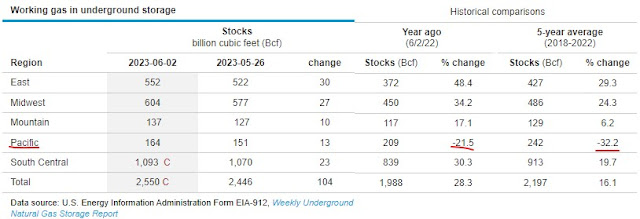

The Energy Information Administration released their weekly report yesterday.

Prices increased in all West Coast markets this report week. At PG&E Citygate in Northern California, the price rose 96 cents from $3.02/MMBtu last Wednesday to $3.98/MMBtu yesterday. The price at SoCal Citygate in Southern California increased 3 cents from $4.80/MMBtu last Wednesday to $4.83/MMBtu yesterday. The price at Sumas on the Canada-Washington border rose 59 cents from $2.02/MMBtu last Wednesday to $2.61/MMBtu yesterday.

Select inventories of EU and UK...

Overall, very good, with EU wide numbers at 78.86% full.A brief look at the 12 month highs for futures... TTF (EU) and UKG (UK).

A slight uptick for the 12 month, but still below the 5-5 picture.

Current week ending prices...

Current futures (August v 12 month high)