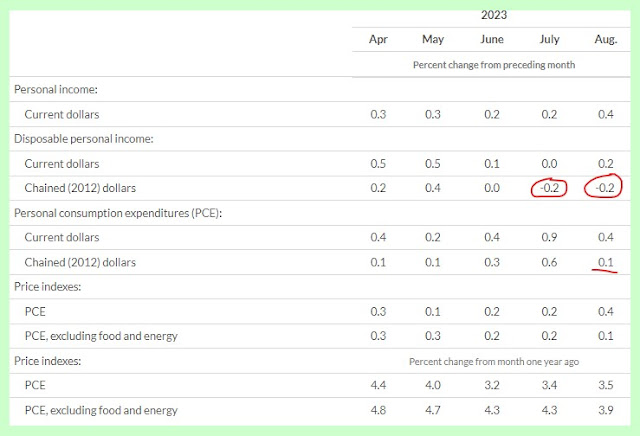

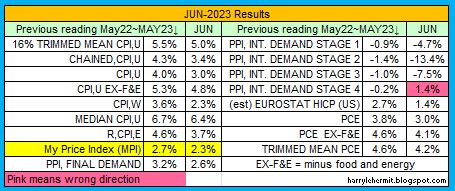

So here is the various inflation numbers...

|

| Click image to enlarge |

This also, includes the latest revisions in the PCE release. I include the previous month's report to indicate any revisions.

|

| Click image to enlarge |

For reference only, the PCE ex food and energy, has increased 10.3%, from February, 2021. The cpi-u ex food and energy, increased 12.3% over that period. The CPI including food and energy has risen 14.4%.

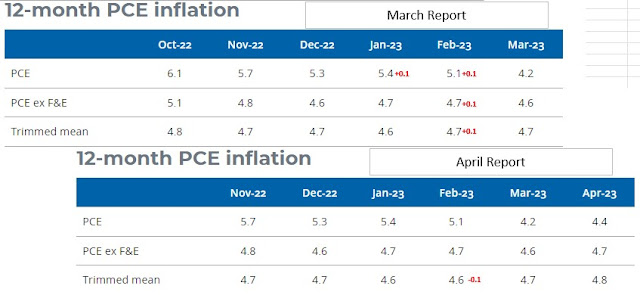

I guess my 1st point being... back in the transitory days of inflation, with it around 5.5%, the prices did not stop rising. So 5.5%, really was transitory. The March data should be slightly below that transitory number, yet I don't expect those proponents of transitory to come out saying... see I told you so.

The 2nd point being... we were upset when inflation was eroding our purchasing power between 4%~5%, so the sticky prices (ex food and energy) seem to be stuck in that range. Smarter minds than me, forecast core PCE to achieve that noble 2% target in late 2024.

I am beginning to think a recession will be necessary to bring down those sticky prices, although those smart minds are already forecasting 3 consecutive quarters of negative GDP, beginning in 2nd Qtr, 2023. Which brings me to GDP.

Being a glass half full kind of guy, I look for the potential problem areas in reports, such as the GDP. It strikes me that the increase in inventories and the net deficit of imports/exports, erases that 2.6% annualized to 0%.

Going forward, I would anticipate the net deficit in imports/exports to slightly increase for the 1st quarter, and inventories to remain steady or slightly increase. Which requires the other categories to do the heavy lifting. You guessed it... it largely falls on the consumer.

I have completely wasted a few hours on this article, and it is time to enjoy Saturday.