Advance Monthly Sales for Retail and Food Services, December Report.

Advance estimates of U.S. retail and food services sales for December 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $709.9 billion, up 0.6 percent (±0.5 percent) from the previous month, and up 5.6 percent (±0.7 percent) above December 2022. Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022. Total sales for the October 2023 through December 2023 period were up 3.9 percent (±0.4 percent) from the same period a year ago. The October 2023 to November 2023 percent change was unrevised from up 0.3 percent (±0.3 percent)*.

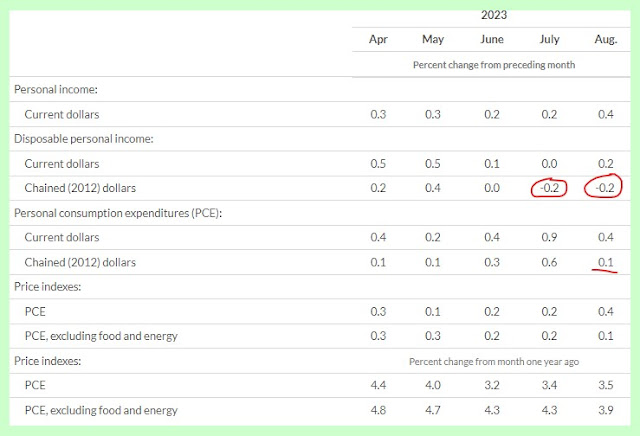

Hmmm... "Total sales for the 12 months of 2023 were up 3.2 percent (±0.4 percent) from 2022." The BLS listed that same period as having inflation of 3.4%. Which means the seasonal variation and trading-day differences have come into the equation. Otherwise, sales were up a bit more than indicated, imho.

First up the revisions...

We continue a pattern of previous months being revised downward, so the monthly changes are somewhat suspect.

When adjusted for inflation, the annual shows an improvement of +2.2%. The January numbers will be quite interesting, imho. The January report, adjusted for inflation, is slightly above the December number with inflation adjustements. Revisions will likely take place. 😒

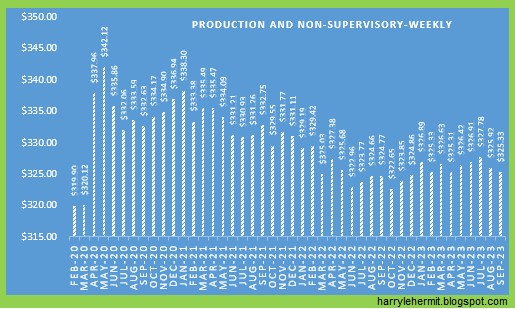

The inflation adjusted chart looks like this...