Sunday, June 19, 2022

Those Pesky Sensors at Intersections

Thursday, June 16, 2022

A Conundrum On Inflation and Recession.

I'm not the brightest bulb and may be seeing things wrong, but... the Just in Case inventory surplus may be coming to an end.

To clarify... we had all sorts of supply chain issues, which were originally shortages of goods, due to parts, etc. THEN the supply chain issues became a snarled supply chain which caused shortages AND was exacerbated by companies ordering heavy to ensure arrival of supply to meet demand. This is Just In Case inventory control.

The reduction in inventories allowed companies to pocket some hefty profits and pep up stocks. Everything from reduction of Oil and oil product inventories to freezers, etc. I even noticed my local Walmart pulled in those shipping containers all over their back lot.

Now companies, such as Walmart and Target are talking about reduced profits, due to excess inventory. Oops! Certain major companies that supply all those retail stores with products (excluding food) are now beginning to cancel components to make their products... from their suppliers.

Understand the mantra is how the consumer's spending habits are changing. Seriously, how many TVs and Freezers, etc. can people buy for stimulus money they were given.

As these companies slow their ordering to reduce inventory... a potential recession is looming. Meaning their inventory is no where near where it should be. Should be a buyers market at some point... just not yet. Again, this will not really impact food... as we still gotta eat.

So these companies that had slowly began reducing inventory will now need to speed up. With interest rates sharply climbing, financing the debt to hold excessive inventory climbs as well. Not a good scenario to be in. Think GM in 2008, with their excessive inventory wish mushroomed and sales slumped to where they could not pay vendors.

Which brings me to the other part of this diatribe. How many zombie companies are about to be flushed out of the system?

The consumer, which is solely holding the economy together, will at some point overcome the euphoria of post covid and slow down the spending. My guess is a reduction will begin around fall, with an uptick for the holidays... and then the gloom of January will hit us.

Let's hope those companies have shed their excess inventories by then. Or as I think of it.. the time of steep discounts.

Wednesday, June 15, 2022

Review of EIA Weekly Report for 6-15-2022

Petroleum product movement from the Gulf Coast to the East Coast remains robust while exports reach record highs

That's what it says and yes, those exports keeps adding up. 102,309,000 barrels of crude and petroleum exports ABOVE what has been imported since first of March. Oh and 14,091,000 barrels of gasoline have been exported in that period, ABOVE imports.

I keep hearing how someone is threatening the refiners to do more. Do what... export? I really can't believe our dear leaders are that dumb, BUT... they think we are and can be easily misled. So in addition to the current heatwave baking the country, we must endure more hot air from D.C.

Of course, it would be easy to see the futures market for gasoline was heading down sharply by as much as 25¢, then criticize refiners, at which point someone could then turn around and take credit... when gasoline prices drop at the pump. Just wait for it. Of course, it will serve as some kind of proof of skullduggery, the next time prices jump back up.

Frankly, an angry electorate cannot think rationally and it is easy to trot out the usual bogeymen to deflect blame.

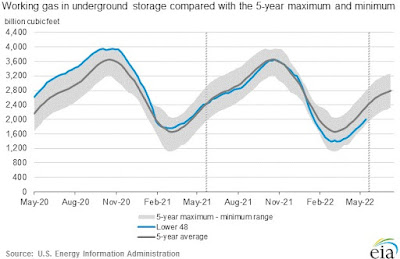

The problems with Freeport has really rocked the LNG market...

Dutch is up 50% and the UK is nearly double last week. Of course, problems with Nord Stream and also the Norwegian pipeline is wreaking havoc.That's their problem, which actually might provide some relief to U.S. Consumers as the natural gas slated for LNG export will stay at home... for awhile.

It really cannot hurt... or even over saturate our storage.

Retail Trade Report for May 2022

Advance Estimates of U.S. Retail and Food ServicesAdvance estimates of U.S. retail and food services sales for May 2022, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $672.9 billion, a decrease of 0.3 percent (±0.5 percent)* from the previous month, but 8.1 percent (±0.7 percent) above May 2021. Total sales for the March 2022 through May 2022 period were up 7.7 percent (±0.7 percent) from the same period a year ago. The March 2022 to April 2022 percent change was revised from up 0.9 percent (±0.5 percent) to up 0.7 percent (±0.2 percent).

Retail trade sales were down 0.4 percent (±0.4 percent)* from April 2022, but up 6.9 percent (±0.7 percent) above last year. Gasoline stations were up 43.2 percent (±1.6 percent) from May 2021, while food services and drinking places were up 17.5 percent (±4.0 percent) from last year.

Simply put... we have started to spend less and buy even less. Certainly the aforementioned items by the release come into play, but a few added comments from me. M/M and Y/Y.

- Motor vehicle & parts dealers …….……….. -3.52% -3.73%

- Electronics & appliance stores …………….. -1.33% -4.45%

- Nonstore retailers …………………..….……….. -0.98% +6.98%

An example would be...

Grocery stores …………………..………..……….. +1.23% +8.71%

The nearest in the CPI report was food at home, with +1.4% May over April and +11.9% Y/Y. It's almost as if people are purchasing less or at least... cheaper options. The thing about food is only so much budget cutting can take place, until you hit bone.

An example of that would be the CPI decrease in beef and veal, with an upward spike in chicken and fish. It's not necessarily a healthier diet, as fruits and vegetables have hit a pause.

The report calls out food services and drinking places on an annual basis, but what about monthly...

Food services & drinking places ……….. +0.67% +17.47%

The monthly increase looks a bit shaky, once inflation is applied and the annual should be no surprise, as we were in the early stages a fully opening back up from Covid.

The bright spot is gasoline, which is not really a bright spot, in my opinion.

So another report into the dustbin. Which way is everything headed? I will wait for the smart people to tell me.

Tuesday, June 14, 2022

Producer Price Index for May 2022

The Producer Price Index for final demand increased 0.8 percent in May, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This rise followed advances of 0.4 percent in April and 1.6 percent in March. (See table A.) On an unadjusted basis, final demand prices moved up 10.8 percent for the 12 months ended in May.In May, nearly two-thirds of the rise in the index for final demand was due to a 1.4-percent advance in prices for final demand goods. The index for final demand services increased 0.4 percent.Prices for final demand less foods, energy, and trade services moved up 0.5 percent in May after increasing 0.4 percent in April. For the 12 months ended in May, the index for final demand less foods, energy, and trade services rose 6.8 percent.

Simple math... the index rose 10.8% in May and the index less foods, energy and trade services was up 6.8%. So guess what rose substantially faster than 10.8% overall... Yep, foods, energy and trade services. I suspect you already knew that, but remember this is PRODUCER prices, not retail. Can you guess what gets passed on to the consumer? Ouch!

So it is no wonder that people much smarter I, have quickly revised the CPI forecast upward. There is "some" good news, although it can easily be explained away as a blip. Producer Food Prices did pause in May, which is not to say they fell very much. The easy explanation would be demand for cheaper foods may be in play. The beef and veal index, slipped 9.5%, but chickens rose.

Monday, June 13, 2022

Let's brag about our firearms on Social Media

Guns are back in the headlines, so it is to be expected the discussion is on social media. I am not going to say which way I lean in the debate. I am curious about those bragging about their guns and what they would do IF needed.

Sunday, June 12, 2022

Would Keystone XL Have Helped?

That seems to be all the rage, now with gasoline prices topping the US $5 mark. It seems that everyone can agree, that it is the fault of one political party or the other. So it would seem that allowing the Keystone XL pipeline to be built... would have increased the volume of crude coming into the United States and thereby reduce the price of gasoline.

Except we are exporting crude and petroleum products at an enormous and historical rate. We have exported 920,255,000 barrels of oil and petroleum products since the beginning of March. Certainly we have imported a lot as well. 827,071,000 barrels of oil and petroleum products in that same period. Oh wait... that export number is nearly 100 million barrels higher than the import number.

What would the crude inventory look like... Note the gray area is the 5 year range, both top and bottom, with the blue line being where we actually are and the red line being those 100 million barrels. Note the 5 year is distorted by the sudden drop in consumer demand, due to covid, which would normally be in the 420 million barrel range. Even the past 5 years is distorted in comparison to 7 years ago. (If you struggle with the small print, just click on the image.

It gets even better as we have exported 86,667,000 barrels of gasoline over that same period, while importing 74,508,000 barrels of gasoline. Oops!

This is why I am having a problem with the idea surrounding the failure to approve Keystone XL as having an impact on our current gasoline prices.

To be sure, IF we could go back in time and retroactively approve Keystone XL it should reduce the global impact of crude and thereby the price of gasoline, IF everything else remained the same.

To do that, we would need to ignore the shale boom (drill baby drill) and our own Congress in December, 2015, lifted the oil export ban that had been in place for over 40 years and let's not forget the releases of the Strategic Petroleum Reserve (SPR).

Briefly, the Keystone XL was proposed back in 2008, just as U.S. gasoline prices roared past the $4 per gallon mark. Keystone XL was a proposal by what was then called Trans Canada, based in Calgary. It was the 4th phase of the project, which came under fire. Politics in Canada prevents pipelines of this scale from going to their coasts, thus it is almost captive to the U.S. Market.

It should be noted that XL was struck down in November, 2015.

Here is the gasoline price chart, with some embedded notes from me. (Pardon the penmanship)

CALGARY, Alberta, March 24 (Reuters) - Canada has capacity to increase oil and gas exports by up to 300,000 barrels per day (bpd) by the end of 2022 to help improve global energy security following Russia's invasion of Ukraine, Natural Resources Minister Jonathan Wilkinson on Thursday.

A FEW CHARTS WITH SOME POLITICS - January 07, 2026

The crude inventories are in good shape for this time of year... It should be noted that the total inventory of Petroleum and Petroleum prod...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...

-

Weather Yep, been a fun few days, as we received about 6" of snow, then about 3/4" of ice, then another 3" of snow. I am no l...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...