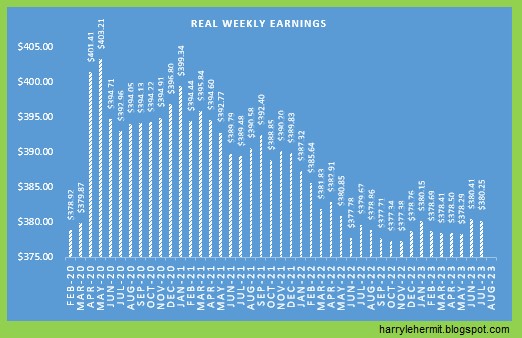

The BLS has released the latest Real Earnings Report.

Real average hourly earnings for all employees decreased 0.5 percent from July to August, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.2 percent in average hourly earnings combined with an increase of 0.6 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

Real average weekly earnings decreased 0.1 percent over the month due to the change in real average hourly earnings combined with a 0.3-percent increase in the average workweek.

Real average hourly earnings increased 0.5 percent, seasonally adjusted, from August 2022 to August 2023. The change in real average hourly earnings combined with a decrease of 0.3 percent in the average workweek resulted in a 0.3-percent increase in real average weekly earnings over this period.

The report was a bit of setback in earnings, as the hourly rate fell -5¢. It is up +2¢ somce February 2020.

Weekly earnings decline -38¢ from last month, although up +95¢ from February 2020.

The above charts include all categories of workers.

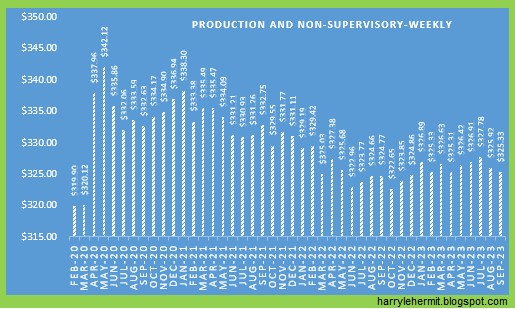

Now for the production and non supervisory...

This category saw a drop of -6¢ per hour, although still +15¢ above February 2020.

Weekly is a bit different...

2 consecutive months of decline, although not a trend at this point. Down -89¢ on the month, although still +$6.02 above February, 2020.

I do remember last month being hailed as proof of something. I forget what it was, but this month is also proof of something. Can't wait to hear the spin on this... if it even crops up in the news cycle.

That gasoline index, cited in August as being below last August... is true. Per AAA, the average for August 2022 was $3.97 and this year at $3.84. BUT, September of 2022 averaged $3.73 and thus far this month is $3.82 and current trading indicate today's national average of $3.85... is heading north of $4 very soon.

I guess reviewing today's crude report is next on the agenda.