Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year.

Saturday, February 21, 2026

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Wednesday, July 20, 2022

Review of EIA Weekly Report for 7-20-2022

Last week I posited the notion of demand destruction. Not quite so sure about it happening after this week's numbers. While down -2.19% from year ago levels, quite a jump (7.1%) from last week's number. Information is from the EIA Weekly Report

Wednesday, July 13, 2022

Review of EIA Weekly Report for 7-13-2022

Thursday, July 7, 2022

Review of EIA Weekly Report for 7-07-2022

The EIA.GOV released their weekly report.

Wednesday, June 29, 2022

Review of EIA Weekly Report for 6-29-2022

Monday, June 20, 2022

Even A Broken Clock is Right Twice a Day!!

In this digital age, there will be many that do not understand a reference from way back in the age of analog clocks. But on to the meat of the matter, or where’s the beef?

After months of American citizens complaining about inflation, certain politicians have determined it is a problem and are focused upon the problem. We should also understand the “rest” of the world is also experiencing inflation.

Except there was rarely a peep, until the “rest” of the world caught up with the U.S.A.

Here is a nice graph with annual inflation rates since August 2021. (Click on Picture for larger view).

Eurostat is the source for the EU, France, Germany, as well as the harmonized inflation rate of the U.S. Oddly the U.S. is not in the EU and is tracked, yet U.K. no longer appears anywhere. Someone is taking Brexit very seriously, imo. The U.K. is represented by its own Office of National Statistics, which has both HCIP and CPI. Then Canada data is taken from Statistics Canada. (I estimated the Eurostat numbers for the U.S. at 9.1%, but put 8.8% on this chart/graph to be safe on the low side).

Here is a chart as well...

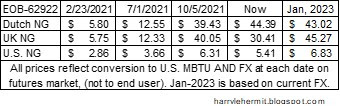

Clearly, we can see the impact of the natural gas pricing in

the EU and UK, as well as the impact of the Ukraine invasion, for all including

Canada. The U.S. can certainly join in the chorus blaming Putin, but what about

the earlier periods, when both the EU and the UK were experiencing less

inflation than the United States?

Why wasn’t inflation an issue then? Did our politicians need to wait for

someone else to blame and then proclaim it's not my fault, everyone is having high inflation?

Hey, it will probably work... given the short attention span of most Americans.

Wednesday, June 15, 2022

Review of EIA Weekly Report for 6-15-2022

Petroleum product movement from the Gulf Coast to the East Coast remains robust while exports reach record highs

That's what it says and yes, those exports keeps adding up. 102,309,000 barrels of crude and petroleum exports ABOVE what has been imported since first of March. Oh and 14,091,000 barrels of gasoline have been exported in that period, ABOVE imports.

I keep hearing how someone is threatening the refiners to do more. Do what... export? I really can't believe our dear leaders are that dumb, BUT... they think we are and can be easily misled. So in addition to the current heatwave baking the country, we must endure more hot air from D.C.

Of course, it would be easy to see the futures market for gasoline was heading down sharply by as much as 25¢, then criticize refiners, at which point someone could then turn around and take credit... when gasoline prices drop at the pump. Just wait for it. Of course, it will serve as some kind of proof of skullduggery, the next time prices jump back up.

Frankly, an angry electorate cannot think rationally and it is easy to trot out the usual bogeymen to deflect blame.

The problems with Freeport has really rocked the LNG market...

Dutch is up 50% and the UK is nearly double last week. Of course, problems with Nord Stream and also the Norwegian pipeline is wreaking havoc.That's their problem, which actually might provide some relief to U.S. Consumers as the natural gas slated for LNG export will stay at home... for awhile.

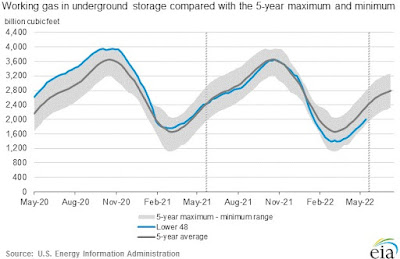

It really cannot hurt... or even over saturate our storage.

Wednesday, June 8, 2022

Review of EIA Weekly Report for 6-8-2022

Gasoline, Diesel and Crude Oil stocks are still well below seasonal average.

Much is being made about those inventories climbing since last week, except gasoline. It should be noted that imports remain similar to previous weeks, but exports fell 1.5 ~2.0 million barrels per day, compared to past week's numbers.

Not sure this portends to a capping of crude and petroleum products pricing. Consider the imports of gasoline actually exceeded the exports of gasoline for the first time in a few weeks. Consumption of gasoline is still slightly below last year's pace... yet inventory fell by about 600K barrels.

The AAA has the national average of regular gasoline at $4.955 per gallon. It should break that $5 level over the next few days, according to the futures market.

Thursday, June 2, 2022

Review of EIA Weekly Report for 6-2-2022

Yes, gasoline prices continue to rise, as inventories are below seasonal 5 year averages... as are distillates and crude.

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...