The EIA.GOV released their weekly report.

Thursday, July 7, 2022

Review of EIA Weekly Report for 7-07-2022

Sunday, July 3, 2022

Allow Me To Butt In, With a Rebuttal of Sorts

Here is the premise...

Some politician said it is the patriotic duty of gasoline suppliers to reduce costs and some rich dude says the politician is misdirecting or unaware of how the market works. This happened to flow right into some of my social media accounts.

This prompted one poster to reply with this. I won't do a screen capture, as it might be some violation of something. You can open the link. Crude Oil (WTI) is up 40% and Gasoline is up 60%, both from 1 year ago. It does seem to support the theory, that gasoline prices are out of line.

The problem being WTI and Brent are Global Benchmarks and Gasoline is basically a U.S. market... benchmark. So why is this? (click to enlarge)

Friday, July 1, 2022

Time to Reflect on My Grocery Hoarding.

I haven't reviewed my overall results and status for bit, so here goes. But am I really a hoarder. I wasn't early on, but became one.

Early on, I found myself scrambling, just to keep certain things in supply. Obviously toilet paper was an issue and I even ordered from God knows where. Many paper products were not to be found on the shelves and on line ordering became the go to source.

Even on line was bereft of many of these items. Staples such as a variety of beans, as well as other pantry items were not to be found. Granted, I was picky about brand, etc. but still it was quite a challenge. Even distilled water disappeared from shelves and led me to distilling my own... with limited success.

By fall of 2020, the shortages seemed to have eased up. I was using curbside for groceries from 2 different stores and was still coming up with "out of stock" on numerous items. For example the T.P. orders were for different quantities and was very hit and miss... until one week, all quantities from both stores were in the basket. I stopped ordering curbside on the same day, as the vehicle was absolutely full. About 18 months of T.P. and I could wipe that from the list for awhile.

The pantry items started rolling in as well. I built some shelves in the den and began piling up the goods. By end of 2020, I was well supplied.

Here it is, middle of 2022 and I am still hoarding, but have long since began reducing volumes in storage. I am about half of where I was in late 2020, with more to go.

In 2020, people were hoarding because of Covid, but it would appear that inflation is now in the driver's seat, with people starting to buy pantry items before the price goes up.

Where do I stand? I will continue to back off the storage and really see no purpose to stockpiling. I understand the concern of food "shortages" being a possibility... but the cynic in me suggests this could be a bit of fearmongering for the USA, although not for certain regions of the world. Besides, I have been hoarding fat for years and it might not hurt to reduce that bit of buildup.

I think the food "shortage" will most likely be food insecurity and that could be worrying, as prices of basic commodities rise out of range of many people.

Thursday, June 30, 2022

End of the Month... June 2022

Okay, it is the end of June. Time for a recap of data published this month for May by the really smart guys, with comments by a really dumb person (me).

First up is the various inflation gauges...

(Note that I have estimated the Eurostat for the USA, as the official data has not been published.)Wednesday, June 29, 2022

Review of EIA Weekly Report for 6-29-2022

Tuesday, June 28, 2022

Still Too Early to Project C.O.L.A Increases... But the Early Bird Gets the Worm. Yuck!

Yes, it is too early, but I cannot help myself. After perusing all the forecasts of inflation, here goes. Of course an explanation is needed as to the rules regarding determining C.O.L.A.

CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) is the gauge used, not the headline CPI, as in CPI-U (Consumer Price index for ALL Urban Consumers). The difference being the salaried and technical folks are in the latter.

Typically the CPI-W has lagged behind the CPI-U, (hereafter referred to simply CPI). This can be seen in the CPI reading of 292.296 (May-2022), compared to 288.022 for the CPI-W. Both started their indexes at the same time... back in the early 80s.

However, after lagging all that time, the CPI-W is catching up with a vengeance. Why? I don't know, maybe something to do with Covid. (That's intended to be humorous).

- June CPI-W is forecast as 9.3%~9.4%

- July CPI-W is forecast as 9.2%~9.4%

- August CPI-W is forecast as 8.7%~9.0%

- September CPI-W forecast as 8.3%~8.5%.

Saturday, June 25, 2022

Bored on a Saturday Night

There

is nothing on television worth watching, and the news is to be avoided.

I have completed all my chores for the week and looking for something to do.

So,

allow me to jabber about stuff, I know very little about... and prove to you how little I know.

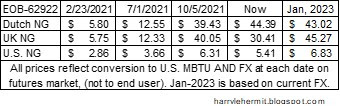

The futures

market indicates UK natural gas prices will likely double from current, while the Dutch seems to believe in consistency, going into January of 2023. It strikes me odd, as the Dutch and UK futures had remained rather consistent until about a month ago.

I cannot quite understand why, but last fall, the topic of storage was in the news, and I do seem to recall the U.K. had divested itself of most of their NG storage capacity. . It likely was due to long range planning away from fossil fuels.

That's okay, as it is their business. My concern is the prices in the U.S. While prices have doubled and then some, the futures market seems to hold steady where we currently are. Naturally, the doubling of price of Natural Gas on the market does not translate to doubling of price to the end user, but $3.50+ per MBTU will.

That adds up to about $20 a month more for the average American Household and it is important to remember... only about half of American households use Natural Gas, so about $40 more per month. BUT, most of those households rely disproportionately on Natural Gas in the colder months.

Likely most Americans have adjusted. Nearly all of us use Electricity and about 40% of that comes from Natural Gas.

The problem will be when the Freeport company is back up to 100%. The problem with the chart above, is it omits the runup to over $9.30 per MBTU just prior to the fire at Freeport. Freeport accounts for about 17% of LNG exports. That fire caused a major disruption for exports, which reduced the draw on our own inventory.

Freeport states they should be partially up and running in 90 days and at full capacity by end of the year. It is not a stretch to think U.S. natural gas prices will near the $10 per MBTU by then.

Just double the above numbers and you can see the problem.

On the good news, the gasoline futures have slid 44¢ from their peak on June 6th. Gasoline at the pump always rockets upward, but fall like a feather. That price should continue to fall another 17¢, unless something else happens. If you are wondering about a discrepancy, rest assured the gasoline was on pace to hit $5.20 at the pump and then the bottom suddenly fell out. Something about bad economic news.

There was a bit of concern about some Canadian Model's itinerary, but the Canadian Model appears to have changed her mind.

That wraps it for me, as this is started to be boring. Oh wait, maybe there is something on the streaming services, that I would be interested in, AND haven't seen a dozen times.😀

It's Been Awhile

Finally some more reports coming out from the government services, with PPI and Retail Sales . Granted it is still a month behind, as Octob...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...

-

This week's full report . Gasoline pump prices fell -1.6¢ for the week, and continues well below year ago levels, by -38.8¢, or -10.8%...

-

The EV projection shifted this week, due to North Carolina shifting below the upper threshold of margin of error. The electoral vote forecas...