This week's full report.

Wednesday, February 7, 2024

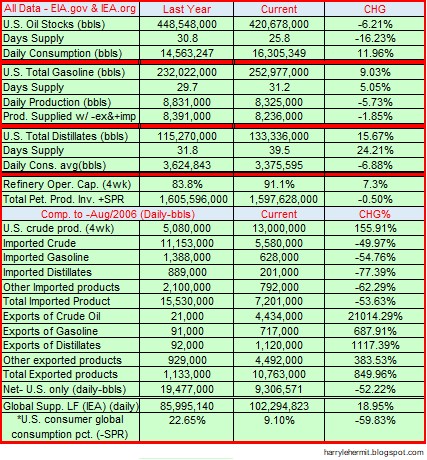

This Week in Petroleum Summary February 7th, 2024 per EIA.GOV

Wednesday, January 31, 2024

This Week in Petroleum Summary January 31st, 2024 per EIA.GOV

This week's full report.

Monday, January 29, 2024

Review of December 2023 data, 4Q GDP, PCE and personal income

Alas, 2023 reports have concluded. The GDP's 4Q advance reading indicates a sterling 3.1% rise. I will make mention of the 5 year Quinquennial revision from 2012 dollars to 2017 dollars. As would be expected the numbers jumped 9.0%. I can't help but notice the big drag on GDP of net exports of good and services, slid a whopping -26.7%.

Even under the revised numbers, that latter component fell another -5.9% from one year ago.

Wednesday, January 24, 2024

This Week in Petroleum Summary January 24th, 2024 per EIA.GOV

This week's full report.

Saturday, January 20, 2024

My electricity bills over time (January, 2024 Edition)

It is January, and the monthly bill has arrived.

Friday, January 19, 2024

Comparison of Inflation in selected countries- January, 2024 Edition

With the United Kingdom, Canada and EUstats release of December data, I have updated my comparison graph. [Note, the USA(EU method) is directly from Eurostat.]

Long before inflation was everywhere, the phrase was transitory. Yes Virginia, the USA led that "transitory" inflation, until the rest of the world started catching up.

The chart is quite "busy", but the timeline is quite accurate.

'nuff said!

Thursday, January 18, 2024

This Week in Petroleum Summary January 18th, 2024 per EIA.GOV

This week's full report.

It's Been Awhile

Finally some more reports coming out from the government services, with PPI and Retail Sales . Granted it is still a month behind, as Octob...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...

-

This week's full report . Gasoline pump prices fell -1.6¢ for the week, and continues well below year ago levels, by -38.8¢, or -10.8%...

-

The EV projection shifted this week, due to North Carolina shifting below the upper threshold of margin of error. The electoral vote forecas...