It is that time of month, to survey the damage from inflation. The BLS report was released this morning and it was a whopper. (historical releases)

Remember that 8.6%~8.9% forecast? Toast!!!

From the release...

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.3 percent in June on a seasonally adjusted basis after rising 1.0 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 9.1 percent before seasonal adjustment.

The result looks like this...

I didn't fare much better, with an increase at 8.0% y/y and 1.1% m/m.

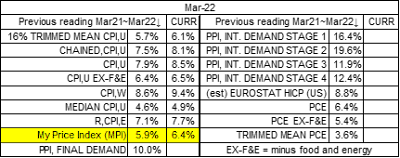

The various inflation numbers, from the BLS and others ended up looking like this. The Eurostat is my estimate, based on several months of data collection and attempting to understand their method. Their last data published for the USA was in April.

With nothing really good on the inflation front, the hourly real earnings were dismal, falling further below the pre-covid February 2020 number.

The weekly real earnings followed the same pattern...

I will attempt a July reading for the CPI-U, as I do expect the month to month to be nearer to "0", than this month's 1.3%. This is mostly due to gasoline prices continuing to fall. This mornings national average was $4.61, and is steadily falling to possibly $4.11 per gallon... based on current future's pricing. This would be pricing back in the good old days, of April's average.

March was actually higher at $4.22; May at $4.44; June at $4.93. February was at $3.52, for those interested. However, the end of July will most likely still be in the $4.30 range, with a July average of approximately $4.55. (Barring any disruptions in refinery operation, etc.)

Backing the gasoline's rise out of the index, the CPI-U would have been about 8.4%. So the fall off of gasoline pricing does have a significant impact for this month's projections. Also, the core came in a bit higher than anticipated.

So, I will project 0.3%~0.5% month to month and a reading of 8.9%~9.1%. I fervently hope I am over shooting, this time.

Once again, in the too early to project C.O.L.A. category, I am adjusting to 9.4%~9.6%. The past few months have been much hotter, year on year, but we are now entering the normal seasonal slowdown period in certain areas and the rate of inflation "should" start to ease.

The should start to ease, might be clearer with tomorrow's PPI release. I would hope for softer numbers. Friday's release of the retail sales, might also provide a further hint to "demand destruction". Then there is the role being played by the strong dollar. Without that, WTI crude would be about $115 per dollar. This also is impacting imported goods as well. How much of that "trickles down" to the consumer... is to be seen.