This week's full report.

Wednesday, January 31, 2024

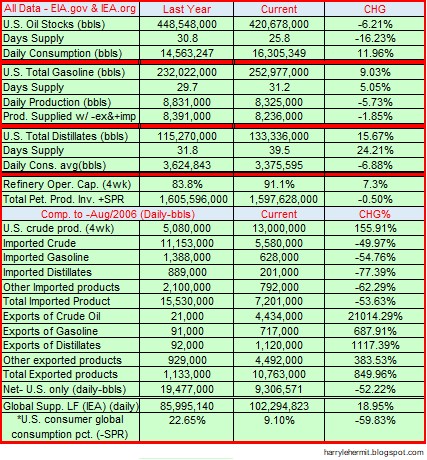

This Week in Petroleum Summary January 31st, 2024 per EIA.GOV

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Monday, January 29, 2024

Review of December 2023 data, 4Q GDP, PCE and personal income

Alas, 2023 reports have concluded. The GDP's 4Q advance reading indicates a sterling 3.1% rise. I will make mention of the 5 year Quinquennial revision from 2012 dollars to 2017 dollars. As would be expected the numbers jumped 9.0%. I can't help but notice the big drag on GDP of net exports of good and services, slid a whopping -26.7%.

Even under the revised numbers, that latter component fell another -5.9% from one year ago.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, January 24, 2024

This Week in Petroleum Summary January 24th, 2024 per EIA.GOV

This week's full report.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Saturday, January 20, 2024

My electricity bills over time (January, 2024 Edition)

It is January, and the monthly bill has arrived.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Friday, January 19, 2024

Comparison of Inflation in selected countries- January, 2024 Edition

With the United Kingdom, Canada and EUstats release of December data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Long before inflation was everywhere, the phrase was transitory. Yes Virginia, the USA led that "transitory" inflation, until the rest of the world started catching up.

The chart is quite "busy", but the timeline is quite accurate.

'nuff said!

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Thursday, January 18, 2024

This Week in Petroleum Summary January 18th, 2024 per EIA.GOV

This week's full report.

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Wednesday, January 17, 2024

1/17/2024, Advance Retail Sales Report for December Data

Advance Monthly Sales for Retail and Food Services, December Report.

Advance estimates of U.S. retail and food services sales for December 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.9 billion, up 0.6 percent (±0.5 percent) from the previous month, and up 5.6 percent (±0.7 percent) above December 2022. Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022. Total sales for the October 2023 through December 2023 period were up 3.9 percent (±0.4 percent) from the same period a year ago. The October 2023 to November 2023 percent change was unrevised from up 0.3 percent (±0.3 percent)*.

Hmmm... "Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022." The BLS listed that same period as having inflation of 3.4%. Which means the seasonal variation and trading-day differences have come into the equation. Otherwise, sales were up a bit more than indicated, imho.

First up the revisions...

We continue a pattern of previous months being revised downward, so the monthly changes are somewhat suspect.

When adjusted for inflation, the annual shows an improvement of +2.2%. The January numbers will be quite interesting, imho. The January report, adjusted for inflation, is slightly above the December number with inflation adjustements. Revisions will likely take place. 😒

The inflation adjusted chart looks like this...

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

Long retired, but still quite opinionated. I post random stuff about things, of which I know little. Sometimes, I even tweet...

https://twitter.com/harrylehermit

This Week in Petroleum Summary May 8th, 2024 per EIA.GOV

This week's full report . Gasoline fell -2.3¢ for the week, but remains +10.3¢ from year ago level. Consumption did edge up this past r...

-

The Energy Information Administration released their weekly report yesterday. The Pacific Region continues to be below year ago and 5 year...

-

The monthly summary... The overall PCE edged upward, on annual basis, with PCE ex food and energy staying flat. Of course, the official got...

-

This week's full report . Consumption slid, although not sure if a downward trend is developing. Last year's data would indicate a d...