A story of glass half empty versus a glass half full...

For months on end, the data has contained revisions of prior months being downward, which gave that current report a glass half empty kind of vibe.

For the past two months... the previous months data has been revised upward, which emits a vibe of glass half full for the current month.

That's a positive, imho.

|

https://www.bea.gov/news/2023/personal-income-and-outlays-june-2023

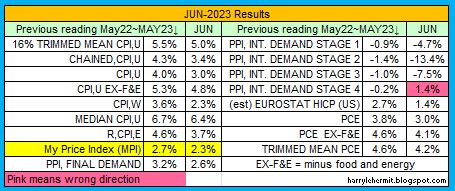

Certainly a downward trend is in full view across the board, when mentioning inflation...

The Annual PCE, ex food and energy, is also slipping.

This is good news, as it indicates "sticky" prices are starting their downward slide. Just in time, as energy prices seem to be edging up and food prices may as well. Not everything is rosy, but optimism is not unreasonable.

EXCEPT, next month's projections are for PCE to come in around 3.4% and core at 4.4%. Is that the last dying gasp of inflation, or signs of things to come? |

No comments:

Post a Comment