The BLS has released the April Producer Price Index Report. (historical releases)

The Producer Price Index for final demand declined 0.3 percent in May, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.2 percent in April and fell 0.4 percent in March. On an unadjusted basis, the index for final demand moved up 1.1 percent for the 12 months ended in May.

In May, the decline in the final demand index can be traced to prices for final demand goods, which fell 1.6 percent. The index for final demand services increased 0.2 percent.

Prices for final demand less foods, energy, and trade services were unchanged in May after inching up 0.1 percent in April. For the 12 months ended in May, the index for final demand less foods, energy, and trade services increased 2.8 percent.

Overall, the trend is downward and some relief might be in sight for the consumer.

The decreased costs in unprocessed intermediate, have not completely moved into the processed area. Possibly by next month?

Unprocessed goods for intermediate demand: The index for unprocessed goods for intermediate demand fell 4.8 percent in May after increasing 1.6 percent in April. Almost 60 percent of the broad- based decrease is attributable to a 7.8-percent drop in prices for unprocessed energy materials.

Nearly 60 percent of the May decline in the index for unprocessed goods for

intermediate demand can be traced to prices for crude petroleum, which fell 10.2 percent.

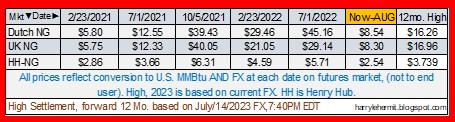

The price drops all across the petroleum sector are evident in the report. Another big drop should be forthcoming in the report for June, as this sector peaked last June.

After that, the impact of petroleum will decrease and the focus will shift elsewhere. As the saying goes... the low hanging fruit will have been picked by fall.

When looking at the overall, as in the first graph and seeing it hold relatively steady, then realizing the significant drops in energy... sticky it is.