The winter weather is the likely culprit for the drop in overall consumption. Only time will tell.

Sunday, February 8, 2026

A Bit of Update on the Energy Market, and a Few Political Opinions.

Wednesday, January 7, 2026

A FEW CHARTS WITH SOME POLITICS - January 07, 2026

The crude inventories are in good shape for this time of year...

Thursday, February 13, 2025

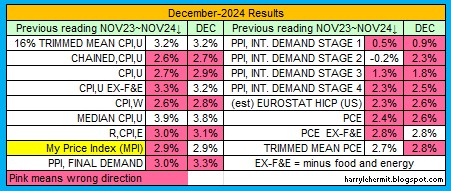

Producer Price Index and some other opinions

The Producer Price Index was released this morning and indicated an upturn.

Note that I did not revise the December, 2024 final demand, as did the BLS. Yes, December was revised upward to 3.5%. https://www.bls.gov/news.release/archives/ppi_01142025.htm

The nervous nellies will scream inflation is roaring back. Maybe so, but it will not repeat the horrors of 2021~2022. How can I say that? Once you understand the causes, the answer becomes easy.

- After the covid shutdown and collapse of international trade, the shipping industry was in disarray, with containers to move goods... in all the wrong places.

- Retailers had significantly reduced inventories to meet the slowing demand.

- There was a rather large stimulus paid to American citizens, on top of some previous payouts.

- The covid vaccine was becoming rapidly available.

- The American people were told that it was now safe to resume normal activities.

- An impending west coast port strike for mid 2022, which did not materialize.

Wednesday, February 12, 2025

A Few Reports and some opinions... of course!

The CPI came out today and now that Trump is in office, it has suddenly turned terrible. Nevermind, it is for January, so remarkable for just 11 days in office. /s

The media's memory is a bit wacky, with claims that it has suddenly shifted upward, even though the lowest annual rate since February 2021 was this past September.

Friday, January 31, 2025

1-31-2025 Week In Review

Energy

Crude inventory up a bit, with distillates down, and gasoline up. SPR up a bit. Price at the pump has barely budged and should continue in a narrow band.

Politics

It is the same old, same old. It was funny, but is now getting boring. Example: When there is a school shooting, we know what is said immediately by both sides. A plane crash provides us with the same dynamics, but in opposite polarization.

Unfortunately, there is a history regarding this issue, dating back to the Obama presidency, which is in the courts since 2014 and is still not resolved, as of 1-29-2025.

BRIGIDA v. UNITED STATES DEPARTMENT OF TRANSPORTATION

GDP

Annualized at 2.3%. Personal Consumption Expenditures were up dramatically.

Almost, as it has been 27 days and the temps are expected to be near 60 for a couple of days, and above freezing til the 9th.

End of the line

I am getting so bored with the current news cycle. I think it is time to simply blog, when there is something of interest.

Also, I have had adsense running and think it is time to remove adsense from this blog. I am the only person interested, so it makes more sense to cut adsense. My reasons for adsense were mostly to understand the audience, but since there isn't any... there you go. Besides, there never was any meaningful knowledge to gain, that was not already present under stats.

Also, I always checked from my home screen and never really looked at the end product on line. I recently checked and clearly, I do not know how to properly place ads. It is rather embarrassing.

Adios!

Friday, January 3, 2025

Changing direction on blogging

A new year is upon us, and just some thoughts.

Thus returning to my thoughts and opinions. Which could be about anything.

The presidential election is over, but politics is never over, so there is that.

The economy is something of interest, which includes several items and becomes political.

International events might arise, which are also political in nature.

Frankly, about everything that happens anymore... becomes political, whether immigration, crime, etc.

I could summarize what transpired in 2024, but you should already know. What none of us know... is what impact it will have on 2025.

We have the debt ceiling, a new congress, a new president, wars cropping up everywhere, and the list goes on and on.

After the past few years of revisions to various previous month's economic numbers, which resulted in more positive news on date of release... we will likely start to see the truth going forward. I am suggesting the results have not been as positive as the media has proclaimed.

Energy Prices

Futures indicate that gasoline pump prices ranging from -4.2¢~+4.4¢ over the near term.

Port Strike

It strongly appears that the ILA v USMX strike will be postponed for 3 1/2 months, as that would be the most beneficial for both sides.

Tariffs

Has anyone been watching the foreign exchange market? The Yen and Yuan have been weakening against the dollar. So have a host of other currencies.

Woohoo! The strong dollar fans are overlooking what caused offshoring and will inhibit reshoring. Our trading partners are not converting all those sales in dollars... back to their native currencies. No, they are purchasing Dollarized assets, such as bonds, financials, properties, etc.

Basically... propping up the dollar. We have not learned a darn thing over the past 40 years, as to why the early 80s inflation was brought down so low, until the great covid shipping snafu.

That's it for this week.

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

Remember back when the 2022 1st and 2nd quarter GDP numbers came in... and those politically motivated types screamed "we are in a rece...