The Energy Information Administration released their weekly report yesterday.

The Pacific Region continues to be below year ago and 5 year levels, but is slowly gaining.

Prices increased in West Coast markets, still the highest priced markets in the United States, except in Southern California where a large maintenance event concluded. The price at Sumas on the Canada-Washington border rose 37 cents from $3.72/MMBtu last Wednesday to $4.09/MMBtu yesterday, and the price at PG&E Citygate in Northern California rose 54 cents, up from $5.17/MMBtu last Wednesday to $5.71/MMBtu yesterday.

Select EU and UK storage...

Inventories continue to improve across the EU and UK. (100% inventory capacity is approximately a 90 day supply.)

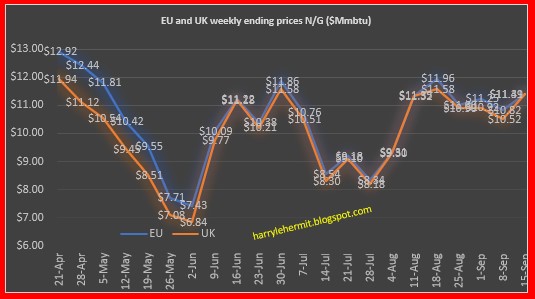

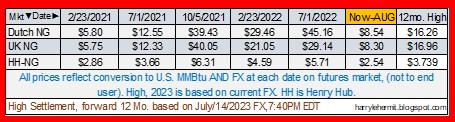

Dutch and UK futures, surged 6% and 7% respectively over last week. February, 2024 futures, surged nearly 22% from last week.

Henry Hub futures surged 7% almost across the board.

The upward pressure stems from labor action in Australia, increased LNG demand in Asia, as well as a Norwegian pipeline tapering down to closure in early fall. The labor action had been somewhat anticipated, and certainly the latter two... were on tap. Or as Rumsfeld might have said... the labor action was a known unknown, and the latter were known knowns.

So something else might be shaking the market.