The winter weather is the likely culprit for the drop in overall consumption. Only time will tell.

Sunday, February 8, 2026

A Bit of Update on the Energy Market, and a Few Political Opinions.

Wednesday, January 7, 2026

A FEW CHARTS WITH SOME POLITICS - January 07, 2026

The crude inventories are in good shape for this time of year...

Friday, January 31, 2025

1-31-2025 Week In Review

Energy

Crude inventory up a bit, with distillates down, and gasoline up. SPR up a bit. Price at the pump has barely budged and should continue in a narrow band.

Politics

It is the same old, same old. It was funny, but is now getting boring. Example: When there is a school shooting, we know what is said immediately by both sides. A plane crash provides us with the same dynamics, but in opposite polarization.

Unfortunately, there is a history regarding this issue, dating back to the Obama presidency, which is in the courts since 2014 and is still not resolved, as of 1-29-2025.

BRIGIDA v. UNITED STATES DEPARTMENT OF TRANSPORTATION

GDP

Annualized at 2.3%. Personal Consumption Expenditures were up dramatically.

Almost, as it has been 27 days and the temps are expected to be near 60 for a couple of days, and above freezing til the 9th.

End of the line

I am getting so bored with the current news cycle. I think it is time to simply blog, when there is something of interest.

Also, I have had adsense running and think it is time to remove adsense from this blog. I am the only person interested, so it makes more sense to cut adsense. My reasons for adsense were mostly to understand the audience, but since there isn't any... there you go. Besides, there never was any meaningful knowledge to gain, that was not already present under stats.

Also, I always checked from my home screen and never really looked at the end product on line. I recently checked and clearly, I do not know how to properly place ads. It is rather embarrassing.

Adios!

Friday, January 24, 2025

1-24-2025 Week In Review

Current Rage...

I probably should stop watching UK's Sky News. I was watching it during the swearing in and their announcer said something that just hit me the very, very wrong way. For the record, it was not something derogatory about Trump, which is typical of this outfit, while ignoring anything negative about you know who.

When did it start...

I am not a historical scholar and would not suggest that political rancor never existed. However, the "butthurt" of losing parties seems to have dialed up in my lifetime. Actually, I would suggest it started with the election of Clinton.

There was a lot of rumors, etc. during his tenure. With the 2000 election, the opposite party seemed to have some butthurt. The election of Obama gave us the "tea party" and then there was the first term of Trump. Biden followed and now with Trump again.

Both sides seem to have developed severe cases of "butthurt", imo. I don't see it ending any time soon, either.

Misinformation abounds in unlikely places.

"FBI" agent that took down Capone. That was in a crossword puzzle. Ness was a Prohibition Bureau agent, and the FBI was not in place until 1935, although it was preceded by the Bureau of Investigation. The Prohibition Bureau was originally in the Treasury and absorbed by the BOI (Justice) in early 1933. Late 1933, saw it returned to the Treasury and eventually became the ATF of today.

Make up your damn minds...

The media kept saying all he does is lie, lie, and lie. Now they are complaining because he actually told the truth. Make up your damn minds... or at least stop losing your minds.

ENERGY

A lot of racket, but no serious movement, imho. Pump prices are set to slightly rise, for both gasoline and diesel. There was a lot of talk about a "draw", which did bring down the total about 3.9M barrels, but the total is still 24.2M barrels ahead of last year on this date.

Birthright citizenship...

Remember this... "so long as they are permitted by the United States to reside here."

United States v. Wong Kim Ark, 169 U.S. 649 (1898) Chinese persons, born out of the United States, remaining subjects of the Emperor of China, and not having become citizens of the United States, are entitled to the protection of, and owe allegiance to, the United States so long as they are permitted by the United States to reside here, and are " subject to the jurisdiction thereof" in the same sense as all other aliens residing in the United States.

If you can't understand that part, then you may be shocked with the final outcome of this. The recent judge's ruling is merely the first salvo, imo.

Weather

Finally, the temps are set to moderate, which means above freezing. Maybe it will last long enough for all this snow to melt.

That's all for this round.

Friday, January 17, 2025

1-17-2025 Week In Review

Laugh of the week

Watching Sky News and a lady proclaimed that social media sites should be held to the same strict standards as newspaper publishers and television news sites. Clearly she meant the UK, but some of the craziest and insane misinformation has come to me via Sky News and UK newspapers.

Admittedly, the UK media is not as off the rails as American Media.

Greenland, what if...

If Greenland were to be independent, would it still be part of NATO? If not, why would we think they would align with the USA. China and/or Russia would run the bids up, imo. A strategic part of the world could be up for grabs.

Don't just laugh off the "Greenland" rhetoric, imho.

Climate Change

Accepting that the climate is definitely changing, why is all the focus all on the halt of bad emissions? If we were to suddenly halt these bad emissions, things will not return to normal the next day. In fact it would take many decades, if not hundreds of years.

During that period of time, the ice caps will continue to melt, the oceans will continue to rise and the storm patterns will persist. The state of Florida will likely be under water, much of New York City will be under water. So why aren't preparations being made NOW... for such events?

Which brings me to...

LA Fires

There has always been wild fires in California, yet climate change is now considered the root cause. Yet nothing is being done to prepare for what should be considered a certainty.

Blaming "climate change" is much easier than doing something, imho.

Cease Fire

I am typing this on Thursday, 1-16-2025. Call me skeptical, but this seems like a peace deal for Biden, that will fall apart immediately and the Democrats will attempt to blame it on Trump. It theoretically takes place on Sunday, the 19th, so I think shortly after noon on the 20th... things will fall apart.

Economic reports this week

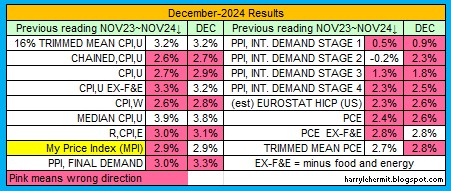

A lot of pink, which indicates rising numbers, but not above expectations, imo.Energy

Pump prices will likely rise about a nickel over the next couple of weeks. Which matches the nickel rise over the past week.

That's it, this is getting boring.

Saturday, August 6, 2022

Are We, Or Aren't We...

... in a recession?

No one truly knows, although many have an opinion, and depending on political stripe... we either are or we aren't. And it is always because something is a clear sign. Never mind, those government stats containing revisions from previous months, it must be deemed as absolute.

Then there are the BIG money folks, that have gotten rich off QE and want those glory days to return... meaning the FED to reverse policy. BIG money really needs there to be a recession for that to happen and will lobby long and hard, that we are already in a recession and are betting on the FED to ease off rate hikes, etc.

GDP gets revised a couple of times and then is revised once a year thereafter.

The change in total nonfarm payroll employment for May was revised up by 2,000, from+384,000 to +386,000 https://www.bls.gov/news.release/archives/empsit_08052022.htm

The previous month...

The change in total nonfarm payroll employment for April was revised down by 68,000, from +436,000 to +368,000, and the change for May was revised down by 6,000, from +390,000 to +384,000 https://www.bls.gov/news.release/archives/empsit_07082022.htm

Which is it?

My goal is not to cast doubt on government reports, but putting my heart and soul into a specific set of data as gospel... is just plain foolish, in my opinion.

Earlier I mentioned the possibility of a 3rd QTR GDP print being positive. I base that on the blowout of trade balance and how it impacted the 1st two Quarters.

Latest Energy Consumption Data and A Few Ponderings About "Other" stuff!

Pump prices remain relatively steady, with consumption jumping on the weekly basis, but nearly flat... year over year. Now for the opinion s...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

Remember back when the 2022 1st and 2nd quarter GDP numbers came in... and those politically motivated types screamed "we are in a rece...