First off, the base year for chained dollars is now 2017, instead of the previous 2012.

Secondly, there were revisions in past quarters, or updates. This is done annually.

- 2023 Quarter one GDP was revised upward, from 2.0% annualized, to 2.2% annualized.

- 2023 Quarter one GDI was revised upward from -1.8% annualized to 0.5% annualized.

There are other changes, but that was a sampling.

While the chained dollar report for last month, based on 2012, showed the Real GDP at 20.387T, the new report based on 2017, is now 22.225T.

However, there were significant reductions in the report, with Durable Goods being reduced, both on the personal consumption level and imports.

Clearly there were large adjustments elsewhere to overcome those changes, such as in personal consumption services (quite large), Fixed Investment and Government consumption and Net exports of goods and services.

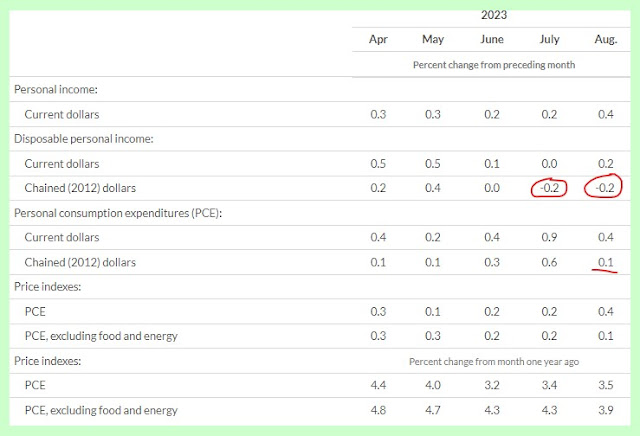

Nothing really out of line from expectations, although the Personal Consumption Expenditures for Goods was quite a drop from Quarter one. However, it is still positive and the drop was not quite a surprise, as the Monthly PCE report has been screaming a sharp decline.