Wednesday, June 29, 2022

Review of EIA Weekly Report for 6-29-2022

Tuesday, June 28, 2022

Still Too Early to Project C.O.L.A Increases... But the Early Bird Gets the Worm. Yuck!

Yes, it is too early, but I cannot help myself. After perusing all the forecasts of inflation, here goes. Of course an explanation is needed as to the rules regarding determining C.O.L.A.

CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) is the gauge used, not the headline CPI, as in CPI-U (Consumer Price index for ALL Urban Consumers). The difference being the salaried and technical folks are in the latter.

Typically the CPI-W has lagged behind the CPI-U, (hereafter referred to simply CPI). This can be seen in the CPI reading of 292.296 (May-2022), compared to 288.022 for the CPI-W. Both started their indexes at the same time... back in the early 80s.

However, after lagging all that time, the CPI-W is catching up with a vengeance. Why? I don't know, maybe something to do with Covid. (That's intended to be humorous).

- June CPI-W is forecast as 9.3%~9.4%

- July CPI-W is forecast as 9.2%~9.4%

- August CPI-W is forecast as 8.7%~9.0%

- September CPI-W forecast as 8.3%~8.5%.

Saturday, June 25, 2022

Bored on a Saturday Night

There

is nothing on television worth watching, and the news is to be avoided.

I have completed all my chores for the week and looking for something to do.

So,

allow me to jabber about stuff, I know very little about... and prove to you how little I know.

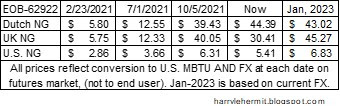

The futures

market indicates UK natural gas prices will likely double from current, while the Dutch seems to believe in consistency, going into January of 2023. It strikes me odd, as the Dutch and UK futures had remained rather consistent until about a month ago.

I cannot quite understand why, but last fall, the topic of storage was in the news, and I do seem to recall the U.K. had divested itself of most of their NG storage capacity. . It likely was due to long range planning away from fossil fuels.

That's okay, as it is their business. My concern is the prices in the U.S. While prices have doubled and then some, the futures market seems to hold steady where we currently are. Naturally, the doubling of price of Natural Gas on the market does not translate to doubling of price to the end user, but $3.50+ per MBTU will.

That adds up to about $20 a month more for the average American Household and it is important to remember... only about half of American households use Natural Gas, so about $40 more per month. BUT, most of those households rely disproportionately on Natural Gas in the colder months.

Likely most Americans have adjusted. Nearly all of us use Electricity and about 40% of that comes from Natural Gas.

The problem will be when the Freeport company is back up to 100%. The problem with the chart above, is it omits the runup to over $9.30 per MBTU just prior to the fire at Freeport. Freeport accounts for about 17% of LNG exports. That fire caused a major disruption for exports, which reduced the draw on our own inventory.

Freeport states they should be partially up and running in 90 days and at full capacity by end of the year. It is not a stretch to think U.S. natural gas prices will near the $10 per MBTU by then.

Just double the above numbers and you can see the problem.

On the good news, the gasoline futures have slid 44¢ from their peak on June 6th. Gasoline at the pump always rockets upward, but fall like a feather. That price should continue to fall another 17¢, unless something else happens. If you are wondering about a discrepancy, rest assured the gasoline was on pace to hit $5.20 at the pump and then the bottom suddenly fell out. Something about bad economic news.

There was a bit of concern about some Canadian Model's itinerary, but the Canadian Model appears to have changed her mind.

That wraps it for me, as this is started to be boring. Oh wait, maybe there is something on the streaming services, that I would be interested in, AND haven't seen a dozen times.😀

Thursday, June 23, 2022

It's Politics As Usual, or How to Manipulate Weak Minds

As I am biding my time, awaiting this week's EIA Crude and Products report... I thought I would delve into my current frustrations.

Namely, the failure of the fourth estate… or the press, media et al. I blame them for getting Trump elected in the first place. So eager were they to boost ratings, they went right along with the Trump Phenomena early in the race. I am not just referring to that right wing network. It was “must see TV”.

No doubt they were sure Trump could not win a presidency and therefore… pushed him over other republican candidates.

Unfortunately for all, they managed to subvert the 2016 election, in my opinion. It was not the Russians or anyone else. The fourth estate handed that election to Trump. To distance themselves from any blame, they went on the attack, and it was furious.

I have no quibble with any of that, but they destroyed what little credibility that remained. By 2020, it was clear that truth, like Elvis… had left the building.

The issue I have, is their great fear of a Trump or Trump-like person (Republican) might win in 2024, they have completely lost any civic responsibility… when it comes to a sitting president.

We should not blame Biden for the current inflation…

- The supply chain is snarled and causing inflation... don't blame Biden. (What really caused the ports to be congested in the first place)?

- This inflation is transitory... don't blame Biden.

- It's Putin's invasion of Ukraine that is causing inflation... don't blame Biden. (For the past 3 months, but what about the previous 12 months)?

- It's the greedy oil industry, running up prices... don't blame Biden. (Take the energy component out of the CPI and the inflation rate would still be at a 40 year high.)

Monday, June 20, 2022

Even A Broken Clock is Right Twice a Day!!

In this digital age, there will be many that do not understand a reference from way back in the age of analog clocks. But on to the meat of the matter, or where’s the beef?

After months of American citizens complaining about inflation, certain politicians have determined it is a problem and are focused upon the problem. We should also understand the “rest” of the world is also experiencing inflation.

Except there was rarely a peep, until the “rest” of the world caught up with the U.S.A.

Here is a nice graph with annual inflation rates since August 2021. (Click on Picture for larger view).

Eurostat is the source for the EU, France, Germany, as well as the harmonized inflation rate of the U.S. Oddly the U.S. is not in the EU and is tracked, yet U.K. no longer appears anywhere. Someone is taking Brexit very seriously, imo. The U.K. is represented by its own Office of National Statistics, which has both HCIP and CPI. Then Canada data is taken from Statistics Canada. (I estimated the Eurostat numbers for the U.S. at 9.1%, but put 8.8% on this chart/graph to be safe on the low side).

Here is a chart as well...

Clearly, we can see the impact of the natural gas pricing in

the EU and UK, as well as the impact of the Ukraine invasion, for all including

Canada. The U.S. can certainly join in the chorus blaming Putin, but what about

the earlier periods, when both the EU and the UK were experiencing less

inflation than the United States?

Why wasn’t inflation an issue then? Did our politicians need to wait for

someone else to blame and then proclaim it's not my fault, everyone is having high inflation?

Hey, it will probably work... given the short attention span of most Americans.

Sunday, June 19, 2022

A Timeline of Events and Some Thoughts

How

did we get where we are?

In

previous postings, I made mention of the repeal of the Crude Export Act in 2015. That set the stage for

exporting of crude from the U.S., which was due in part to drill baby drill and

lowering of WTI prices within the U.S. As a result, ALL crude oil became priced on the

global market demand. At that time, exports were limited to Alaskan Crude and

daily exports were in the 500K barrel range.

Also at

that time, WTI crude had fallen to $34.74 per barrel and gasoline stood at

$2.026 per gallon nationally. This was down from the high of $100+ per

barrel in July of 2014, as was gasoline at $3.60+ per gallon. Which was prior

to drill baby drill taking hold. Hence the necessity to do something for the

drillers.

In

February 2020, WTI crude had risen to $51.43 and gasoline to $2.466. Exports of

Crude were in the 3.5M barrels daily.

Of

course, February 2020 gave us the first glimpse of COVID. With Covid the infamous

negative futures price of -$37.63 in April (Monthly average at $17.13). People

were paying someone else to take delivery of crude. Gasoline fell to $1.773 by

end of April. Crude exports slowed to the 3M barrel daily level.

[All

data from EIA.GOV]

The

crude prices stayed in the $40 range until December 2020 and gasoline in the

$2.20 range. It was about this time that an antsy public was given hope via

vaccines. By February 2021, crude was in the $60 range and gasoline had jumped

to $2.60+.

While

there had been spot shortages of many goods early on, they had mostly eased by

this time, as well. There were lingering shortages of materials to repair

equipment, build cars, etc. The economy was still out of balance, in my

opinion.

As

the shots became widely available and hopes of finally ridding covid seemed on

the horizon... consumers became increasingly anxious to get out of lockdowns,

etc.

The

economy had largely survived due to stimulus. It was in February that Texas had

the big freeze, with impacted refining and saw gasoline jump to $2.80

range.

Then

came the 3rd stimulus, which even Miss Transitory thinks was too much... in

retrospect.

Crude also began its climb, as

demand increased. By end of 2021, it was nearing $80 and gasoline was in the

$3.30 range. We were still exporting around 3M barrels per day. Even with the

shuttering of older refineries. Why spend money on something that is being

phased out, due to climate change?

Then came Ukraine and the recognition that Europe is dependent upon Russia. Before the invasion, Crude had already climbed to $92 and gasoline to $3.60.

Interestingly, certain politicians have advocated assisting Europe wean itself from Russian energy. Even an age-old enemy such as Venezuela is now somehow to be considered friendly. An old friend (Saudi Arabia) that became NO longer a friend, is now to be once again... viewed favorably.

We are now exporting 3.5M barrels on average per day since March and some days goes above 4 million. And it's not just crude, but refined products as well. 102,309,000 barrels of crude and petroleum exports ABOVE what has been imported since first of March. Oh and 14,091,000 barrels of gasoline have been exported in that period, ABOVE imports.

I have highlighted the flip areas.

Where once we imported more of all products, than we exported AND where we once

imported more gasoline than we exported.

In my opinion, we would still be seeing record prices at the pump, although not in the $5 range (certainly above $4 and still be complaining). So, it would be correct to blame the current prices on Putin, but to run around suddenly buddying up some folks, releasing SPR to the tune of 1M barrels a day, then complain about refineries doing what you asked, is a bit much. I am not defending refineries, just noting the hypocrisy of certain politicians.

What's next... blaming the high prices on climate change? We are just one hurricane in the Gulf from the blame game to shift to that very item. I also found the timing of blaming refineries, just as he or his henchmen got advance news of impending bad economic reports. Those bad economic reports have caused the futures of both crude and gasoline to fall nearly 10% this past week.

I'm sure the subsequent fall in pump prices will be extolled as proof the refineries were gouging us. And many Americans will believe it, report it, etc. One reporter noted that we consumed 10% more gasoline this past week than the previous week, although the data says -1.0% for the week and -2.9% year over year. Seriously, are we that ignorant, not to see through these lies? Apparently, the answer is yes.

Which brings me to the IQ of the American people. On certain social media boards, there are still individuals saying we should drill more, etc. without regard to the fact we are exporting. Some people haven't gotten the news or are ignoring it for political gain.

Of course, the thread that caught my eye, was regarding the falling IQ of Americans. According to one individual, the IQ of Americans was once 110 and has now fallen to 99 and is a clear indication of our stupidity. That no one pointed out the obvious flaw and piled on to that belief... does indicate our stupidity. I doubt anyone caught the irony of the original post, including the original poster.

I consider myself of average intelligence and possibly with age... below. It is kind of scary to think where we are headed.

#gasoline #covid #crude-oil #alaska #opinion #exports

Those Pesky Sensors at Intersections

It's Been Awhile

Finally some more reports coming out from the government services, with PPI and Retail Sales . Granted it is still a month behind, as Octob...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...

-

This week's full report . Gasoline pump prices fell -1.6¢ for the week, and continues well below year ago levels, by -38.8¢, or -10.8%...

-

The EV projection shifted this week, due to North Carolina shifting below the upper threshold of margin of error. The electoral vote forecas...