The Energy Information Administration released their weekly report today...

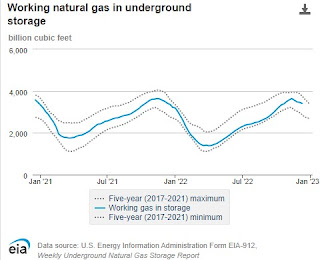

Continues to hold inventories above mid range of 5 year maximum and minimum. Regionally... a bit different story...

Mountain and Pacific regions experienced some drops, week to week and down from one year ago. That storm hitting into the west, is now moving hard into the east, so I would expect some drops in more regions on next week's report.

Overall, prices have edged up on UKG and TTF, with U.S. futures jumping about 9.5%.

Overall, that percentage is still in a rather narrow band, as is UKG and TTF. Forward looking, does not see an let up, as EU and UK reserves will likely be quite slim, by spring. A lot of Russian natural gas was used to build up those reserves, prior to NordStream being curtailed and then shut down.

Not sure who will fill that gap in the 2023 runup to next winter. I would expect U.S. natural gas prices to shoot up during this period, as more LNG Tankers and Processing capacity comes on line. Then there is the matter of Russian LNG, which is still getting to the market, and quite possibly more than what the U.S. is shipping. Highly likely, it is more.

While that might infuriate some, it would ease the run up of prices in U.S. Natural Gas.

Take your pick!

No comments:

Post a Comment