The BEA released the 2nd estimate of GDP and it was revised to -0.6% annualized. You can read the link at your leisure. I am not going to yap about the data or the verbiage in the release.

What did amaze me, was a ripple in the news about the trade deficit. Here is my updated trade deficit drag on GDP...

|

| Click to Enlarge |

This was all yesterday's news, so onto the Personal Income and Outlays...

Personal income increased $47.0 billion (0.2 percent) in July, according to estimates released today by the Bureau of Economic Analysis (tables 3 and 5). Disposable personal income (DPI) increased $37.6 billion (0.2 percent) and personal consumption expenditures (PCE) increased $23.7 billion (0.1 percent).The PCE price index decreased 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent (table 9). Real DPI increased 0.3 percent in July and real PCE increased 0.2 percent; goods increased 0.2 percent and services increased 0.2 percent (tables 5 and 7).

|

| Click to Enlarge |

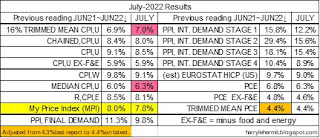

Here is a summary of various inflation gauges for July...

|

| Click to Enlarge |

It is impossible for me to finish without an opinion, although my opinion is sprinkled throughout.

As I have noted in previous articles, even the BLS stated the flat July reading was totally due to -7.7% change in gasoline prices. I would put the fall for August near the -10% range. It would seem the expectations would be for another flat month or possibly a negative print.

But... the energy index was down last month -4.5%. There is more to energy than just gasoline as the rise in electricity was +1.9% and piped gas (N/G?) was down -3.9%. I would expect a continuation of electricity rises and a reversal of piped gas... back to increases.

Also, the SPR release is set to halt at end of October, and OPEC is suggesting production cuts... to stabilize prices!

Diesel prices falling has shifted the past two days and is showing an upward tilt, as fall harvest is now beginning. Gasoline prices continue to fall, but we haven't had a storm in the gulf. Keep an eye on the tropics!

Speaking of weather... food is rather dependent on the weather, with droughts inhibiting yields, and heavy rains disrupting both planting and harvesting. These weather occurrences are always an issue for someone, somewhere. The frequency and widespread occurrences, are troubling.

Fertilizer is also used to increase yields in crops, and are a global commodity. A lot of natural gas is used in the production of fertilizers. European producers of fertilizers are reducing and/or curtailing production of fertilizers... as natural gas prices have become to high to operate.

Of course, that would be a European problem, except fertilizers are once again... a global commodity. Research phosphate, nitrogen, potash, anhydrous ammonia, etc.

While LNG export is limited by infrastructure... these fertilizers are mostly not. So even if there is a good growing season, the cost of raising those crops will increase, due to fuel costs (diesel) and yield enhancing fertilizer.

The old adage "hope for the best, but prepare for the worst", comes to mind. Not that the worst will happen, but let's not become giddy over some short term positives about peaking inflation, etc.

Or as Yogi said... "it ain't over, till it's over."

No comments:

Post a Comment