so, but it will not repeat the horrors of 2021~2022. How can I say that? Once you understand the causes, the answer becomes easy.

- After the covid shutdown and collapse of international trade, the shipping industry was in disarray, with containers to move goods... in all the wrong places.

- Retailers had significantly reduced inventories to meet the slowing demand.

- There was a rather large stimulus paid to American citizens, on top of some previous payouts.

- The covid vaccine was becoming rapidly available.

- The American people were told that it was now safe to resume normal activities.

- An impending west coast port strike for mid 2022, which did not materialize.

Wednesday, February 12, 2025

A Few Reports and some opinions... of course!

The CPI came out today and now that Trump is in office, it has suddenly turned terrible. Nevermind, it is for January, so remarkable for just 11 days in office. /s

The media's memory is a bit wacky, with claims that it has suddenly shifted upward, even though the lowest annual rate since February 2021 was this past September.

Tuesday, December 17, 2024

Advance Retail Sales Report- December 17th, 2024

November Advance Monthly Sales for Retail and Food Services, the Report.

Advance estimates of U.S. retail and food services sales for November 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $724.6 billion, an increase of 0.7 percent (±0.5 percent) from the previous month, and up 3.8 percent (±0.5 percent) from November 2023. Total sales for the September 2024 through November 2024 period were up 2.9 percent (±0.5 percent) from the same period a year ago. The September 2024 to October 2024 percent change was revised from up 0.4 percent (±0.5 percent)* to up 0.5 percent (±0.1 percent).

Note the numbers are not adjusted for inflation. Keep in mind, the BLS listed the annual inflation rate of 2.75% annual, and down 0.05% on the month.

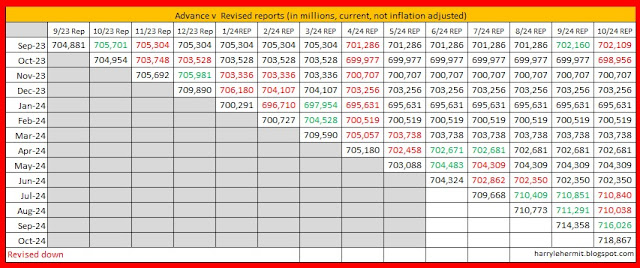

First up, the revision history...

Thursday, December 12, 2024

PPI - Dec. 2024 release with Nov. 2024 Data

The BLS has released the November 2024 Producer Price Index Report for the month of October. (historical releases)

The Producer Price Index for final demand rose 0.4 percent in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices increased 0.3 percent in October and 0.2 percent in September. (See table A.) On an unadjusted basis, the index for final demand advanced 3.0 percent for the 12 months ended in November, the largest rise since moving up 4.7 percent for the 12 months ended February 2023.

In November, nearly 60 percent of the broad-based rise in final demand prices can be attributed to a 0.7-percent increase in the index for final demand goods. Prices for final demand services moved up 0.2 percent.

Wednesday, December 11, 2024

BLS Data Dump. Real Earnings - December 11th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.25 for hourly- private non farm payrolls, seasonally adjusted...

BLS Data Dump. CPI - December 11th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in November, after rising 0.2 percent in each of the previous 4 months, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.

The index for shelter rose 0.3 percent in November, accounting for nearly forty percent of the monthly all items increase. The food index also increased over the month, rising 0.4 percent as the food at home index increased 0.5 percent and the food away from home index rose 0.3 percent. The energy index rose 0.2 percent over the month, after being unchanged in October.

The 2.749% is above last month's 2.598% is back above the 2.62% of March, 2021, and still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Saturday, November 16, 2024

My electricity bills over time (November, 2024 Edition)

My electricity usage over time. I track many things to monitor my inflation versus the CPI.

Friday, November 15, 2024

Advance Retail Sales Report- November 17th, 2024

October Advance Monthly Sales for Retail and Food Services, the Report.

Advance estimates of U.S. retail and food services sales for October 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $718.9 billion, an increase of 0.4 percent (±0.5 percent)* from the previous month, and up 2.8 percent (±0.5 percent) from October 2023. Total sales for the August 2024 through October 2024 period were up 2.3 percent (±0.5 percent) from the same period a year ago. The August 2024 to September 2024 percent change was revised from up 0.4 percent (±0.5 percent)* to up 0.8 percent (±0.2 percent).

Note the numbers are not adjusted for inflation. Keep in mind, the BLS listed the annual inflation rate of 2.6% annual, and up 0.12% on the month.

First up, the revision history...

Thursday, November 14, 2024

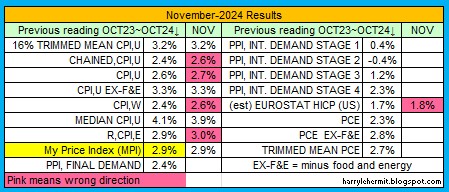

PPI November 2024 release with October 2024 Data

The BLS has released the November 2024 Producer Price Index Report for the month of October. (historical releases)

The Producer Price Index for final demand increased 0.2 percent in October, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.1 percent in September and 0.2 percent in August. (See table A.) On an unadjusted basis, the index for final demand moved up 2.4 percent for the 12 months ended in October.

In October, most of the rise in final demand prices can be traced to a 0.3-percent advance in the index for final demand services. Prices for final demand goods inched up 0.1 percent.

The index for final demand less foods, energy, and trade services increased 0.3 percent in October after moving up 0.1 percent in September. For the 12 months ended in October, prices for final demand less foods, energy, and trade services rose 3.5 percent

Wednesday, November 13, 2024

BLS Data Dump. Real Earnings - November 13th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.24 for hourly- private non farm payrolls, seasonally adjusted (last month was revised downward)...

BLS Data Dump. CPI - November 13th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in October, the same increase as in each of the previous 3 months, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.6 percent before seasonal adjustment.

The index for shelter rose 0.4 percent in October, accounting for over half of the monthly all items increase. The food index also increased over the month, rising 0.2 percent as the food at home index increased 0.1 percent and the food away from home index rose 0.2 percent. The energy index was unchanged over the month, after declining 1.9 percent in September.

The 2.598% is still below the 2.62% of March, 2021, but still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Sunday, October 20, 2024

Comparison of Inflation in selected countries- October, 2024 Edition

With the United Kingdom, Canada, and EUstats release of June data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat]

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

Remember back when the 2022 1st and 2nd quarter GDP numbers came in... and those politically motivated types screamed "we are in a rece...