With the United Kingdom, Canada, and EUstats release of June data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat]

Sunday, October 20, 2024

Comparison of Inflation in selected countries- October, 2024 Edition

Friday, September 20, 2024

Comparison of Inflation in selected countries- September, 2024 Edition

With the United Kingdom, Canada, and EUstats release of June data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat]

Sunday, August 25, 2024

Comparison of Inflation in selected countries- August, 2024 Edition

With the United Kingdom, Canada, and EUstats release of June data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat]

Thursday, July 18, 2024

Comparison of Inflation in selected countries- July, 2024 Edition

With the United Kingdom, Canada, and EUstats release of June data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat]

- Clogged ocean shipping containers in wrong places.

- Massive stimulus

- Vaccine rollout

- Ukraine Invasion

- Perception of definite strikes at ports for July, 2022

- Timing of rate hikes

Tuesday, June 25, 2024

Comparison of Inflation in selected countries- June, 2024 Edition

With the United Kingdom, Canada, and EUstats release of May data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat]

Thursday, May 30, 2024

Comparison of Inflation in selected countries- May, 2024 Edition

With the United Kingdom, Canada and EUstats release of April data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat with the exception of April-2024. That data was calculated by me]

- Rapid roll out of vaccines

- Proclamations of Covid being whipped.

- Massive stimulus mailed directly to households, plus government programs

- Refinery outages in Texas.

- Am eminent dock workers strike, that didn't take place.

- Low petroleum and petroleum product inventories

- Container congestion, due to empty containers in all the wrong places.

- European decision to curtail NG and petroleum imports from Russia.

Thursday, April 18, 2024

Comparison of Inflation in selected countries- April, 2024 Edition

With the United Kingdom, Canada and EUstats release of March data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Wednesday, March 20, 2024

Comparison of Inflation in selected countries- March, 2024 Edition

With the United Kingdom, Canada and EUstats release of February data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Saturday, February 24, 2024

Comparison of Inflation in selected countries- February, 2024 Edition

With the United Kingdom, Canada and EUstats release of December data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

|

Friday, January 19, 2024

Comparison of Inflation in selected countries- January, 2024 Edition

With the United Kingdom, Canada and EUstats release of December data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Long before inflation was everywhere, the phrase was transitory. Yes Virginia, the USA led that "transitory" inflation, until the rest of the world started catching up.

The chart is quite "busy", but the timeline is quite accurate.

'nuff said!

Wednesday, December 20, 2023

Comparison of Inflation in selected countries- December, 2023 Edition

With the United Kingdom, Canada and EUstats release of November data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Wednesday, November 22, 2023

Comparison of Inflation in selected countries- November, 2023 Edition

With the United Kingdom, Canada and EUstats release of October data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Friday, September 29, 2023

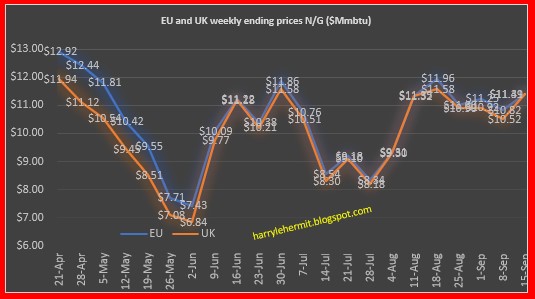

Natural Gas Summary, UK, EU, USA... Week Ending 9-29-2023

The Energy Information Administration released their weekly report.

|

| EIA.GOV via SNL Energy |

[The reason for this observation is LNG, which has introduced the prospect of U.S. Natural Gas prices being affected by global demand for LNG. The EU and UK serve as a benchmark for these demand issues.]

Friday, September 22, 2023

Natural Gas Summary, UK, EU, USA... Week Ending 9-22-2023

The Energy Information Administration released their weekly report.

[The reason for this observation is LNG, which has introduced the prospect of U.S. Natural Gas prices being affected by global demand for LNG. The EU and UK serve as a benchmark for these demand issues.]

Data from the Aggregated Gas Storage Inventory report...

Thursday, September 21, 2023

Comparison of Inflation in selected countries- September, 2023 Edition

With the United Kingdom, Canada and EUstats release of August data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Friday, September 15, 2023

Natural Gas Summary, UK, EU, USA... Week Ending 9-15-2023

The Energy Information Administration released their weekly report.

|

| EIA.GOV, via SNL Energy |

Now for a look at The European Union and United Kingdom.

[The reason for this observation is LNG, which has introduced the prospect of U.S. Natural Gas prices being affected by global demand for LNG. The EU and UK serve as a benchmark for these demand issues.]

Data from the Aggregated Gas Storage Inventory report...

|

Friday, September 8, 2023

Natural Gas Summary... Week Ending 9-08-2023

The Energy Information Administration released their weekly report.

The Pacific Region continues to be slightly ahead of year ago numbers, but still below the 5 year average, although still improving.

The South Central Region continued the slide against year ago levels, but is still above 5 year average.

|

| EIA.GOV, via SNL Energy |

[The reason for this observation is LNG, which has introduced the prospect of U.S. Natural Gas prices being affected by global demand for LNG. The EU and UK serve as a benchmark for these demand issues.]

Data from the Aggregated Gas Storage Inventory report...

|

| Data per AGIS |

Thursday, August 31, 2023

U.S. NatGas Inventory Report, August 31, 2023

The Energy Information Administration released their weekly report today.

The Pacific Region is now slightly ahead of year ago numbers, but still below the 5 year average.

The South Central Region slipped below one year ago levels, but is still above 5 year average.

|

| EIA.GOV, via SNL Energy |

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

Remember back when the 2022 1st and 2nd quarter GDP numbers came in... and those politically motivated types screamed "we are in a rece...