The BLS report for March...

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.2 percent in March on a seasonally adjusted basis after rising 0.8 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.5 percent before seasonal adjustment.

From last Month...

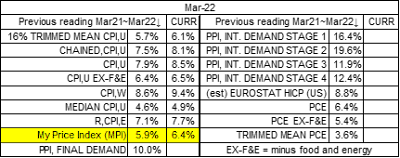

The forecast for March is a bit blurry, due to energy prices, but the expectations would be 8.2% ~ 9.1%. I would unhappily lean towards the 8.7% range, just based on the rapid rise of gasoline during this month, although it may be peaking as I type. I would expect the upward trend in food prices to continue.

With this release comes a variety of other numbers...

I am unhappily at 6.4%...Going forward, it is getting even harder to forecast inflation, as several variables are at play. It would appear that many consumables are starting to slow, which would indicate a potential for slowing of inflation in that area. But then again, China is in lockdown in so many places that further supply disruptions are possible.

Gasoline costs may abate, but likely due to decreased demand and the aforementioned China slowdown.

Food is the one area that will continue to see inflation, as all manner of issues are arising.

I can fairly confidently (and sadly) state that April numbers due out in May, will likely be north of 8.0%, such as between 8.0% and 8.5%.

EDIT: just hours after writing this, the Chinese are loosening the lockdown and crude and gasoline prices have taken off. We'll see where this leads.

No comments:

Post a Comment