Advance Monthly Sales for Retail and Food Services, March Report.

Advance estimates of U.S. retail and food services sales for March 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.6 billion, up 0.7 percent (±0.5 percent) from the previous month, and up 4.0 percent (±0.5 percent) above March 2023. Total sales for the January 2024 through March 2024 period were up 2.1 percent (±0.5 percent) from the same period a year ago. The January 2024 to February 2024 percent change was revised from up 0.6 percent (±0.5 percent) to up 0.9 percent (±0.2 percent).

Retail trade sales were up 0.8 percent (±0.5 percent) from February 2024, and up 3.6 percent (±0.5 percent) above last year. Nonstore retailers were up 11.3 percent (±1.6 percent) from last year, while food services and drinking places were up 6.5 percent (±2.1 percent) from March 2023.

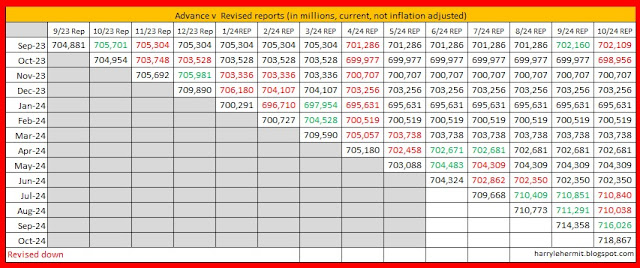

The previous two months were revised upward. Here is the revision history...

The inflation adjusted retail sales...

Taking a look at retail sales (current dollars), with inflation adjusted (real dollars Feb. 2020).

The orange dots is the inflation adjusted, the line has been consistently just below the 600,000 mark (in millions)

Another comparison would be inflation adjusted as well.

Sales when adjusted for inflation, has remained relatively flat, after the recovery from covid, and vaccine rollout, plus stimulus. The timing for this, coupled with major issues in container transportation... resulted in the transitory phase of inflation.

Quite a good argument can be made the "transitory" inflation was exported, due to ocean going shipping problems. Of course, by mid to late 2021, energy became a predominant factor, followed by the Russian invasion of Ukraine and subsequent energy issues. By that time, inflation became everywhere.

This month's report was pretty darn stellar, given the upward revisions of the previous two months. The standout was electronic shopping and mail order houses, which account for 17.3% of the total, but was a 45.4% of the overall annual gains, with the monthly rise being 64.7% of the total monthly gain.

There are problem areas, however.

But we can take a good report, without muddying up the picture. At least in my humble opinion.