Normally I write about Inflation and "business" outlook, etc. Recent events have muddled my thoughts and it is hard to make sense of what might happen... so here goes, while acknowledging recent events potential impact.

Inflation

The BLS CPI report is slated for release on March 10th. THIS REPORT IS FOR FEBRUARY, so would have limited impact from the invasion. The range is 7.6% ~ 7.9%, with the upper end more likely. Pre Invasion expectations for March CPI, being released in April... to be even higher.

It is those expectations that are going to be heavily impacted by the Ukraine Invasion.

Food

The potential disruption of basic food commodities, have driven multiple items to either all time highs or nearing those all time highs. Wheat, Corn, Barley, Canola, Rice, etc. etc.

Grains are going up, so what about meats? There is a mixed message compared to a couple of months back, with the likelihood of staying flat. However, while chicken prices are moderating, there are worries about bird flu, etc.

The CPI has food as about 14% of the average household expense. It should come as no surprise that the above average income households spend less that 14% and below average income households, will spend more that 14%.

It is about 50/50 of that 14% going to food away from home and food at home. I have no data as to how that breaks out for above and below average income households, so will refrain from positing a guess. I would think the food index will rise month to month and add onto the inflation pressures.

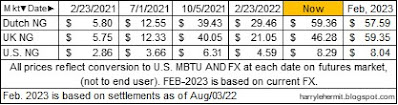

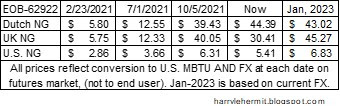

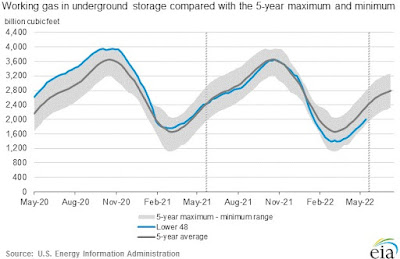

Energy

While energy makes up only about 8% of the CPI index compared to food's 14%, guess which will get all the media attention! That most of the current significant rises are in the past few days, the March 10th report is considering just the month of February.

I have no doubt the national average for gasoline will reach all time highs and possibly reach $4.5 @ gallon. The previous was in July, 2008 at either $4.11 or $4.17, depending on data source. This level, with everything else staying flat, would push March inflation to 8.5% y/y. For reference, this is in the range of Jan48 ~ Aug48 preceding a recession; Feb51 ~ Jun 51 Korean War; Dec73 ~ Aug75 Oil embargo resulting in recession and Oct78 ~ Dec81, which straddled two recessions and the Iran Revolution.

I guess I am saying that nothing gets Americans more antsy... than the price of gasoline. Not even...

Ukraine

Certainly I am concerned about the innocent lives being taken and the disruptions to others. It is not lost on me that not a lot will be done, other than taking in refugees, etc. I recall reading where it has become popular in Ukrainian circles to wonder how many more buildings are left in the west, to be lit up with Ukrainian colors. Apparently, they realize this is about the extent of their support. Is that what is called "virtue signaling?"

Here in the USA on social media, it seems the discussion is about all the things we should've, could've or would've done to prevent this. I am not sure how this could have been avoided, short of keeping the U.S.S.R. intact. A right that wasn't ours to make.

Sure, we might have rejected those former members of the Warsaw Pact from joining NATO, but why? And why did they ask to join NATO? I don't recall NATO countries sending in tanks and overrunning those countries and forcing them to join NATO.

Sadly, we can now see the answer to these questions. Horrifying as it might seem, Russia will eventually pound Ukraine into submission. Then some rebel enclave (Russian) in Moldavia will need to have Russian "peacekeepers", so who will be next?

A couple of other questions might be... Is Putin really that strong? Or are we just that weak? Frankly, the lack of resolve by western countries can be pinned on a very divided public. It should also be pointed out that while a large number of countries voted to condemn the invasion and a very few rejected the U.N. condemnation... the abstentions were by countries with nearly 1/2 of the global population. We in the west need to toughen up or the future will be grim, imo.

Putin

It is not uncommon for idiots such as myself to make stupid statements. To have national leaders uttering such statements is borderline insane.

Uttering that someone in Putin's inner circle should take him out, is something idiots like me would say. I would suspect that Putin's inner circle are not nice people and have their own vested interests, which might include assuming Putin's leadership position at some point... once their own vested interests are in place and could safely assume that role. In other words, someone that is whispering in Putin's ear and Putin considers as being faithful to him. Possibly even a more sinister version of Putin.

I am reminded of Fidel Castro. Fidel Castro came to power by ousting Fulgencio Batista, a person which was reviled by the US. Castro was treated with open arms, appearing on American Television as some kind of conquering hero... until he quickly lost that mantle and became the most hated by the same groups. It did not take long and led to assassination attempts, severing of diplomatic ties, The Bay of Pigs and finally leading to the Cuban Missile Crisis.

Be damn careful of what you wish.

Summation

I suspect the Ukraine invasion will shortly be displaced on American television as inflation and economic worries become more prominent. As for inflation, the polls seem to indicate that 50% of the American public blames Biden and 25% blame Putin. Which may explain the Administration's reluctance to sever Russian Imports and the Republicans are keen on doing just that. Politics is always in play.

I frequent various European news editions and this will likely be the same, and they have a much bigger dependence on Russia's energy.

How we got in this shape can and should be discussed, but afterwards we must acknowledge... WE ARE IN THIS SHAPE! What are we DO about it and not just talk about it?