The Energy Information Administration released their weekly report on Thursday.

Friday, May 19, 2023

Natural Gas Inventory Report, May 19, 2023

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, May 12, 2023

Natural Gas Inventory Report, May 12, 2023

The Energy Information Administration released their weekly report on Thursday.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Saturday, May 6, 2023

West Coast Natural Gas Inventories improving, but still below seasonal norms.

The Energy Information Administration released their weekly report on Thursday.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, April 28, 2023

West Coast Natural Gas Inventories still way below normal, but showing signs of life.

The Energy Information Administration released their weekly report yesterday.

For Europe, inventories are well above both last year (double) and near top of 5 year average.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, April 21, 2023

West Coast Natural Gas Inventories still way below normal, but showing a slight rise.

The Energy Information Administration released their weekly report yesterday.

In the West, prices generally declined this week, except for the price at PG&E Citygate in Northern California, which rose 38 cents from $5.79/MMBtu last Wednesday to $6.17/MMBtu yesterday. The price at SoCal Citygate in Southern California decreased 33 cents from $7.99/MMBtu last Wednesday to $7.66/MMBtu yesterday. In the Pacific Northwest, the price at Sumas on the Canada-Washington border fell $1.17 from $4.80/MMBtu last Wednesday to $3.63/MMBtu yesterday. Southern California Gas (SoCalGas) began planned maintenance on Line 5000 on Monday, April 17, which will curtail 630 million cubic feet per day of natural gas flows through April 28.

Still about triple the price of Henry Hub.

Elsewhere...

According to news reports, the UK storage is sufficient to last through the summer. Not sure what that even means, as future's prices seem to indicate a rise. In any case, the so called cap currently in place of £2,500 is likely to show little easing, in my humble opinion.

German inventories are holding steady at 64%. It should be noted the winter was mild, plus consumption was reduced... largely by industry, according to Der Spiegel. Can that extend through another year? If productivity was not impacted... were these industries wasteful?

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, April 14, 2023

West Coast Natural Gas Inventories still way below normal

The Energy Information Administration released their weekly report yesterday.

The graph indicates at the upper end of the 5 year, a deeper dive results in something like this...Mountain and especially the West Coast is way below normal, which is also reflected in the pricing of that region, compared to others.Although falling week over week, prices in West Coast markets remain elevated and are currently the highest in the United States. The price at SoCal Citygate in Southern California decreased 66 cents from $8.65/MMBtu last Wednesday to $7.99/MMBtu yesterday, and the price at PG&E Citygate in Northern California fell $1.52, down from $7.31/MMBtu last Wednesday to $5.79/MMBtu yesterday.

Generally speaking, about triple the rest of the nation. Some specific issues were colder than normal weather, this past winter, as well as numerous pipeline problems.

Elsewhere...

Haven't checked UK storage, but Germany is holding steady at 64%, which is more than double this time last year and near 50% higher than the 2016~2020 average for same period.

It is hard to imagine a repeat of last year's gyrations and LNG shipments don't seem to be affecting Henry Hub. That is not to infer European energy costs are substantially waning. The consumer will likely continue to feel the shock for quite some time. Sorry!

Germany at 64% storage has to recoup the cost of that storage, which was really quite high... and continues to be quite high.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, April 6, 2023

Natural Gas Inventories look to be good, except on the left coast.

The Energy Information Administration released their weekly report Thursday.

In great shape, except for the west coast...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, March 16, 2023

Cooking With Natural Gas March 16 2023

The Energy Information Administration released their weekly report Thursday.

|

| Click image to enlarge |

Of course, it varies by region...

|

| Click image to enlarge |

The price at Sumas on the Canada-Washington border, the main pricing point in the Pacific Northwest, fell $3.74 from $7.16/MMBtu last Wednesday to $3.42/MMBtu yesterday.

The price at Malin, Oregon, the northern delivery point into the PG&E service territory, fell $1.48 from $7.52/MMBtu last Wednesday to $6.04/MMBtu yesterday, leading to a $1.86/MMBtu decline in the price at the PG&E Citygate in Northern California from $8.80/MMBtu last Wednesday to $6.94/MMBtu yesterday.

So the U.S. is starting to look good. HOWEVER, storage contains natural gas that was priced at much higher rates. While most futures are substantially down, that higher priced NatGas in storage will prop up energy prices to the consumer. They should trend downward from here. How long that takes... I don't know.

The same situation is seen in UK and EU. However prices are still elevated and will likely remain elevated. There should be some easing to the consumer, but not sure that will happen this year.

|

| Click image to enlarge |

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, February 16, 2023

Cooking With Natural Gas Feb 16 2023

I had briefly considered a seasonal hiatus regarding the NatGas reports, but something popped up in my in basket, telling me to hold on for at least another 6 weeks. The Groundhog didn't lie, just missed the timing!!

The Energy Information Administration released their weekly report Thursday.

|

| Click to Enlarge |

|

| Click to Enlarge |

|

| Click to Enlarge |

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, February 9, 2023

Cooking With Natural Gas Feb 9 2023

The Energy Information Administration released their weekly report Thursday.

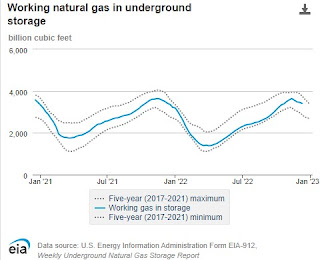

Natural Gas storage is still within 5 year range for the USA.

|

| Click to Enlarge |

|

| Click to Enlarge |

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, January 13, 2023

Natural Gas Report, Jan. 13 2023

The Energy Information Administration released their weekly report Thursday.

Natural Gas storage is still holding up in the USA.

|

| Click to Enlarge |

|

| Click to Enlarge |

|

| Click to Enlarge |

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Saturday, December 24, 2022

Natural Gas Report, Dec. 24, 2022

The Energy Information Administration released their weekly report Thursday, and I am just now getting around to commenting, and given the current climate, could be old news.

Such as the latest storage being from 12-16.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, December 15, 2022

Natural Gas Report, Dec. 15, 2022

The Energy Information Administration released their weekly report today...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, December 8, 2022

Natural Gas Situation in the United States

The Energy Information Administration released their weekly report today...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, November 30, 2022

Quick Take on GDP Revision

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the third quarter of 2022 (table 1), according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.6 percent. The second estimate primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased more than previously estimated (refer to "Updates to GDP").

That is good news, except when delving into the details, although still not so bad... just not so optimistic going forward.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, November 17, 2022

Is There a Natural Gas Shortage In the US?

Not if today's report from EIA.GOV is any indication.

- The earth was 94.5 Million miles from the sun in July.

- The earth will be 91.4 Million miles from the sun this coming January.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

A Foray into the 2024 Presidential Election, Part XVI

Really not seeing any major shifts, although the Minnesota margin widened ever so slightly. Still too difficult to read. The unadjusted poll...

-

The BLS has released the April, 2024 Producer Price Index Report . ( historical releases ) The Producer Price Index for final demand rose...

-

On to the Real Earnings . There seems to be a downward trend, across the board, even with downward revisions of previous months data. An in...

-

First up is the BLS Report for CPI ...( historical releases ) The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percen...