Finally some more reports coming out from the government services, with PPI and Retail Sales. Granted it is still a month behind, as October data should be out.

Tuesday, November 25, 2025

It's Been Awhile

Saturday, July 19, 2025

Week Ending Report-7-19-2025

Several reports from the week, including...

CPI- https://www.bls.gov/news.release/cpi.htm

PPI- https://www.bls.gov/news.release/ppi.htm

Real Earnings- https://www.bls.gov/news.release/realer.htm

Advance Retail- https://www.census.gov/retail/sales.html

Petroleum- https://www.eia.gov/petroleum/weekly/crude.php

A brief snapshot of CPI, CPI-W, CPI-E, PPI...

Saturday, June 14, 2025

So Far No Recession

It's been awhile since last post, as I have been very busy.

First up, the CPI report. My personal CPI was 2.4%, which matched the CPI-U. The CPI-W edged up to 2.2%, and the forecast of COLA jumped up quite a bit.

Wednesday, February 12, 2025

A Few Reports and some opinions... of course!

The CPI came out today and now that Trump is in office, it has suddenly turned terrible. Nevermind, it is for January, so remarkable for just 11 days in office. /s

The media's memory is a bit wacky, with claims that it has suddenly shifted upward, even though the lowest annual rate since February 2021 was this past September.

Friday, January 17, 2025

1-17-2025 Week In Review

Laugh of the week

Watching Sky News and a lady proclaimed that social media sites should be held to the same strict standards as newspaper publishers and television news sites. Clearly she meant the UK, but some of the craziest and insane misinformation has come to me via Sky News and UK newspapers.

Admittedly, the UK media is not as off the rails as American Media.

Greenland, what if...

If Greenland were to be independent, would it still be part of NATO? If not, why would we think they would align with the USA. China and/or Russia would run the bids up, imo. A strategic part of the world could be up for grabs.

Don't just laugh off the "Greenland" rhetoric, imho.

Climate Change

Accepting that the climate is definitely changing, why is all the focus all on the halt of bad emissions? If we were to suddenly halt these bad emissions, things will not return to normal the next day. In fact it would take many decades, if not hundreds of years.

During that period of time, the ice caps will continue to melt, the oceans will continue to rise and the storm patterns will persist. The state of Florida will likely be under water, much of New York City will be under water. So why aren't preparations being made NOW... for such events?

Which brings me to...

LA Fires

There has always been wild fires in California, yet climate change is now considered the root cause. Yet nothing is being done to prepare for what should be considered a certainty.

Blaming "climate change" is much easier than doing something, imho.

Cease Fire

I am typing this on Thursday, 1-16-2025. Call me skeptical, but this seems like a peace deal for Biden, that will fall apart immediately and the Democrats will attempt to blame it on Trump. It theoretically takes place on Sunday, the 19th, so I think shortly after noon on the 20th... things will fall apart.

Economic reports this week

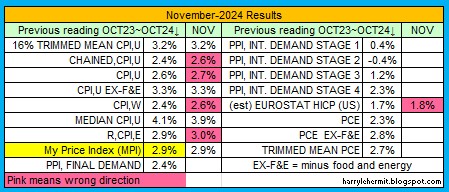

A lot of pink, which indicates rising numbers, but not above expectations, imo.Energy

Pump prices will likely rise about a nickel over the next couple of weeks. Which matches the nickel rise over the past week.

That's it, this is getting boring.

Wednesday, December 11, 2024

BLS Data Dump. Real Earnings - December 11th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.25 for hourly- private non farm payrolls, seasonally adjusted...

BLS Data Dump. CPI - December 11th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in November, after rising 0.2 percent in each of the previous 4 months, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.

The index for shelter rose 0.3 percent in November, accounting for nearly forty percent of the monthly all items increase. The food index also increased over the month, rising 0.4 percent as the food at home index increased 0.5 percent and the food away from home index rose 0.3 percent. The energy index rose 0.2 percent over the month, after being unchanged in October.

The 2.749% is above last month's 2.598% is back above the 2.62% of March, 2021, and still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Saturday, November 16, 2024

My electricity bills over time (November, 2024 Edition)

My electricity usage over time. I track many things to monitor my inflation versus the CPI.

Wednesday, November 13, 2024

BLS Data Dump. Real Earnings - November 13th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.24 for hourly- private non farm payrolls, seasonally adjusted (last month was revised downward)...

BLS Data Dump. CPI - November 13th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in October, the same increase as in each of the previous 3 months, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.6 percent before seasonal adjustment.

The index for shelter rose 0.4 percent in October, accounting for over half of the monthly all items increase. The food index also increased over the month, rising 0.2 percent as the food at home index increased 0.1 percent and the food away from home index rose 0.2 percent. The energy index was unchanged over the month, after declining 1.9 percent in September.

The 2.598% is still below the 2.62% of March, 2021, but still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Saturday, October 19, 2024

My electricity bills over time (October, 2024 Edition)

My electricity usage over time. I track many things to monitor my inflation versus the CPI.

Thursday, October 10, 2024

BLS Data Dump. Real Earnings - October 10th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.24 for hourly- private non farm payrolls, seasonally adjusted...

BLS Data Dump. CPI - October 10th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, the same increase as in August and July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.4 percent before seasonal adjustment.

The index for shelter rose 0.2 percent in September, and the index for food increased 0.4 percent. Together, these two indexes contributed over 75 percent of the monthly all items increase. The food at home index increased 0.4 percent in September and the food away from home index rose 0.3 percent over the month. The energy index fell 1.9 percent over the month, after declining 0.8 percent the preceding month.

The 2.44% is below the 2.62% of March, 2021, but still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Thursday, September 19, 2024

My electricity bills over time (September, 2024 Edition)

My electricity usage over time. I track many things to monitor my inflation versus the CPI.

Wednesday, September 11, 2024

BLS Data Dump. Real Earnings - September 11th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.21 for hourly- private non farm payrolls, seasonally adjusted...

Whereas real weekly earnings for that same cohort has moved from $378.92 to $384.47, up from last month...

BLS Data Dump. CPI - September 11th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, the same increase as in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.5 percent before seasonal adjustment.

The index for shelter rose 0.5 percent in August and was the main factor in the all items increase. The food index increased 0.1 percent in August, after rising 0.2 percent in July. The index for food away from home rose 0.3 percent over the month, while the index for food at home was unchanged. The energy index fell 0.8 percent over the month, after being unchanged the preceding month.

The 2.53% is finally below the 2.62% of March, 2021, but still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Friday, August 23, 2024

My electricity bills over time (August, 2024 Edition)

My electricity usage over time. I track many things to monitor my inflation versus the CPI.

Wednesday, August 14, 2024

BLS Data Dump. CPI - August 13th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, after declining 0.1 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment.

The index for shelter rose 0.4 percent in July, accounting for nearly 90 percent of the monthly increase in the all items index. The energy index was unchanged over the month, after declining in the two preceding months. The index for food increased 0.2 percent in July, as it did in June. The food away from home index rose 0.2 percent over the month, and the food at home index increased 0.1 percent.

It was a bit below the expectations of 3.0% on the annual, and the 0.2% was seasonally adjusted up from the actual 0.116%. So not so bad, and in fact... fairly decent.

For the record: February 2021, 1.7%; March 2021, 2.6%.

Here is the unadjusted CPI for the past 12 months...

My own personal CPI rose 3.0% Y/Y, but slid -0.2% on the month (I'm happy with that) ...

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

Remember back when the 2022 1st and 2nd quarter GDP numbers came in... and those politically motivated types screamed "we are in a rece...