First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent on a seasonally adjusted basis, after being unchanged in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.0 percent before seasonal adjustment.

The index for gasoline fell 3.8 percent in June, after declining 3.6 percent in May, more than offsetting an increase in shelter. The energy index fell 2.0 percent over the month, as it did the preceding month. The index for food increased 0.2 percent in June. The food away from home index rose 0.4 percent over the month, while the food at home index increased 0.1 percent. [emphasis added]

A lot of chatter about this being the first negative in 4 years and means rate cuts are an almost certainty.

A bit of reality... From the December 2022 report.

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, after increasing 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.5 percent before seasonal adjustment.

The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes.

For the record, the FED increased rates 4 times by 25 basis points each , starting on 2-1-2023, 3-22-2023, 5-3-2023, and 7-26-2023.

That is in no way suggesting further rate hikes, but should dampen the enthusiasm, given a couple of key phrases in the CPI release. The drop in gasoline prices have probably hit bottom and could inch up in July. To put it in perspective, that -0.1% adjusted would have been more like +0.1% adjusted. That 0.0% unadjusted, would have been +0.2% unadjusted.

Likely, the month to month for July, will indicate something like +0.2% ~ +0.3%, when kicking in the anticipated increase in food, especially the food away from home.

Here is the unadjusted CPI for the past 12 months...

My own personal CPI rose 3.1% Y/Y and 0.1% on the month...

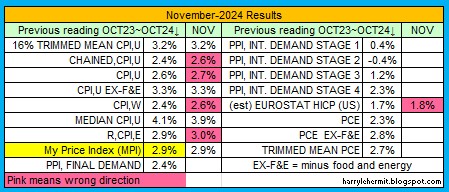

Taking a look at the current report card...

My inflation rate is slowing, but following several years of my personal inflation being below the COLA, I am not so happy, with the current outlook.

Don't get me wrong, I would rather the COLA goes lower, as that indicates less inflation. I do, however, need to adjust my spending, or suck it up.