Bear with me, as I explain the 2 groups.

Group one would be more applicable to middle income before taxes, with spending power of about $77,681 after taxes. This seems to be the median or average of CPI spending, considering household size, etc. The before tax income and before savings rate places the income over $100K, in my estimation. The $77,681 spending is applicable to CPI.

Group two would be more applicable to lower middle class, with purchasing power of about $47,000 with all other factors such as persons in household, etc. Approximating income level as being near Middle class low of $60,319, before taxes and any meaningful savings. The bottom line drops back to $47,000

The intent is to indicate the impact of inflation on two groups of middle income households. It should be a given that lower middle class and poor or near poor, would be impacted much more.

The $77,681 is to be considered the spending of an average household on the CPI scale. (It may be lower, but the end principle remains the same.)

This chart highlights "some" spending habits of this group...

While food is 13.388% of spending for this group, the second group is about 22.128%. Let's see how their lower spending shows up...

Here the spending on other stuff is curtailed, compared to the upper middle income group. While the accuracy of my numbers might not be completely accurate, they do portray a significant difference in decision making of what to spend money on.

An that was just the two extremes of the "middle income" group. I should point out that 40% of the purchasing items for the upper middle income group has been omitted. That lower middle income group will need to cut back on the highlighted 4 items to partake of that other 40%.

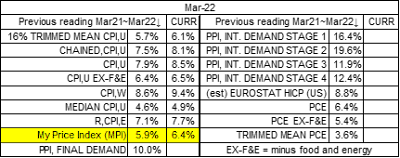

Those cutbacks are even more extreme for the lower middle class, the poor and near poor. In a way, the inflation rate for the lower middle income group is probably closer to 9.8% annual, compared to the 7.9% for the upper middle income group. Worse (higher inflation) down the income scale.

Economists debate when inflation will begin to recede. A lot depends on the public's willingness to spend, go further in debt, etc. It is about supply and demand. When supply exceeds demand, prices will begin to fall and of course, the reverse has prices rising.

At this point, I would speculate that demand will fall across many categories as the supply catches up. However, the demand for food will continue to increase as the global population grows. That supply has been limited for various factors, such as supply chain bottlenecks, covid strapped suppliers AND Global weather patterns... such as too much rain during planting season and not enough rain during growing season.

Going forward, the price of inputs for crops was escalating prior to Russia's invasion of Ukraine. Food is a global commodity, so any threats to crop production have a global impact.

We can expect food prices to continue to climb, with the poor, near poor and lower middle class being impacted even further. Some hard decisions will have to be made by these groups and they will not be very happy about those decisions. That American Dream is moving further and further away, imho.