It would appear the final counts for the election are now completed.

Tuesday, December 17, 2024

2024 Presidential Election Review, part 4 of 4 and conclusion

Advance Retail Sales Report- December 17th, 2024

November Advance Monthly Sales for Retail and Food Services, the Report.

Advance estimates of U.S. retail and food services sales for November 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $724.6 billion, an increase of 0.7 percent (±0.5 percent) from the previous month, and up 3.8 percent (±0.5 percent) from November 2023. Total sales for the September 2024 through November 2024 period were up 2.9 percent (±0.5 percent) from the same period a year ago. The September 2024 to October 2024 percent change was revised from up 0.4 percent (±0.5 percent)* to up 0.5 percent (±0.1 percent).

Note the numbers are not adjusted for inflation. Keep in mind, the BLS listed the annual inflation rate of 2.75% annual, and down 0.05% on the month.

First up, the revision history...

Thursday, December 12, 2024

PPI - Dec. 2024 release with Nov. 2024 Data

The BLS has released the November 2024 Producer Price Index Report for the month of October. (historical releases)

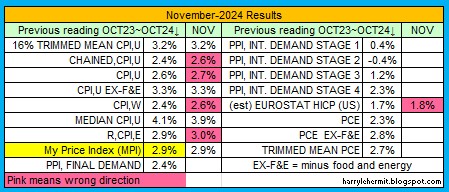

The Producer Price Index for final demand rose 0.4 percent in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices increased 0.3 percent in October and 0.2 percent in September. (See table A.) On an unadjusted basis, the index for final demand advanced 3.0 percent for the 12 months ended in November, the largest rise since moving up 4.7 percent for the 12 months ended February 2023.

In November, nearly 60 percent of the broad-based rise in final demand prices can be attributed to a 0.7-percent increase in the index for final demand goods. Prices for final demand services moved up 0.2 percent.

Wednesday, December 11, 2024

This Week in Petroleum Summary December 11th, 2024 per EIA.GOV

This week's full report.

Gasoline pump prices slid -1.3¢ for the week, but continues below year ago levels, by -13.3¢, or -4.2%. Days supply rose to 25.5. For perspective... last year was 26.3 days.

BLS Data Dump. Real Earnings - December 11th, 2024

On to the Real Earnings.

Harkening back to February 2020, when the real hourly rate was $11.02, that rate is now $11.25 for hourly- private non farm payrolls, seasonally adjusted...

BLS Data Dump. CPI - December 11th, 2024

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in November, after rising 0.2 percent in each of the previous 4 months, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.

The index for shelter rose 0.3 percent in November, accounting for nearly forty percent of the monthly all items increase. The food index also increased over the month, rising 0.4 percent as the food at home index increased 0.5 percent and the food away from home index rose 0.3 percent. The energy index rose 0.2 percent over the month, after being unchanged in October.

The 2.749% is above last month's 2.598% is back above the 2.62% of March, 2021, and still above the 1.68% of February, 2021.

Here is the unadjusted CPI for the past 12 months...

Wednesday, December 4, 2024

This Week in Petroleum Summary December 4th, 2024 per EIA.GOV

This week's full report.

Gasoline pump prices slid -0.4¢ for the week, but continues below year ago levels, by -20.9¢, or -6.4%. Days supply rose to 24.5. For perspective... last year was 26.2 days.

For those interested, the exports of Crude, Petroleum Products, Including Gasoline has far outweighed the imports, by this much, since March, 2022.

A Bit of Update on the Energy Market, and a Few Political Opinions.

The winter weather is the likely culprit for the drop in overall consumption. Only time will tell. The overall inventories are still in goo...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...