The monthly summary continues to improve, although PCE ex food and energy inflation numbers continue to be a concern.

Friday, September 27, 2024

Review of August 2024 data, 2Q GDP, PCE and personal income

Friday, August 30, 2024

Review of July 2024 data, 2Q GDP, PCE and personal income

The monthly summary continues to improve, although PPI numbers continue to be a concern... going forward.

Friday, July 26, 2024

Review of June 2024 data, 2Q GDP, PCE and personal income

The monthly summary continues to improve, although PPI numbers continue to be a concern... going forward.

The 2nd quarter GDP came in above expectations at 2.8% annualized. I was puzzled by the slower growth in Services at 2.2% annualized, which helps explain the 2.3% annualized for personal consumption. Durable goods up 4.6% and nondurables at 1.4%, both annualized.

Overall a good report, but I would be a bit concerned if fixed investment can continue its expansion, which is equipment driven, while inventories keep building.

As for the PCE excluding food and energy... not much movement. Granted the market is anticipating a rate cut in September... and it might be warranted. A string of rate cuts might not be so warranted, imho.

We can start the cycle again for next month, with the likelihood of CPI being at or slightly above this past month's reading.

Friday, June 28, 2024

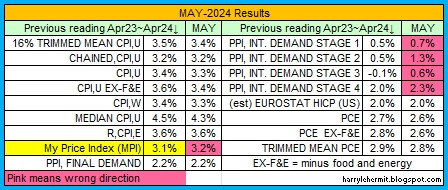

Review of May 2024 data, 1Q GDP revisions, PCE and personal income

The monthly summary continues to improve, although PPI numbers are of concern... going forward.

Friday, May 31, 2024

Review of April 2024 data, 1Q GDP revisions, PCE and personal income

The monthly summary is not so bad, actually.

Friday, April 26, 2024

Review of March 2024 data, 1Q GDP, PCE and personal income

The monthly summary is not so wonderful, incomparison...

Friday, March 29, 2024

Review of February 2024 data, 4Q GDP Revision, PCE and personal income

The monthly summary...

The overall PCE edged upward, on annual basis, with PCE ex food and energy staying flat.

Of course, the official got revised up for January, which indicates a difference from my report...

Thursday, February 29, 2024

Review of January 2024 data, 4Q GDP Revision, PCE and personal income

The monthly summary...

Monday, January 29, 2024

Review of December 2023 data, 4Q GDP, PCE and personal income

Alas, 2023 reports have concluded. The GDP's 4Q advance reading indicates a sterling 3.1% rise. I will make mention of the 5 year Quinquennial revision from 2012 dollars to 2017 dollars. As would be expected the numbers jumped 9.0%. I can't help but notice the big drag on GDP of net exports of good and services, slid a whopping -26.7%.

Even under the revised numbers, that latter component fell another -5.9% from one year ago.

Friday, December 22, 2023

Review of November 2023 data, GDP, PCE and personal income

I'll try not to harp about this too much. The BEA switched from 2012 dollars to 2017 dollars for 3Q23, and adjusted prior data. I download all such reports, so I can easily tell the difference.

Yes, inflation is slowing, not deflating, with the exception of gasoline, which looks to have stopped falling.

All in all, a pretty good monthly report card. I do think the market is making too big a deal on expectations of the FED cutting rates before summer, but what do I know?

Tuesday, December 5, 2023

A Further Review of 3rd Quarter, 2023 GDP... just for fun!!

So yes, the GDP was revised to 5.2% annualized, from 4.9% annualized. That does not mean the economy is robust. It's not bad, but robust is a bit of hype for politicians.

The BEA moved from 2012 dollars to 2017 dollars for the 3rd quarter releases and going forward, until next change in... say 5 years.

In theory, it should have been even across the board, after compensating for 5 years of dollar value adjustments, etc. Such as inflation being about 7.5% during that 5 year period.

If only there was someone, somewhere that downloads those excel spreadsheets from each GDP iteration.

Voila...

Note the column headings for 2012 dollars and 2017 dollars AND the % Change. The changes were clearly not uniform across the various groupings.

While there was a 9% upward adjustment, several groupings failed to match that rise, including some that went negative... while others outpaced the 9% reading.

So in theory, all the numbers going back in time were revised to reflect the current situation. But again, that was very uneven. Just consider the trade deficit, which is a drag on GDP... and those changes.

All in all, it did distort the 3rd quarter readings and possibly provided a misleading annualized number. That would be no big deal... if not for an election year and people willing to make everything political.

While the current 5.2% annualized is being hailed as something significant, I wonder what will be hailed, when the 4th Qtr. 2023 is revealed on January 25th, 2024. My guess is way below that 5.2%. Back to the 2.0% annualized, or even lower!

One can imagine the hysteria over such falling numbers, but the adjustment was improperly attributed to a "robust" economy.

So remember... the trade deficit, which is a drag on GDP was revised dramatically lower, after the BIG change for 2012 to 2017 dollars. That trade deficit adjustment was about 100% of that 5.2% annualized, or ±0.1% annualized without that lone adjustment.

You think I might be off my rocker! The current Real GDP rolls in at 22,506.4B, which is a hefty 281B above the 2nd qtr. figure of 22,225.4B. Now take a look at that downward revision of the trade deficit, -284B.

Remember the trade deficit is a drag on GDP, so a downward revision in the Trade deficit would result in a higher GDP print. IF the GDP had not been revised downward by -284B, then that +281B gain in GDP would evaporate. As in +0.1% annualized.

One group will claim the economy is crashing into a recession, another group will be saying soft landing is working, and another group will be screaming the FED must cut rates rapidly.

I then ask you, if stating the 3Q23 was actually 0.1% and the 4Q24 was +1.7%, would indeed indicate a possible soft landing. Of course, the groups would likely being crying the same thing... just 3 months earlier.

It is fun to watch all the spin!

Thursday, November 30, 2023

Review of October 2023 data, GDP, PCE and personal income

Just some charts with a bit of commentary...

Friday, August 26, 2022

GDP 2Q, 2022 2nd Est., PCE, Income and Outlays, Inflation Summary and Opinions!

The BEA released the 2nd estimate of GDP and it was revised to -0.6% annualized. You can read the link at your leisure. I am not going to yap about the data or the verbiage in the release.

What did amaze me, was a ripple in the news about the trade deficit. Here is my updated trade deficit drag on GDP...

|

| Click to Enlarge |

Personal income increased $47.0 billion (0.2 percent) in July, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $37.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $23.7 billion (0.1 percent).The PCE price index decreased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent (table 9). Real DPI increased 0.3 percent in July and real PCE increased 0.2 percent; goods increased 0.2 percent and services increased 0.2 percent (tables 5 and 7).

|

| Click to Enlarge |

|

| Click to Enlarge |

Friday, July 29, 2022

GDP, PCE, Income and Outlays, Inflation Summary and July Wrap-up!

Personal income increased $133.5 billion (0.6 percent) in June, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $120.4 billion (0.7 percent) and personal consumption expenditures (PCE) increased $181.1 billion (1.1 percent).The PCE price index increased 1.0 percent. Excluding food and energy, the PCE price index increased 0.6 percent (table 9). Real DPI decreased 0.3 percent in June and real PCE increased 0.1 percent; goods increased 0.1 percent and services increased 0.1 percent (tables 5 and 7). (emphasis added)

Thursday, June 30, 2022

End of the Month... June 2022

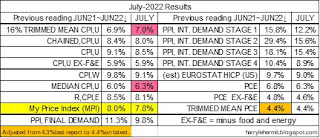

Okay, it is the end of June. Time for a recap of data published this month for May by the really smart guys, with comments by a really dumb person (me).

First up is the various inflation gauges...

(Note that I have estimated the Eurostat for the USA, as the official data has not been published.)Friday, May 27, 2022

End of the Month... April 2022 PCE, 2nd est. GDP, and Other Stuff.

The final results for April data is now in and it looks like a mixed bag. Sure the headline numbers are indicating deceleration of inflation, but there are still problem areas. The most important being my price index, which is increasing. I have highlighted some areas of acceleration of inflation.

Remember that energy was flat for April and has risen in May, which comes out next month. The deceleration of inflation in overall CPI indicates a potential repeat of the April headline number. The core, which is without food and energy, indicates some moderation. We'll just have to wait.

The Personal Income and Outlays for April came out and it isn't stellar in my opinion. Personal consumption expenditures were up 0.7% for the inflation adjusted month to month. The disposable personal income was flat on the inflation adjusted month to month. Credit cards anyone?

Somehow the concept of driving 120 mph on an ice covered road comes to mind, with a slight decrease in overall speed. Then the FED is slightly tapping the brakes. What could go wrong?

In other news, the 2nd release of the 1st Quarter GDP indicated a bit less than the Advance. I have read some comments about a potential negative 2nd quarter as meaning we are in a recession. WRONG! It is just a symptom. 2020 saw two quarters and no recession, as discussed by the gurus of such stuff. After debating most of 2008, it was finally decided that December of 2007, was the start of the great recession. The first back to back negative quarters were 3rd and 4th Quarter of 2008. So clearly more information than GDP numbers are a factor.

As for the 2nd quarter GDP, which will not be released until end of July... there is ample reason to believe it will not be negative. The trade numbers were a major hit to the 1st quarter GDP. The dollar has strengthened, which should reduce the deficit numbers, the inventory builds should be increasing, which is a plus for GDP, although troubling. The trade deficit should also be waning, due to a potential China slowdown.

So a positive number for GDP 2nd Quarter is in the offing... but that does not mean the economy is doing peachy keen. That expected positive inventory gain, could be a sign of demand destruction. With energy prices taking a bite out of disposable income, consumers will likely dial back in other areas.

So the outlook is a mixed bag in my opinion. A mixed bag is better than all negative, so there is some room for optimism.

Have a good holiday!!

Friday, October 29, 2021

Positive Spins?

Yesterday gave us the initial 3rd qtr. GDP reading from the BEA, and while it was far below original expectations, it could be explained away as an anomaly, due to the obvious drop in goods, maybe from reduced car sales, supply chain disruptions, etc. Meaning not all is lost for the 4th qtr.

Today gives us the Bureau and Labor Statistics release of Employment Cost Index Summary. It was good news for wages since 3 months ago, with wages up 1.5%, compared to about 1% in inflation (BLS CPI). Year over year is still lagging as wages are 4.2% over last year, while inflation is 5.4% (BLS CPI) over the same period.

It could be stated with reasonable certainty that wages are on the uptick and outpacing inflation. They will need to keep a healthy rise, as forecast for October inflation results is in the 5.7%~5.8% range. Not sure if rising wages can keep up with that pace, as the producers are pushing the additional cost downstream. That was reflected in last month's PPI report from the BLS.

Then there is the matter of the BEA's Personal Income and Outlays, September 2021. The troubling number would be the inflation adjusted disposable personal income drop of -1.6% in one month (current dollars). This is explained away as a decrease in government social benefits. This as personal income also dropped -1.0% in one month, also in current dollars.

Personal consumption expenditures slowed from the August increase of 0.6% (chained dollars) to September's 0.3% (chained dollars).

It is that inflation adjusted -1.6% drop in disposable income that should be concerning going forward. How does that translate to continued goods and services improvement? It should be noted that a large part of the GDP improvement has been borne by the consumer, with their pct. of total GDP rising during the past 6 quarters.

I guess time will tell, but attempts to put a positive spin on all of this will just have to wait.

A FEW CHARTS WITH SOME POLITICS - January 07, 2026

The crude inventories are in good shape for this time of year... It should be noted that the total inventory of Petroleum and Petroleum prod...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...

-

Weather Yep, been a fun few days, as we received about 6" of snow, then about 3/4" of ice, then another 3" of snow. I am no l...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...