The Energy Information Administration released their weekly report yesterday.

Nationally, stocks continue to be above the mid point of 5 year range. However... once again the Pacific.

While the Pacific gained this past week, it only matched the curve for time of year.

Prices increased in most West Coast markets this week, except at SoCal Citygate in Southern California, where the price decreased 45 cents from $3.85/MMBtu last Wednesday to $3.40/MMBtu yesterday. Natural gas consumption in California declined 8% (0.4 Bcf/d) week over week, led by a 26% (0.5 Bcf/d) decrease in consumption in the electric power sector, according to data from S&P Global Commodity Insights.

Select inventories of EU and UK...

Total percent of capacity rose this past week to 80.76%.

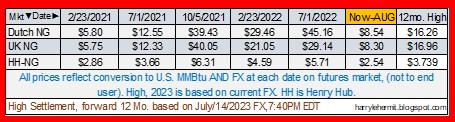

The near term Natural Gas Prices for the EU and UK fell this past week. (Note: figures are in dollar terms and Mmbtu.)

Not surprisingly, the high 12 month also slipped. Currently that 12 month high is January, 2024.

Just for comparison, the UK current pricing would suggest £1,484.27 per annum, while the 12 month high (Jan-24) would suggest £2,235.81. OFGEM has a cap around £2,047, which is line with the October/November futures. (Note: The OFGEM cap reduction is more of a reduced consumption number, not so much as lower price per unit. Make of that, as you wish.)

No comments:

Post a Comment