Last week I posited the notion of demand destruction. Not quite so sure about it happening after this week's numbers. While down -2.19% from year ago levels, quite a jump (7.1%) from last week's number. Information is from the EIA Weekly Report

I would suggest the jury is still out on demand destruction. The gasoline inventory did jump by 3.5MB, while crude fell -455KB and distillates down -1.3MB. Spot market for gasoline is suggesting another 35¢ per gallon fall... from current average of $4.467.

Exports of Crude and Petroleum Products outpaced imports to the tune of 4.6MB to reach a disparity since March of 129,266,000 barrels. Gasoline slid to 17,087,000 barrels as it may be that we are finally returning to a more normal seasonal flows. Typically imported gasoline outpaces exported from late December until mid summer, and then reverts to exports being more than imports.

The past few years, with understanding covid messed up 2020...

The stronger dollar is also playing a role in bringing down WTI Crude prices. By way of comparison, if the dollar was at same level as end of July 2021, the price would be $119.14, rather than the current $102.28.

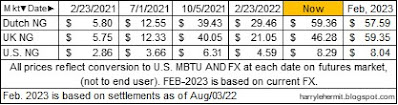

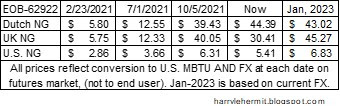

Another example would the impact on U.K. pricing of Brent...

This helps explain some of the fall in U.S. pump prices, versus U.K., which is not seeing much of a decline. This might seem beneficial to the U.S. consumer, but a word of caution... the dollar has been know to fall quite significantly at times.

2008 would be a reminder, when we in the U.S. were talking about our high gasoline prices and trying to compare the high prices in the U.K. and the EU, by using the exchange rate at that time. The dollar was at its weakest since the early 70s... by quite a bit.

As an exercise, the U.K is currently at £1.88 per liter, at £88.90 per barrel of crude. We are at $102.28 and pump price average is $4.467. IF the dollar was at April 2008 levels, the numbers for the U.K. would stay the same in THEIR currency. However, the WTI crude would be at $154 and pump prices would be near $5.50 national. We in the U.S. would attempt to make ourselves feel better, by using that weak dollar to convert the £1.88 per liter, the Brits are actually paying and come up with something like $10 per gallon.

In any case, the dollar rises and then it falls. Don't expect anything permanent and don't strut with glee over a strong dollar. Just understand that rise and fall does impact any global commodity.

On to the Natural Gas futures, and yes in dollars, as it makes it easier for me to understand.

Even with the conversion, I cannot make sense of what appears to be a train wreck in the works. Granted the UK gets about 40% of its Natural Gas for the North Sea, and that pricing is probably mixed with the spot market, prior to end user... But those future would seem to suggest a much higher price on the "mixed" result to consumer.

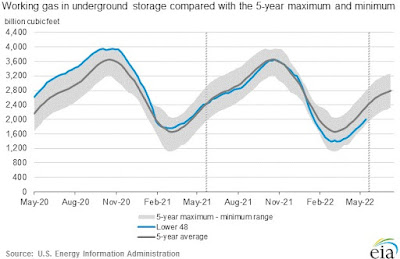

I got enough to worry about here, although our Natural Gas stocks are rebounding, but anything near a midpoint of 5 year average. While crude, gasoline, etc. were distorted by covid, not so much for Natural Gas.

I guess the bottom line is whether we are starting to see demand destruction in the crude/gasoline side of the equation and then if that destruction is due to a slower economic outlook or simply high prices?