With the United Kingdom EUstats release of June data, I have updated my comparison graph...

Wednesday, July 19, 2023

Comparison of Inflation in selected countries- July, 2023 Edition

Tuesday, July 18, 2023

7-18-23, Advance Retail Sales Report for June

Advance Monthly Sales for Retail and Food Services, June 2023.

Advance estimates of U.S. retail and food services sales for June 2023, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $689.5 billion, up 0.2 percent (±0.5 percent)* from the previous month, and up 1.5 percent (±0.7 percent) above June 2022. Total sales for the April 2023 through June 2023 period were up 1.6 percent (±0.4 percent) from the same period a year ago. The April 2023 to May 2023 percent change was revised from up 0.3 percent (±0.5 percent)* to up 0.5 percent (±0.2 percent).

Retail trade sales were up 0.2 percent (±0.5 percent)* from May 2023, and up 0.5 percent (±0.5 percent)* above last year. Nonstore retailers were up 9.4 percent (±1.6 percent) from last year, while food services and drinking places were up 8.4 percent (±2.3 percent) from June 2022.

Those figures are nominal, meaning not adjusted for inflation. Compare the nominal 0.2% monthly and 1.5% annual increase... to the CPI of 0.2% monthly and 3.0% annual. In other word, the montly was flat in inflation adjusted and -1.5% on the annual inflation adjusted.

Building materials, gasoline stations, sporting goods, and surprisingly... grocery stores slid.

As stated earlier, the spending habits are simply shifting from one thing to another, with no real growth... except inflation generated.Friday, July 14, 2023

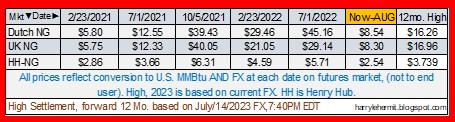

Natural Gas Inventory Report, July 14, 2023

The Energy Information Administration released their weekly report yesterday.

Prices increased in most West Coast markets this week, except at SoCal Citygate in Southern California, where the price decreased 45 cents from $3.85/MMBtu last Wednesday to $3.40/MMBtu yesterday. Natural gas consumption in California declined 8% (0.4 Bcf/d) week over week, led by a 26% (0.5 Bcf/d) decrease in consumption in the electric power sector, according to data from S&P Global Commodity Insights.

Select inventories of EU and UK...

Thursday, July 13, 2023

Producer Price Index July 2023 release for June Data.

The BLS has released the June Producer Price Index Report. (historical releases)

The Producer Price Index for final demand increased 0.1 percent in June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices declined 0.4 percent in May and edged up 0.1 percent in April. (See table A.) On an unadjusted basis, the index for final demand advanced 0.1 percent for the 12 months ended in June.

In June, the increase in final demand prices can be traced to a 0.2-percent rise in the index for final demand services. Prices for final demand goods were unchanged.

The index for final demand less foods, energy, and trade services moved up 0.1 percent in June after no change in May. For the 12 months ended in June, prices for final demand less foods, energy, and trade services advanced 2.6 percent.

Wednesday, July 12, 2023

Gasoline consumption per latest EIA data, July 12, 2023

Gasoline prices (per AAA) rose from last report to $3.541, as anticipated. One year ago the price had fallen to $4.665, and was on its downward trajectory... into the mid September lull, around $3.67.

Consumption slipped week over week, but stands 6.3% above year ago numbers. (This is a four week moving average).

The import/export surplus of gasoline since last March 1st 2022, jumped to +101.1M barrels. It had basically remained flat for the past 3 months, until this past week's 2.3M barrel jump.

Rinse and repeat. There remains a slight upward bias, mostly due to a jump in WTI price, due to mostly dollar fall, mostly due to anticipation of FED pausing rate hikes, due to today's CPI report.

All of which will likely come due... when next month's CPI tracks higher.

Crude and Petroleum Product Inventories - July 12 2023

Data per the EIA weekly report.

Crude stocks Increased by +5.9M barrels, from last week, yet remains down -0.9% from the 5 year seasonal average. It should be noted the 5 year average includes the abnormal 2020 and 2021 number. Otherwise, the current inventory is nearly +2.5% above normal.

Distillates inventory jumped +4.8M barrels; and Gasoline inventories stayed flat. Distillates (-14%,-3.7%) and Gasoline (-5.6%, -2.8%) are both below 5 year and 3 year adjusted average inventories.

The SPR fell another -401K barrels.

You can fool all of the people some of the time,And fool some of the people all of the time.But you can't fool all the people, all of the time.

The question becomes... who is fooling whom?

BLS releases latest Real Earnings... July 12, 2023

The BLS has released the latest Real Earnings Report.

Real average hourly earnings for all employees increased 0.2 percent from May to June, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.4 percent in average hourly earnings combined with an increase of 0.2 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

Real average weekly earnings increased 0.5 percent over the month due to the change in real average hourly earnings combined with a 0.3-percent increase in the average workweek.

Real average hourly earnings increased 1.2 percent, seasonally adjusted, from June 2022 to June 2023. The change in real average hourly earnings combined with a decrease of 0.6 percent in the average workweek resulted in a 0.6-percent increase in real average weekly earnings over this period.

Generally speaking, real income growth has about matched pre-Covid, per the graphs below.

But first, as usual, a few notes about the graphs and underlying data, especially #2 and #3, which seem to fall into the political rhetoric arena....

- These hourly and weekly figures are in 1982~1984 dollars, so that inflationary impact can be easily seen. The $11.03 per hour in the first graph would be $33.34 per hour in today's dollars.

- Much is made about the decrease in hourly wages, but some easy explanation... We can all remember when covid shut everything down, and people were sent home. Some kept working at their jobsite or from home.

- Many others went home without a job. A lot of those were lower wage employees, which skewed the hourly and weekly rates upward, until those employees slowly returned to work.

- I have January, 2020 (pre-covid) on each graph, so that comparisons can be made to current. Also, the unemployment rate then and now are very similar.

The hourly rate is 2% above pre-covid.

A Bit of Update on the Energy Market, and a Few Political Opinions.

The winter weather is the likely culprit for the drop in overall consumption. Only time will tell. The overall inventories are still in goo...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...