The BLS has released the latest Real Earnings Report.

Real average hourly earnings for all employees decreased 0.2 percent from August to September, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.2 percent in average hourly earnings combined with an increase of 0.4 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

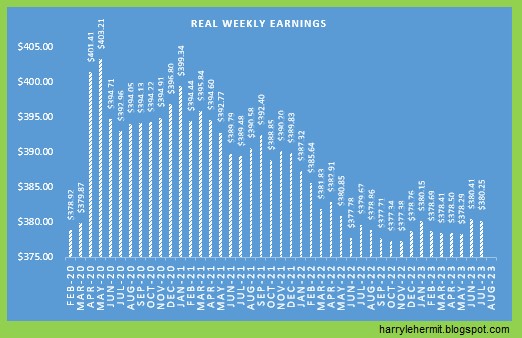

Real average weekly earnings decreased 0.2 percent over the month due to the change in real average hourly earnings combined with no change in the average workweek.

Real average hourly earnings increased 0.5 percent, seasonally adjusted, from September 2022 to September 2023. The change in real average hourly earnings combined with a decrease of 0.6 percent in the average workweek resulted in a 0.1-percent decrease in real average weekly earnings over this period.

I added emphasis to the decrease.

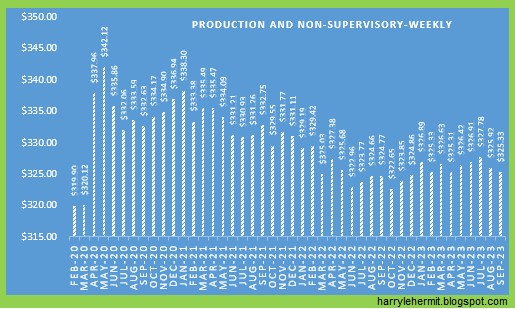

Graph time...

I suppose the good news... the Real Hourly is still +2¢ above pre covid, and down -2¢ from last month.