Data from the Aggregated Gas Storage Inventory report...

Friday, September 1, 2023

EU & UK NatGas Inventory Report, September 01, 2023

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, August 31, 2023

U.S. NatGas Inventory Report, August 31, 2023

The Energy Information Administration released their weekly report today.

The Pacific Region is now slightly ahead of year ago numbers, but still below the 5 year average.

The South Central Region slipped below one year ago levels, but is still above 5 year average.

|

| EIA.GOV, via SNL Energy |

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Review of July data and the August PCE Release

Some ups and some down in the latest release from the BEA. (red revised down, green revised up).

Chained dollar disposable income was revised down for April and June, with a negative print on July.

However, the chained dollar PCE was revised down for March and May, with upward revisions in April and June.

It seems evident that savings AND debt are currently driving the economy. How long that can last is the big question.

Then there is the matter of PCE Excluding Food & Energy. If the target is 2%, then there is a way to go, given the forecast for August is at 4%. Years ago, when the PCE ex food and energy was failing to achieve even 2%, there was discussion of moving the target to 4%.

That hasn't happened, so how can it be expected for the FED to ease off the interest rates?

|

| https://www.bea.gov/news/2023/personal-income-and-outlays-july-2023 |

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, August 30, 2023

Quick Review of The GDP report 2Q-2023, 2nd estimate

The BEA released the 2nd estimate of 2Q-2023 GDP...

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the second quarter of 2023 (table 1), according to the "second" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.0 percent.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.4 percent (refer to "Updates to GDP"). The updated estimates primarily reflected downward revisions to private inventory investment and nonresidential fixed investment that were partly offset by an upward revision to state and local government spending.

Here is a screenshot of the data page...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Sunday, August 27, 2023

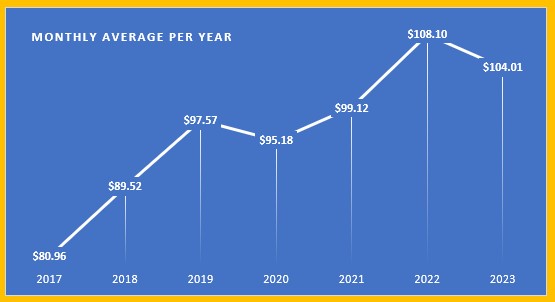

A look at my electricity bills over time

I do odd things, one of which is monitoring my electric bills.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, August 25, 2023

EU & UK NatGas Inventory Report, August 25, 2023

Data from the Aggregated Gas Storage Inventory report...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, August 24, 2023

U.S. NatGas Inventory Report, August 24, 2023

The Energy Information Administration released their weekly report today.

|

| EIA.GOV, via SNL Energy |

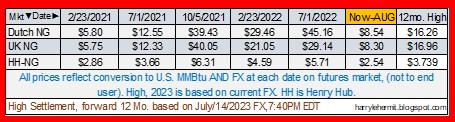

Current price levels suggest consumer inflation in natgas as well as pass through products (electricity) will continue to moderate. These products represent about 3.6% of the average consumer basket.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, August 18, 2023

EU & UK NatGas Inventory Report, August 18, 2023

Data from the Aggregated Gas Storage Inventory report...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

U.S. NatGas Inventory Report, August 18, 2023

The Energy Information Administration released their weekly report yesterday.

Price changes in California were mixed this week. The price at PG&E Citygate in Northern California fell 7 cents, down from $5.71/MMBtu last Wednesday to $5.64/MMBtu yesterday. The price at SoCal Citygate in Southern California increased $2.85 from $4.95/MMBtu last Wednesday to $7.80/MMBtu yesterday. El Paso Natural Gas Company reported maintenance on the North Mainline near Leupp, Arizona, beginning on Monday August 14. In addition, ongoing maintenance is occurring at the SoCalGas pipeline system. Prices in the West remain the highest in the country as above-average temperatures keep demand for cooling high and as the Pacific region remains the only region in the United States with below-average storage levels.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, August 11, 2023

Natural Gas Inventory Report, August 11, 2023

The Energy Information Administration released their weekly report yesterday.

The Pacific Region continues to be below year ago and 5 year levels, but is slowly gaining.

Prices increased in West Coast markets, still the highest priced markets in the United States, except in Southern California where a large maintenance event concluded. The price at Sumas on the Canada-Washington border rose 37 cents from $3.72/MMBtu last Wednesday to $4.09/MMBtu yesterday, and the price at PG&E Citygate in Northern California rose 54 cents, up from $5.17/MMBtu last Wednesday to $5.71/MMBtu yesterday.

Select EU and UK storage...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Producer Price Index August 2023 release

The BLS has released the July Producer Price Index Report. (historical releases)

The Producer Price Index for final demand increased 0.3 percent in July, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices were unchanged in June and declined 0.3 percent in May. (See table A.) On an unadjusted basis, the index for final demand advanced 0.8 percent for the 12 months ended in July.

In July, the increase in final demand prices was led by a 0.5-percent rise in the index for final demand services. Prices for final demand goods edged up 0.1 percent.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, July 28, 2023

Natural Gas Inventory Report, July 28, 2023

The Energy Information Administration released their weekly report yesterday.

Across much of the West, prices increased this week, particularly in California. In the Rocky Mountain region, the price at Cheyenne Hub in southeast Wyoming rose 16 cents from $2.24/MMBtu last Wednesday to $2.40/MMBtu yesterday. In California, the price at PG&E Citygate in Northern California rose 40 cents, up from $4.89/MMBtu last Wednesday to $5.29/MMBtu yesterday. The price at SoCal Citygate in Southern California increased $6.69 from $5.64/MMBtu last Wednesday to $12.33/MMBtu yesterday.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Review of June data and the July PCE Report

A story of glass half empty versus a glass half full...

For months on end, the data has contained revisions of prior months being downward, which gave that current report a glass half empty kind of vibe.

For the past two months... the previous months data has been revised upward, which emits a vibe of glass half full for the current month.

That's a positive, imho.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, July 27, 2023

Quick Review of The Advance GDP report 2Q-2023

First off... a screen shot with some additions.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, July 21, 2023

Natural Gas Inventory Report, July 21, 2023

The Energy Information Administration released their weekly report yesterday.

In California, the price at PG&E Citygate in Northern California rose 57 cents, up from $4.32/MMBtu last Wednesday to $4.89/MMBtu yesterday. The price at SoCal Citygate in Southern California increased $2.24 from $3.40/MMBtu last Wednesday to $5.64/MMBtu yesterday. Natural gas consumption in the electric power sector increased by 84% (1.3 Bcf/d) in California and by 10% (0.3 Bcf/d) in the desert Southwest this report week

Select inventories of EU and UK...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, July 14, 2023

Natural Gas Inventory Report, July 14, 2023

The Energy Information Administration released their weekly report yesterday.

Prices increased in most West Coast markets this week, except at SoCal Citygate in Southern California, where the price decreased 45 cents from $3.85/MMBtu last Wednesday to $3.40/MMBtu yesterday. Natural gas consumption in California declined 8% (0.4 Bcf/d) week over week, led by a 26% (0.5 Bcf/d) decrease in consumption in the electric power sector, according to data from S&P Global Commodity Insights.

Select inventories of EU and UK...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, July 13, 2023

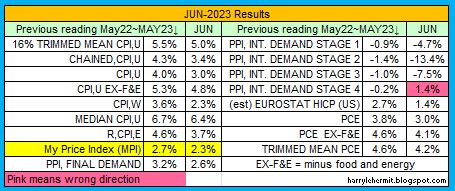

Producer Price Index July 2023 release for June Data.

The BLS has released the June Producer Price Index Report. (historical releases)

The Producer Price Index for final demand increased 0.1 percent in June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices declined 0.4 percent in May and edged up 0.1 percent in April. (See table A.) On an unadjusted basis, the index for final demand advanced 0.1 percent for the 12 months ended in June.

In June, the increase in final demand prices can be traced to a 0.2-percent rise in the index for final demand services. Prices for final demand goods were unchanged.

The index for final demand less foods, energy, and trade services moved up 0.1 percent in June after no change in May. For the 12 months ended in June, prices for final demand less foods, energy, and trade services advanced 2.6 percent.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

This Week in Petroleum Summary May 8th, 2024 per EIA.GOV

This week's full report . Gasoline fell -2.3¢ for the week, but remains +10.3¢ from year ago level. Consumption did edge up this past r...

-

The Energy Information Administration released their weekly report yesterday. The Pacific Region continues to be below year ago and 5 year...

-

The Energy Information Administration released their weekly report Thursday. In great shape, except for the west coast... So prices are do...

-

The monthly summary... The downward shift in inflation continues across the board, with the exception of my price index, which is more about...