The BLS has released the March Producer Price Index Report. (historical releases)

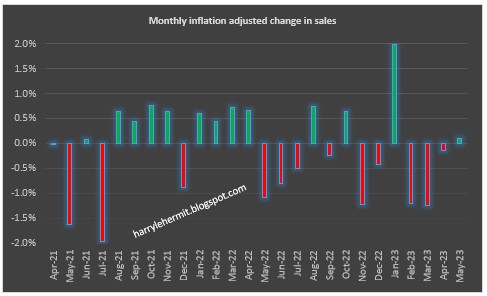

The Producer Price Index for final demand declined 0.5 percent in March, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices were unchanged in February and increased 0.4 percent in January. (See table A.) On an unadjusted basis, the index for final demand advanced 2.7 percent for the 12 months ended in March.

In March, two-thirds of the decline in the index for final demand can be attributed to a 1.0-percent decrease in prices for final demand goods. The index for final demand services moved down 0.3 percent.

Prices for final demand less foods, energy, and trade services edged up 0.1 percent in March after rising 0.2 percent in February. For the 12 months ended in March, the index for final demand less foods, energy, and trade services increased 3.6 percent.

Last month's projection...

Still, I would anticipate March to be year over year of +3.0%, and month to month being flat.

Not too bad for a complete idiot.

Now for my version of spin, or misdirection, or whatever. I tend to look for things that impact me, so my version... may not match your version.

Off the top, the energy index was almost 3/4 of that -0.5% m/m decline in final demand. While most everyone thinks of gasoline, it did rise in March and will continue to do so... maybe through May. It will not achieve last year's June highs, in my opinion.

The story in energy is natural gas. This will show declines into the summer. I don't think it will achieve last summer's high, but it might come close. The upshot being a continuation of m/m declines and annual rates declining into that period.

Currently the PPI final demand number is sitting at 20.8% above the April, 2020 low. The CPI, for reference, is 17.7% above that same period. I would not project any significant correlation between those two figures.

March's number, per the PPIFIS, stands at 140.865, compared to last June's 140.156. It is still +0.5% from June. Clearly, the y/y will continue to decline, but how far will it decline?

Being someone that consumes food on a regular basis, I should point out the final demand on food was +0.6% m/m. That is stark contrast from yesterday's CPI "food at home", at -0.3%. That concerns me more than the rise in current pump prices.

My review of the PPI data, leads me to believe the (core) sticky prices are stuck in the near term. The year over year, however, will continue to fall. At some part, core will also begin to slip.

Next month will likely show another -0.2% m/m, and a +2.0% y/y. No doubt the y/y will likely turn negative in the next few months, largely due to energy. At some point in the summer, the sticky core will have to pitch in, to keep the numbers in decline.

BUT, if that occurs, is it due to slowing demand?

Smarter minds will have to weigh in on that question.