Finally some more reports coming out from the government services, with PPI and Retail Sales. Granted it is still a month behind, as October data should be out.

Tuesday, November 25, 2025

It's Been Awhile

Saturday, August 16, 2025

Week Ending Report-August 16th, 2025

A few reports of interest (to me), from this past week.

The inflation report was rather benign and met expectations. The oddity was in the CPI-W, which directly relates to C.O.L.A. It was a mild 2.5% y/y. The previous projection was a 2.6%~2.7% cola, which now moves a bit down to 2.5%~2.7%.

Saturday, July 19, 2025

Week Ending Report-7-19-2025

Several reports from the week, including...

CPI- https://www.bls.gov/news.release/cpi.htm

PPI- https://www.bls.gov/news.release/ppi.htm

Real Earnings- https://www.bls.gov/news.release/realer.htm

Advance Retail- https://www.census.gov/retail/sales.html

Petroleum- https://www.eia.gov/petroleum/weekly/crude.php

A brief snapshot of CPI, CPI-W, CPI-E, PPI...

Sunday, March 2, 2025

Are We Heading Into A Recession?

Remember back when the 2022 1st and 2nd quarter GDP numbers came in... and those politically motivated types screamed "we are in a recession!"

We are about to undergo another episode of such nonsense, but from the opposite side of the political spectrum.

Hearkening back to that previous period of 2021/22, there were multiple factors that caused the inflation to accelerate into that annual high of 9.2% in June 2022. One of those factors was front loading of imports ahead of an impending West Coast port strike... planned for July 1, 2022. It didn't happen, but that front loading caused the trade deficit to balloon in the first 2 quarters of 2022.

Trade deficits are a drag on GDP. Interestingly enough, the adjustment from 2012 to 2017 dollars, resulted in significant revisions in those first 2 quarter of 2022. Subsequent revisions how has that 1st quarter of 2022 now at -1.0 from original -1.4 and the 2nd quarter now at +0.3, from the original -0.9.

On any given month, the trade deficit subracts about -4.3% from the GDP. During the 1st 2 quarters of 2020, the drag increased -5.2%. Hence the original 1st quarter would have been -0.5% revised to -0.1% and the 2nd quarter would have been flat, to a revised +1.2%.

All of this to forewarn us the trade deficit has ballooned again. The February report...

Yes, that is December and the reasoning is front loading to get ahead of possible tariffs. If that is true, which is likely, the January and February numbers could be even higher.

Now much is made of that Atlanta FED forecast as now being -1.5% for 1st quarter GDP. The sky is falling, but what did the report actually say?

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -1.5 percent on February 28, down from 2.3 percent on February 19. After recent releases from the US Bureau of Economic Analysis and the US Census Bureau, the nowcast of the contribution of net exports to first-quarter real GDP growth fell from -0.41 percentage points to -3.70 percentage points while the nowcast of first-quarter real personal consumption expenditures growth fell from 2.3 percent to 1.3 percent.

That's a -3.29% additional drag, due to extremely high imports. Without this, the GDP forecast would be about +2.2%.

All signs point to the next trade report, which is for January... could be even higher. That release is Thursday, March the 6th.

That Advance 2025 1st Quarter GDP will be released on April 30th.

I would think the data does not suggest we are heading into a recession, however... given the fickle nature of the American consumer and the extraordinary media bias, we will get one, whether we like it or not.

Thursday, February 13, 2025

Producer Price Index and some other opinions

The Producer Price Index was released this morning and indicated an upturn.

Note that I did not revise the December, 2024 final demand, as did the BLS. Yes, December was revised upward to 3.5%. https://www.bls.gov/news.release/archives/ppi_01142025.htm

The nervous nellies will scream inflation is roaring back. Maybe so, but it will not repeat the horrors of 2021~2022. How can I say that? Once you understand the causes, the answer becomes easy.

- After the covid shutdown and collapse of international trade, the shipping industry was in disarray, with containers to move goods... in all the wrong places.

- Retailers had significantly reduced inventories to meet the slowing demand.

- There was a rather large stimulus paid to American citizens, on top of some previous payouts.

- The covid vaccine was becoming rapidly available.

- The American people were told that it was now safe to resume normal activities.

- An impending west coast port strike for mid 2022, which did not materialize.

Tuesday, December 17, 2024

Advance Retail Sales Report- December 17th, 2024

November Advance Monthly Sales for Retail and Food Services, the Report.

Advance estimates of U.S. retail and food services sales for November 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $724.6 billion, an increase of 0.7 percent (±0.5 percent) from the previous month, and up 3.8 percent (±0.5 percent) from November 2023. Total sales for the September 2024 through November 2024 period were up 2.9 percent (±0.5 percent) from the same period a year ago. The September 2024 to October 2024 percent change was revised from up 0.4 percent (±0.5 percent)* to up 0.5 percent (±0.1 percent).

Note the numbers are not adjusted for inflation. Keep in mind, the BLS listed the annual inflation rate of 2.75% annual, and down 0.05% on the month.

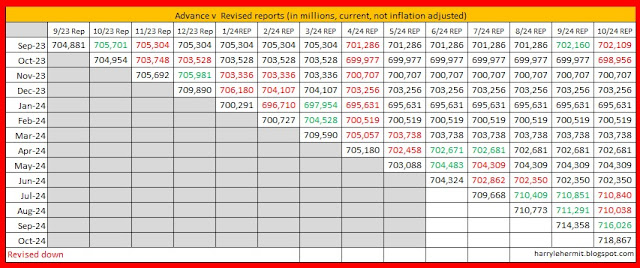

First up, the revision history...

Friday, November 15, 2024

Advance Retail Sales Report- November 17th, 2024

October Advance Monthly Sales for Retail and Food Services, the Report.

Advance estimates of U.S. retail and food services sales for October 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $718.9 billion, an increase of 0.4 percent (±0.5 percent)* from the previous month, and up 2.8 percent (±0.5 percent) from October 2023. Total sales for the August 2024 through October 2024 period were up 2.3 percent (±0.5 percent) from the same period a year ago. The August 2024 to September 2024 percent change was revised from up 0.4 percent (±0.5 percent)* to up 0.8 percent (±0.2 percent).

Note the numbers are not adjusted for inflation. Keep in mind, the BLS listed the annual inflation rate of 2.6% annual, and up 0.12% on the month.

First up, the revision history...

Thursday, October 17, 2024

Advance Retail Sales Report- October 17th, 2024

September Advance Monthly Sales for Retail and Food Services, September Report.

Advance estimates of U.S. retail and food services sales for September 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $714.4 billion, an increase of 0.4 percent (±0.5 percent)* from the previous month, and up 1.7 percent (±0.5 percent) from September 2023. Total sales for the July 2024 through September 2024 period were up 2.3 percent (±0.5 percent) from the same period a year ago. The July 2024 to August 2024 percent change was unrevised from up 0.1 percent (±0.2 percent)*.

Note the numbers are not adjusted for inflation. Keep in mind, the BLS listed the annual inflation rate of 2.4% annual, and up 0.16% on the month.

First up, the revision history...

The historical numbers, also with adjustments for inflation...

Tuesday, September 17, 2024

Advance Retail Sales Report- September 17th, 2024

Advance Monthly Sales for Retail and Food Services, August Report.

Advance estimates of U.S. retail and food services sales for August 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $710.8 billion, an increase of 0.1 percent (±0.5 percent)* from the previous month, and up 2.1 percent (±0.5 percent) from August 2023.

Note the numbers are not adjusted for inflation. Keep in mind, the BLS listed the annual inflation rate of 2.5%

First up, the revision history (might need to click on, to up scale)...

The historical numbers, also with adjustments for inflation...

After last month's "stellar" report, which was mostly from revisions and other items, this month is tame.

There were winners and losers, however. The biggest sales numbers come from the auto sector, which faded a bit over the past month in adjusted sales, and is below the annual.

The next biggest sector is food and beverage stores, which also saw a decrease in adjusted sales. General merchandise continued that trend, with department stores sales for adjusted monthly and annual falling.

Food services and drinking establishments held steady for the monthly adjusted.

Mail order companies, continue to outpace nearly all others.

Thursday, August 15, 2024

Advance Retail Sales Report- August 15th, 2024

Advance Monthly Sales for Retail and Food Services, July Report.

Advance estimates of U.S. retail and food services sales for July 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.7 billion, an increase of 1.0% (±0.5 percent) from the previous month, and up 2.7 percent (±0.5 percent) from July 2023. Total sales for the May 2024 through July 2024 period were up 2.4 percent (±0.5 percent) from the same period a year ago. The May 2024 to June 2024 percent change was revised from virtually unchanged (±0.5 percent)* to down 0.2 percent (±0.2 percent)*.

As for those revisions...

Tuesday, July 16, 2024

Advance Retail Sales Report- July 16, 2024

Advance Monthly Sales for Retail and Food Services, June Report.

Advance estimates of U.S. retail and food services sales for June 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $704.3 billion, virtually unchanged (±0.5 percent)* from the previous month, but up 2.3 percent (±0.5 percent) above June 2023. Total sales for the April 2024 through June 2024 period were up 2.5 percent (±0.5 percent) from the same period a year ago. The April 2024 to May 2024 percent change was revised from up 0.1 percent (±0.4 percent)* to up 0.3 percent (±0.2 percent).

Tuesday, June 18, 2024

Advance Retail Sales Report- June18, 2024

Advance Monthly Sales for Retail and Food Services, May Report.

Advance estimates of U.S. retail and food services sales for May 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $703.1 billion, up 0.1 percent (±0.4 percent)* from the previous month, and up 2.3 percent (±0.5 percent) above May 2023. Total sales for the March 2024 through May 2024 period were up 2.9 percent (±0.5 percent) from the same period a year ago. The March 2024 to April 2024 percent change was revised from virtually unchanged (±0.4 percent)* to down 0.2 percent (±0.2 percent)*.

Wednesday, May 15, 2024

5/15/2024, Advance Retail Sales Report for April Data

Advance Monthly Sales for Retail and Food Services, April Report.

Advance estimates of U.S. retail and food services sales for April 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $705.2 billion, virtually unchanged (±0.4 percent)* from the previous month, but up 3.0 percent (±0.5 percent) above April 2023. Total sales for the February 2024 through April 2024 period were up 3.0 percent (±0.5 percent) from the same period a year ago. The February 2024 to March 2024 percent change was revised from up 0.7 percent (±0.5 percent) to up 0.6 percent (±0.1 percent).

Retail trade sales were virtually unchanged (±0.4 percent)* from March 2024, but up 2.7 percent (±0.5 percent) above last year. Nonstore retailers were up 7.5 percent (±1.6 percent) from last year, while food services and drinking places were up 5.5 percent (±2.1 percent) from April 2023.

WOW! The revisions were substantial and long term...

- Furniture and home furniture stores

- Health and personal care stores

- Sporting goods, hobby, musical etc.

Monday, April 15, 2024

4/15/2024, Advance Retail Sales Report for March Data

Advance Monthly Sales for Retail and Food Services, March Report.

Advance estimates of U.S. retail and food services sales for March 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.6 billion, up 0.7 percent (±0.5 percent) from the previous month, and up 4.0 percent (±0.5 percent) above March 2023. Total sales for the January 2024 through March 2024 period were up 2.1 percent (±0.5 percent) from the same period a year ago. The January 2024 to February 2024 percent change was revised from up 0.6 percent (±0.5 percent) to up 0.9 percent (±0.2 percent).

Retail trade sales were up 0.8 percent (±0.5 percent) from February 2024, and up 3.6 percent (±0.5 percent) above last year. Nonstore retailers were up 11.3 percent (±1.6 percent) from last year, while food services and drinking places were up 6.5 percent (±2.1 percent) from March 2023.

The previous two months were revised upward. Here is the revision history...

The orange dots is the inflation adjusted, the line has been consistently just below the 600,000 mark (in millions)

Another comparison would be inflation adjusted as well.

Sales when adjusted for inflation, has remained relatively flat, after the recovery from covid, and vaccine rollout, plus stimulus. The timing for this, coupled with major issues in container transportation... resulted in the transitory phase of inflation.

Thursday, March 14, 2024

3/14/2024, Advance Retail Sales Report for February Data

Advance Monthly Sales for Retail and Food Services, February Report.

Advance estimates of U.S. retail and food services sales for February 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $700.7 billion, up 0.6 percent (±0.5 percent) from the previous month, and up 1.5 percent (±0.7 percent) above February 2023. Total sales for the December 2023 through February 2024 period were up 2.1 percent (±0.5 percent) from the same period a year ago. The December 2023 to January 2024 percent change was revised from down 0.8 percent (±0.5 percent) to down 1.1 percent (±0.4 percent).

Of course the previous 2 months were revised downward...

Thursday, February 15, 2024

2/15/2024, Advance Retail Sales Report for January Data

Advance Monthly Sales for Retail and Food Services, January Report.

Advance estimates of U.S. retail and food services sales for January 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $700.3 billion, down 0.8 percent (±0.5 percent) from the previous month, and up 0.6 percent (±0.7 percent)* above January 2023. Total sales for the November 2023 through January 2024 period were up 3.1 percent (±0.5 percent) from the same period a year ago. The November 2023 to December 2023 percent change was revised from up 0.6 percent (±0.5 percent) to up 0.4 percent (±0.3 percent).

Cutting through the malarkey...

Looking at the average monthly sales (adjusted for inflation) since March, 2021... is provided in this graph.

- Furniture and home furnishings

- Grocery stores (just barely)

- Food services and drinking places.

Wednesday, January 17, 2024

1/17/2024, Advance Retail Sales Report for December Data

Advance Monthly Sales for Retail and Food Services, December Report.

Advance estimates of U.S. retail and food services sales for December 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.9 billion, up 0.6 percent (±0.5 percent) from the previous month, and up 5.6 percent (±0.7 percent) above December 2022. Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022. Total sales for the October 2023 through December 2023 period were up 3.9 percent (±0.4 percent) from the same period a year ago. The October 2023 to November 2023 percent change was unrevised from up 0.3 percent (±0.3 percent)*.

Hmmm... "Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022." The BLS listed that same period as having inflation of 3.4%. Which means the seasonal variation and trading-day differences have come into the equation. Otherwise, sales were up a bit more than indicated, imho.

First up the revisions...

We continue a pattern of previous months being revised downward, so the monthly changes are somewhat suspect.

When adjusted for inflation, the annual shows an improvement of +2.2%. The January numbers will be quite interesting, imho. The January report, adjusted for inflation, is slightly above the December number with inflation adjustements. Revisions will likely take place. 😒

The inflation adjusted chart looks like this...

Thursday, December 14, 2023

12-15-23, Advance Retail Sales Report for November Data

Advance Monthly Sales for Retail and Food Services, November Report.

First up should be the revisions...

Advance estimates of U.S. retail and food services sales for November 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $705.7 billion, up 0.3 percent (±0.5 percent)* from the previous month, and up 4.1 percent (±0.7 percent) above November 2022.

The inflation adjusted chart looks like this...

Tuesday, October 17, 2023

10-17-23, Advance Retail Sales Report for September Data

Advance Monthly Sales for Retail and Food Services, September 2023.

Advance estimates of U.S. retail and food services sales for September 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $704.9 billion, up 0.7 percent (±0.5 percent) from the previous month, and up 3.8 percent (±0.7 percent) above September 2022. Total sales for the July 2023 through September 2023 period were up 3.1 percent (±0.4 percent) from the same period a year ago. The July 2023 to August 2023 percent change was revised from up 0.6 percent (±0.5 percent) to up 0.8 percent (±0.1 percent).

Retail trade sales were up 0.7 percent (±0.5 percent) from August 2023, and up 3.0 percent (±0.5 percent) above last year. Nonstore retailers were up 8.4 percent (±1.6 percent) from last year, while food services and drinking places were up 9.2 percent (±2.3 percent) from September 2022.

As always, a reminder... "not for price changes", means not adjusted for inflation.

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...