Just some charts to summarize today's report...

Wednesday, December 13, 2023

This Week in Petroleum Summary 12-13-2023, per EIA.GOV

Producer Price Index December release November 2023 Data

The BLS has released the November Producer Price Index Report. (historical releases)

The Producer Price Index for final demand was unchanged in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices decreased 0.4 percent in October and rose 0.4 percent in September. (See table A.) On an unadjusted basis, the index for final demand increased 0.9 percent for the 12 months ended in November.

In November, the indexes for both final demand goods and for final demand services were unchanged.

Final demand goods: The index for final demand goods was unchanged in November after dropping 1.4 percent in October. In November, price increases of 0.6 percent for final demand foods and 0.2 percent for final demand goods less foods and energy offset a 1.2-percent decrease in the index for final demand energy.

Let's revisit that paragraph. What did the -1.2% decrease in the index for final demand energy... offset?

Within final demand goods in November, prices for chicken eggs jumped 58.8 percent. The indexes for fresh fruits and melons, utility natural gas, electric power, and carbon steel scrap also moved higher. In contrast, prices for gasoline fell 4.1 percent.

So gasoline (-4.1%), which is typically moving into seasonal lows, is the reason for that -1.2% decrease, which offsets a bunch of rises in food (+0.6%) and other energy components.

Not to nitpick, but if gasoline is having that impact, and is moving into seasonal lows, which might continue through the December release... could reverse beginning after Christmas, just like last year.

For those of us that like to eat food, that annualized 7.2% increase in food is going to weigh on the budget of many of us, unless we decide to eat less and lose "weight".

Tuesday, December 12, 2023

BLS Data Dump. CPI - December 12, 2023

First up is the BLS Report for CPI...(historical releases)

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.1 percent in November on a seasonally adjusted basis, after being unchanged in October, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.1 percent before seasonal adjustment.

I think the numbers were somewhat in line with everyone's expectations.

I do find the food portion of the darn thing a bit intriguing.

Oddly, when adjusting the index to "average" household spending the food at home has jumped 29.6%, in current dollars.

What really catches the eye, is the -8.5% drop in current dollars for food away from home. This would be cafeterias, restaurants, and other places "away" from home.

This type of comparison with weightings against the index, further indicates a drop in current dollar spending for food in all categories... compared to rate of inflation.Real average hourly earnings for all employees increased 0.2 percent from October to November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This result stems from an increase of 0.4 percent in average hourly earnings combined with an increase of 0.1 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

Here is a graph...

Thursday, December 7, 2023

A Foray into the 2024 Presidential Election, Part V

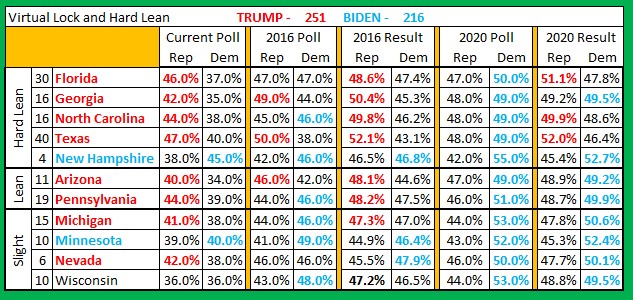

Here is another stab at the 2024 election. Trump appears to be ahead with polling numbers of 44.1%. compared to Biden's 43.3%. Very tight indeed, until polling of individual states relative to electoral votes is considered.

Took a hard look at the virtual locks, in regards to electoral votes, which resulted with Biden having 212 electoral votes locked up, and Trump with 149.

When I say "locked up", I am referring to places like California, Alabama, Arkansas, Delaware, etc. It should be obvious whether they are blue or red. So stencil them in.

However, in 2024, there are some hard leans, as well.

Florida has Trump with a 9 point lead in the polls. Consider where the polls were in 2016 and 2020, the compare to results. That 9 point lead is significant.

Again, Georgia was not really that far out of whack in the 2016 and 2020 polls, so the polls for this year having Trump with a 7 point lead... is quite meaningful.

That trend continues with the other "hard leans" listed, which results in Trump holding a 251~216 lead at this point.

So Trump just needs 19 of 71 remaining EVs. The opposite of that... Biden needs 54 of the remaing EVs.

Turning it around might be possible for Biden.

However, Ukraine is still an issue on his watch, as well as that Middle East mess. Not seeing any upward lift being provided by those.

Economy, could be an issue, but not a lot of upward lift to be seen in this area. Sure, GDP was up 5.2% annualized, but don't forget a massive adjustment was just undertaken, by moving the numbers from 2012 dollars... to 2017 dollars. I alluded to this in a previous article.

On January 25, 2024, the BEA will likely report something in the 1.5%~2.0% annualized GDP growth. A lot of whining will take place about how the economy has gone from robust to anemic. Both are rather silly, but the resultant public opinion will not likely provide any huge boost for Biden.

That report will be followed about 3 weeks later, with the CPI report for January.

There is the inflation issue, of which will be largely cheered with both the November (DEC release) and December (JAN Release) data releases. Both of which will indicate a shallowing month to month rate of inflation.

However, both months will be a result of significantly lower gasoline prices, which is a seasonal norm. While making up a small percentage of consumer spending, the impact will be enough to bring month to month to zero and very likely negative.

Once again, that news turns south with that February release of January's CPI data. Why? Those falling gasoline prices will be in the rear view mirror, and will be rising... We are getting into the heart of political silly season by then.

Frankly, rising gas prices will bring out the grocery prices are much higher crowd. It may well be, but this is about the attitude of voters... which won't be uplifting for the Biden campaign. Voters tend to remember things from days past, when they look at the grocery receipts and those numbers on the gasoline pump.

So not a lot of upside going forward, imho... for a Biden rebound.

Remember, the perception needs to change for Biden to reverse his current dismal ratings.

Wednesday, December 6, 2023

This Week in Petroleum Summary 12-6-2023, per EIA.GOV

Just some charts to summarize today's report...

Tuesday, December 5, 2023

A Further Review of 3rd Quarter, 2023 GDP... just for fun!!

So yes, the GDP was revised to 5.2% annualized, from 4.9% annualized. That does not mean the economy is robust. It's not bad, but robust is a bit of hype for politicians.

The BEA moved from 2012 dollars to 2017 dollars for the 3rd quarter releases and going forward, until next change in... say 5 years.

In theory, it should have been even across the board, after compensating for 5 years of dollar value adjustments, etc. Such as inflation being about 7.5% during that 5 year period.

If only there was someone, somewhere that downloads those excel spreadsheets from each GDP iteration.

Voila...

Note the column headings for 2012 dollars and 2017 dollars AND the % Change. The changes were clearly not uniform across the various groupings.

While there was a 9% upward adjustment, several groupings failed to match that rise, including some that went negative... while others outpaced the 9% reading.

So in theory, all the numbers going back in time were revised to reflect the current situation. But again, that was very uneven. Just consider the trade deficit, which is a drag on GDP... and those changes.

All in all, it did distort the 3rd quarter readings and possibly provided a misleading annualized number. That would be no big deal... if not for an election year and people willing to make everything political.

While the current 5.2% annualized is being hailed as something significant, I wonder what will be hailed, when the 4th Qtr. 2023 is revealed on January 25th, 2024. My guess is way below that 5.2%. Back to the 2.0% annualized, or even lower!

One can imagine the hysteria over such falling numbers, but the adjustment was improperly attributed to a "robust" economy.

So remember... the trade deficit, which is a drag on GDP was revised dramatically lower, after the BIG change for 2012 to 2017 dollars. That trade deficit adjustment was about 100% of that 5.2% annualized, or ±0.1% annualized without that lone adjustment.

You think I might be off my rocker! The current Real GDP rolls in at 22,506.4B, which is a hefty 281B above the 2nd qtr. figure of 22,225.4B. Now take a look at that downward revision of the trade deficit, -284B.

Remember the trade deficit is a drag on GDP, so a downward revision in the Trade deficit would result in a higher GDP print. IF the GDP had not been revised downward by -284B, then that +281B gain in GDP would evaporate. As in +0.1% annualized.

One group will claim the economy is crashing into a recession, another group will be saying soft landing is working, and another group will be screaming the FED must cut rates rapidly.

I then ask you, if stating the 3Q23 was actually 0.1% and the 4Q24 was +1.7%, would indeed indicate a possible soft landing. Of course, the groups would likely being crying the same thing... just 3 months earlier.

It is fun to watch all the spin!

Saturday, December 2, 2023

A Foray into the 2024 Presidential Election, Part Four

Here I go again, delving into the rabbit hole of politics and polls.

The polls are wrong, as we all know.

In 2016, Clinton was leading Trump in Wisconsin by 5 points, yet lost the state.

In 2020, Biden turned it around and led by 9 points in the polls, yet barely won the state by 20,000 votes or 0.6%

Granted Clinton only had a 2 point lead in Michigan, ahead of the election and lost by a slim margin. Once Again, Biden turned it around by having a 9 point margin, before finishing 2.8% ahead.

In 2016 Clinton had a 2 point lead in Pennsylvania, before losing that state. Again Bided turned it around with a 5 point lead, and winning by a slim 1.2%. A win is a win.

Florida was a deadlock and then the election of 2016 had Trump up by a slim 0.8%. Biden had a 3 point lead in Florida for 2020, yet Trump won by 3.3%.

Again in 2020, Biden had a 1 point lead in Texas, and it was widely assumed Texas was turning blue, except Trump won by 5.5%. It was tighter than 2016, so maybe turning blue, but not just yet.

Of course some states matched the poll numbers, such as Georgia. Almost nailed it in 2016 and 2020.

Arizona was near that match for both years, as was Nevada and some others.

I suppose there are many reasons, such as 3rd party candidates, undecided voters, no shows, etc.

So having gone down the rabbit hole of reviewing the 2016 AND 2020 polls by state... I have come up with my own darn formula.

Biden needs to swing 27 Evs back from these. Any two will do, So along with Arizona, Minnesota and Nevada... 2 more.

A Bit of Update on the Energy Market, and a Few Political Opinions.

The winter weather is the likely culprit for the drop in overall consumption. Only time will tell. The overall inventories are still in goo...

-

Reviewed this weeks EIA report and observed the current status of inventories. Oddly, although domestic consumption is down from last year,...

-

Today's EIA.gov report . Crude stocks up again, +7.6M barrels, from last week; Distillates up +2.7M Barrels; and Gasoline slid -1.9M b...

-

This week's full report . Gasoline pump prices rose +1.4¢ for the week, but continues below year ago levels, by -3.2¢, or -1.2%. Days...