Petroleum product movement from the Gulf Coast to the East Coast remains robust while exports reach record highs

That's what it says and yes, those exports keeps adding up. 102,309,000 barrels of crude and petroleum exports ABOVE what has been imported since first of March. Oh and 14,091,000 barrels of gasoline have been exported in that period, ABOVE imports.

I keep hearing how someone is threatening the refiners to do more. Do what... export? I really can't believe our dear leaders are that dumb, BUT... they think we are and can be easily misled. So in addition to the current heatwave baking the country, we must endure more hot air from D.C.

Of course, it would be easy to see the futures market for gasoline was heading down sharply by as much as 25¢, then criticize refiners, at which point someone could then turn around and take credit... when gasoline prices drop at the pump. Just wait for it. Of course, it will serve as some kind of proof of skullduggery, the next time prices jump back up.

Frankly, an angry electorate cannot think rationally and it is easy to trot out the usual bogeymen to deflect blame.

The problems with Freeport has really rocked the LNG market...

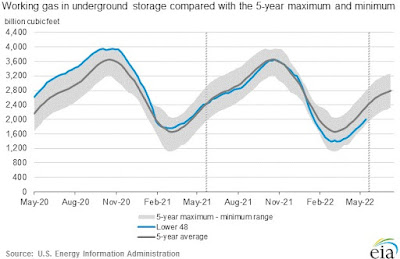

Dutch is up 50% and the UK is nearly double last week. Of course, problems with Nord Stream and also the Norwegian pipeline is wreaking havoc.That's their problem, which actually might provide some relief to U.S. Consumers as the natural gas slated for LNG export will stay at home... for awhile.

It really cannot hurt... or even over saturate our storage.