First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, after declining 0.1 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.9 percent before seasonal adjustment.

The index for shelter rose 0.4 percent in July, accounting for nearly 90 percent of the monthly increase in the all items index. The energy index was unchanged over the month, after declining in the two preceding months. The index for food increased 0.2 percent in July, as it did in June. The food away from home index rose 0.2 percent over the month, and the food at home index increased 0.1 percent.

It was a bit below the expectations of 3.0% on the annual, and the 0.2% was seasonally adjusted up from the actual 0.116%. So not so bad, and in fact... fairly decent.

For the record: February 2021, 1.7%; March 2021, 2.6%.

Here is the unadjusted CPI for the past 12 months...

My own personal CPI rose 3.0% Y/Y, but slid -0.2% on the month (I'm happy with that) ...

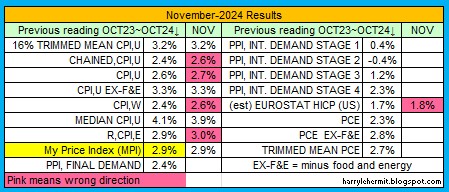

Taking a look at the current report card...

My inflation rate is slowing, but following several years of my personal inflation being below the COLA, I am not so happy, with the current outlook.

That's it for this month's CPI... maybe!

Uhoh!! Edited at 10:30PM, 8-14-2024. changes made to COLA projections, based on +0.1%~+0.2% August projection and September at -0.1%~+0.1%. The likelihood of 2.5% COLA is now very likely. imho.