Here is the premise...

Some politician said it is the patriotic duty of gasoline suppliers to reduce costs and some rich dude says the politician is misdirecting or unaware of how the market works. This happened to flow right into some of my social media accounts.

This prompted one poster to reply with this. I won't do a screen capture, as it might be some violation of something. You can open the link. Crude Oil (WTI) is up 40% and Gasoline is up 60%, both from 1 year ago. It does seem to support the theory, that gasoline prices are out of line.

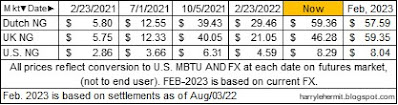

The problem being WTI and Brent are Global Benchmarks and Gasoline is basically a U.S. market... benchmark. So why is this? (click to enlarge)

This seems to have started diverging last fall. Here is the Price history of

WTI Crude and

Gasoline Futures. Which seems to be the product of exporting more gasoline than importing. For that information, here is the

export history and the

import history. (Weekly, in thousand of barrels).

IF gasoline futures had stayed in line with WTI, the futures would be around $3.44 and we (U.S.) would be averaging around $4.29 at the pump... nationally, and we would still be griping. 😭

I made this easy(?) to read graph on the difference...

Yes, we have upped the exports of gasoline and thereby forced the gasoline futures to battle with global pricing structures... just to keep gasoline in the USA.

I didn't check on every country, as various countries are subsidizing, but I do keep tabs on the U.K. Even when factoring in the U.K. using a bit higher octane rating, the U.S. gasoline is a bit cheaper... when backing out taxes. This is not intended to explain away U.S. prices, but rather the nature of global pricing structures.

As to the patriotic theme, that is clearly intended for an American audience that sees a familiar name and thinks of it as an AMERICAN brand. In fact, they are Multi-National (Global) Enterprises. So they likely are being patriotic... but to what nationality?

Our patriotic politicians could reinstate the crude oil export ban, that was overturned in late 2015, and it would bring down the WTI price, but does not help the gasoline side of the equation, as there were no limits on gasoline exports.

Has releasing 1 million barrels a day from the SPR done anything? Why yes, it has kept the WTI from going through the roof and gasoline following a similar track.

Not sure what that will do to crude or gasoline futures, but there will be somebody, somewhere, ready to complain and blame someone. That someone will always be of the opposite political persuasion.

It is sad to watch... but somehow, very entertaining as well.

As for the Crude oil and petroleum products, much the same trend, for those interested...