First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in March on a seasonally adjusted basis, the same increase as in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.5 percent before seasonal adjustment.

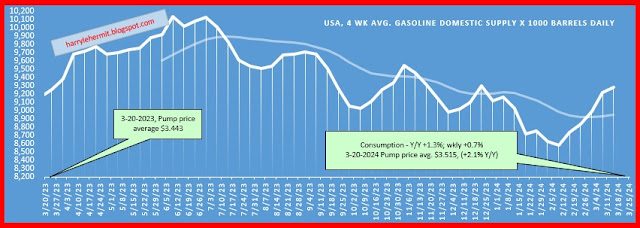

The index for shelter rose in March, as did the index for gasoline. Combined, these two indexes contributed over half of the monthly increase in the index for all items. The energy index rose 1.1 percent over the month. The food index rose 0.1 percent in March. The food at home index was unchanged, while the food away from home index rose 0.3 percent over the month.

Here is the unadjusted CPI for the past 12 months...

My own personal CPI rose 3.0% Y/Y and 0.6% on the month...

Taking a look at the report card...

Not real pretty, imho. It should be noted the release partially laid the surge in inflation at the feet of energy. True on a monthly basis, but Y/Y is up 2.1%, compared to the headline of 3.5%. Even food was at 2.2%, so start looking much harder within that CPI ex food and energy number of 3.8%.

Speaking of food...

Hidden in all those numbers and weightings... food away from home ease barely above January, 2021 numbers. That is NOT adjusted for inflation, but in current dollars. I can't help but think the entities making up the food away from home category... is struggling.

An increase of 4¢ from February, 2020. It is important to adhere to that timing, as it was before the disruption of the workforce, cue to covid.

The overall report does show some stagnation for wage growth. Hard to make anything uplifting from the data.

Sorry!