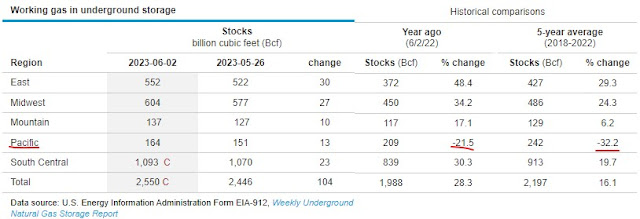

The Energy Information Administration released their weekly report yesterday.

As always... the focus is on the Pacific Region...

Along the West Coast, prices increased this week, in line with the Henry Hub, even as consumption in California declined slightly week over week. The price at PG&E Citygate in Northern California rose 16 cents, up from $2.86/MMBtu last Wednesday to $3.02/MMBtu yesterday, while in Southern California, the price at SoCal Citygate increased more than any other major hub this week, rising $1.67 from $3.13/MMBtu last Wednesday to $4.80/MMBtu yesterday.

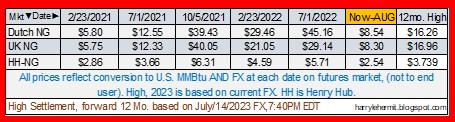

Select inventories of EU and UK...

Virtually all areas continue to increase NG in storage. Despite the hysteria, NG futures continue to ease, both nearby and 12 month... on the EU and UK market, with the Henry Hub, up slightly.

A brief look at the 12 month highs for futures... TTF (EU) and UKG (UK).

Recently, I have noticed some articles stating how the EU/UK natgas prices are surging and giving many reasons. Even one that was AI generated.

Yet these hysterical articles don't seem to hold up for very long.

Surging... compared to what?