Here is another stab at the 2024 election. Trump appears to be ahead with polling numbers of 44.1%. compared to Biden's 43.3%. Very tight indeed, until polling of individual states relative to electoral votes is considered.

Took a hard look at the virtual locks, in regards to electoral votes, which resulted with Biden having 212 electoral votes locked up, and Trump with 149.

When I say "locked up", I am referring to places like California, Alabama, Arkansas, Delaware, etc. It should be obvious whether they are blue or red. So stencil them in.

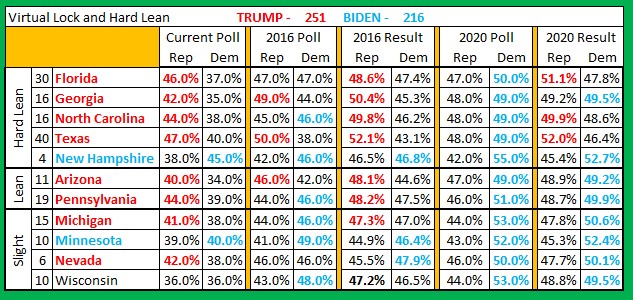

However, in 2024, there are some hard leans, as well.

Florida has Trump with a 9 point lead in the polls. Consider where the polls were in 2016 and 2020, the compare to results. That 9 point lead is significant.

Again, Georgia was not really that far out of whack in the 2016 and 2020 polls, so the polls for this year having Trump with a 7 point lead... is quite meaningful.

That trend continues with the other "hard leans" listed, which results in Trump holding a 251~216 lead at this point.

So Trump just needs 19 of 71 remaining EVs. The opposite of that... Biden needs 54 of the remaing EVs.

Turning it around might be possible for Biden.

However, Ukraine is still an issue on his watch, as well as that Middle East mess. Not seeing any upward lift being provided by those.

Economy, could be an issue, but not a lot of upward lift to be seen in this area. Sure, GDP was up 5.2% annualized, but don't forget a massive adjustment was just undertaken, by moving the numbers from 2012 dollars... to 2017 dollars. I alluded to this in a previous article.

On January 25, 2024, the BEA will likely report something in the 1.5%~2.0% annualized GDP growth. A lot of whining will take place about how the economy has gone from robust to anemic. Both are rather silly, but the resultant public opinion will not likely provide any huge boost for Biden.

That report will be followed about 3 weeks later, with the CPI report for January.

There is the inflation issue, of which will be largely cheered with both the November (DEC release) and December (JAN Release) data releases. Both of which will indicate a shallowing month to month rate of inflation.

However, both months will be a result of significantly lower gasoline prices, which is a seasonal norm. While making up a small percentage of consumer spending, the impact will be enough to bring month to month to zero and very likely negative.

Once again, that news turns south with that February release of January's CPI data. Why? Those falling gasoline prices will be in the rear view mirror, and will be rising... We are getting into the heart of political silly season by then.

Frankly, rising gas prices will bring out the grocery prices are much higher crowd. It may well be, but this is about the attitude of voters... which won't be uplifting for the Biden campaign. Voters tend to remember things from days past, when they look at the grocery receipts and those numbers on the gasoline pump.

So not a lot of upside going forward, imho... for a Biden rebound.

Remember, the perception needs to change for Biden to reverse his current dismal ratings.

No comments:

Post a Comment